Clearwire 2009 Annual Report Download - page 81

Download and view the complete annual report

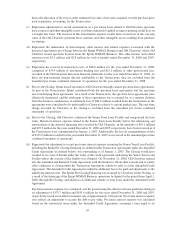

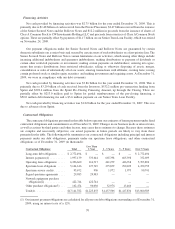

Please find page 81 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) Networ

k

equ

i

pment purc

h

ase o

bli

gat

i

ons represent purc

h

ase comm

i

tments w

i

t

h

ta

k

e-or-pay o

bli

gat

i

ons an

d

/o

r

volume commitments for equipment that are non-cancelable and outstandin

g

purchase orders for network

e

quipment for which we believe delivery is likely to occur

.

(3) Other purchase obli

g

ations include minimum purchases we have committed to purchase from suppliers over

t

ime and/or unconditional purchase obli

g

ations where we

g

uarantee to make a minimum pa

y

ment to supplier

s

f

or goo

d

san

d

serv

i

ces regar

dl

ess o

f

w

h

et

h

er supp

li

ers

f

u

ll

y

d

e

li

ver t

h

em. T

h

ey

i

nc

l

u

d

e, among ot

h

er t

hi

ngs

,

a

g

reements for backhaul, customer devices and IT related and other services. The amounts actuall

y

paid unde

r

s

ome of these “other” a

g

reements will likel

y

be hi

g

her than the minimum commitments due to variabl

e

c

omponents o

f

t

h

ese agreements. T

h

e more s

i

gn

ifi

cant var

i

a

bl

e components t

h

at

d

eterm

i

ne t

h

eu

l

t

i

mate

o

blig

at

i

on owe

di

nc

l

u

d

e

h

ours contracte

d

,su

b

scr

ib

ers an

d

ot

h

er

f

actors

.

(4) In a

ddi

t

i

on, we are party to var

i

ous arrangements t

h

at are con

di

t

i

ona

li

n nature an

d

create an o

bli

gat

i

on to ma

ke

p

ayments on

l

y upon t

h

e occurrence o

f

certa

i

n events, suc

h

as t

h

e actua

ld

e

li

very an

d

acceptance o

f

pro

d

ucts o

r

s

ervices. Because it is not possible to predict the timin

g

or amounts that ma

y

be due under these conditional

arrangements, no suc

h

amounts

h

ave

b

een

i

nc

l

u

d

e

di

nt

h

eta

bl

ea

b

ove. T

h

eta

bl

ea

b

ove a

l

so exc

l

u

d

es

bl

an

k

et

p

urc

h

ase or

d

er amounts w

h

ere t

h

eor

d

ers are su

bj

ect to cance

ll

at

i

on or term

i

nat

i

on at our

di

scret

i

on or w

h

ere

t

he quantit

y

of

g

oods or services to be purchased or the pa

y

ment terms are unknown because such purchas

e

orders are not firm commitments

.

We do not have any obligations that meet the definition of an off-balance-sheet arrangement that have or are

r

easona

bly lik

e

ly

to

h

ave a mater

i

a

l

e

ff

ect on our

fi

nanc

i

a

l

statements

.

Recent Accounting Pronouncement

s

I

n June and December 2009, the Financial Accountin

g

Standards Board, which we refer to as the FASB, issued

new accountin

gg

uidance that amends the consolidation

g

uidance applicable to variable interest entities. The

amen

d

ments w

ill

a

ff

ect t

h

e overa

ll

conso

lid

at

i

on ana

l

ys

i

sun

d

er t

h

e current account

i

ng gu

id

ance. T

h

ene

w

accountin

gg

uidance is effective for fiscal

y

ears and interim periods be

g

innin

g

after November 1

5

, 2009. We

are currentl

y

evaluatin

g

the impact of the new

g

uidance on our financial condition and results of operations.

I

nAu

g

ust 2009, the FASB issued new accountin

gg

uidance for the fair value measurement of liabilities when a

q

uote

d

pr

i

ce

i

n an act

i

ve mar

k

et

i

s not ava

il

a

bl

e. We a

d

opte

d

t

h

e new account

i

ng gu

id

ance on Octo

b

er 1, 2009. T

he

a

d

opt

i

on

did

not

h

ave an

yi

mpact on our

fi

nanc

i

a

l

con

di

t

i

on or resu

l

ts o

f

operat

i

ons.

I

n Octo

b

er 2009, t

h

e FASB

i

ssue

d

new account

i

n

gg

u

id

ance t

h

at amen

d

st

h

e revenue reco

g

n

i

t

i

on

f

or mu

l

t

i

p

l

e

-

element arran

g

ements and expands the disclosure requirements related to such arran

g

ements. The new

g

uidanc

e

amends the criteria for separating consideration in multiple-deliverable arrangements, establishes a selling pric

e

hi

erarc

hy f

or

d

eterm

i

n

i

n

g

t

h

ese

lli

n

g

pr

i

ce o

f

a

d

e

li

vera

bl

e, e

li

m

i

nates t

h

e res

id

ua

l

met

h

o

d

o

f

a

ll

ocat

i

on, an

d

r

equires the application of relative sellin

g

price method in allocatin

g

the arran

g

ement consideration to all

deliverables. The new accountin

gg

uidance is effective for fiscal

y

ears be

g

innin

g

after June 1

5

, 2010. We are

current

l

yeva

l

uat

i

ng t

h

e

i

mpact o

f

t

h

enewgu

id

ance on our

fi

nanc

i

a

l

con

di

t

i

on an

d

resu

l

ts o

f

operat

i

ons

.

I

n January 2010, t

h

e FASB

i

ssue

d

new account

i

ng gu

id

ance t

h

at requ

i

res new

di

sc

l

osures re

l

ate

d

to

f

a

i

rva

l

ue

measurements. The new

g

uidance requires separate disclosure for transfers between Level 1 and 2 and the activitie

s

in Level 3 reconciliation on a gross basis. The new accounting guidance is effective for fiscal years and interim

p

eriods beginning after December 1

5

, 2009, except for the new disclosures related to Level 3 activities, which are

effective for fiscal

y

ears and interim periods be

g

innin

g

after December 15, 2010. The new accountin

gg

uidance onl

y

amended the disclosure re

q

uirements related to fair value measurements, therefore we do not ex

p

ect the ado

p

tion t

o

have any impact on our financial condition or results of operations

.

ITEM 7A

.

Q

uantitative and

Q

ualitative Disclosures About Market Risk

Market risk is the potential loss arisin

g

from adverse chan

g

es in market rates and prices, such as interest rates,

foreign currency exchange rates and changes in the market value of investments due to credit risk

.

7

1