Clearwire 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

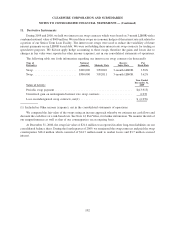

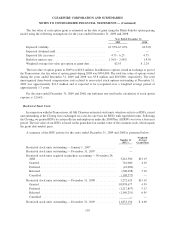

T

he total fair value of grants during 2009 and 2008 was

$

48.0 million and

$

2.9 million, respectively. Th

e

i

ntrinsic value of RSUs released during the years ended December 31, 2009 and 2008 was

$

7.9 million an

d

$3.2 million, respectivel

y

. As of December 31, 2009, there were 11,853,194 units outstandin

g

and total unrec-

ognized compensation cost of approximately

$

30.9 million, which is expected to be recognized over a weighted-

average per

i

o

d

o

f

approx

i

mate

l

y 1.8 years.

For the

y

ears ended December 31, 2009 and 2008, we used a forfeiture rate of 7.75% and 7.50%, respectivel

y

,

i

n determining compensation expense for our RSUs

.

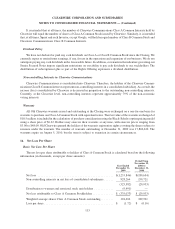

S

p

rint E

q

uit

y

Com

p

ensation P

l

ans

I

n connection with the Transactions, certain of the Sprint WiMAX Business emplo

y

ees became emplo

y

ees of

Clearwire and currently hold unvested Sprint stock options and RSUs in Sprint’s equity compensation plans, whic

h

w

ere

f

er to co

ll

ect

i

ve

ly

as t

h

e Spr

i

nt P

l

ans. T

h

eun

d

er

lyi

n

g

s

h

are

f

or awar

d

s

i

ssue

d

un

d

er t

h

e Spr

i

nt P

l

ans

i

s Spr

i

nt

c

ommon stoc

k

.T

h

e Spr

i

nt P

l

ans a

ll

ow

f

or cont

i

nue

d

p

l

an part

i

c

i

pat

i

on as

l

on

g

as t

h

e emp

l

o

y

ee rema

i

ns emp

l

o

y

e

d

b

y a Sprint subsidiary or affiliate. Under the Sprint Plans, options are generally granted with an exercise price equal

t

ot

h

e mar

k

et va

l

ue o

f

t

h

eun

d

er

l

y

i

ng s

h

ares on t

h

e grant

d

ate, genera

ll

y vest over a per

i

o

d

o

f

up to

f

our years an

d

h

ave a contractua

l

term o

f

ten

y

ears. RSUs

g

enera

lly h

ave

b

ot

h

per

f

ormance an

d

serv

i

ce requ

i

rements w

i

t

h

vest

i

n

g

p

eriods ran

g

in

g

from one to three

y

ears. RSUs

g

ranted after the second quarter 2008 included quarterl

y

perfor-

m

ance targets

b

ut were not grante

d

unt

il

per

f

ormance targets were met. T

h

ere

f

ore, at t

h

e grant

d

ate t

h

ese awar

ds

on

l

y

h

a

d

a rema

i

n

i

ng serv

i

ce requ

i

rement an

d

vest

i

ng per

i

o

d

o

f

s

i

x mont

h

s

f

o

ll

ow

i

ng t

h

e

l

ast

d

ay o

f

t

h

e app

li

ca

bl

e

q

uarter. Emplo

y

ees who were

g

ranted RSUs were not required to pa

y

for the shares but

g

enerall

y

must remain

e

mp

l

oye

d

w

i

t

h

Spr

i

nt or a su

b

s

idi

ary, unt

il

t

h

e restr

i

ct

i

ons

l

apse, w

hi

c

h

was typ

i

ca

ll

yt

h

ree years or

l

ess. At

D

ecember 31, 2009, there were 722,954 unvested options and 213,127 unvested RSUs outstanding

.

Th

es

h

are-

b

ase

d

compensat

i

on assoc

i

ate

d

w

i

t

h

t

h

ese emp

l

o

y

ees

i

s

i

ncurre

dby

Spr

i

nt on our

b

e

h

a

lf

. Spr

i

n

t

p

rovided us with the fair value of the options and RSUs for each reporting period, which must be remeasured based

on t

h

e

f

a

i

rva

l

ue o

f

t

h

e equ

i

t

yi

nstruments at eac

h

report

i

n

g

per

i

o

d

unt

il

t

h

e

i

nstruments are veste

d

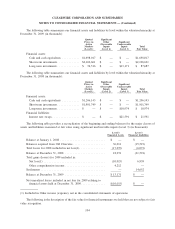

. Tota

l

unreco

g

n

i

ze

d

s

h

are-

b

ase

d

compensat

i

on costs re

l

ate

d

to unveste

d

stoc

k

opt

i

ons an

d

RSUs outstan

di

n

g

as o

f

D

ecember 31, 2009 was $70,250 and $186,100, respectivel

y

, and is expected to be reco

g

nized over approximatel

y

one

y

ear

.

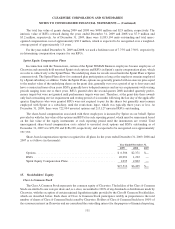

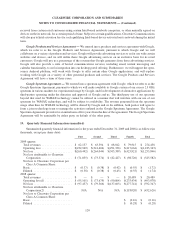

Share-based compensation expense reco

g

nized for all plans for the

y

ears ended December 31, 2009, 2008 an

d

2

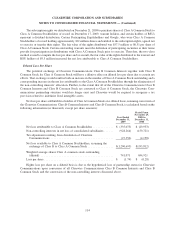

007 is as follows (in thousands)

:

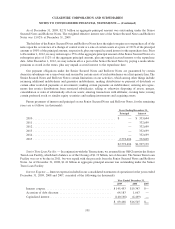

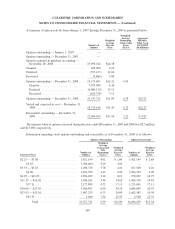

2009 2008 200

7

Y

ear Ended December

31

.

Op

tion

s

.................................................

$

6,386 $2,371 $—

RSU

s

..................................................

20

,

091 1

,

292

—

Spr

i

nt Equ

i

t

y

Compensat

i

on P

l

ans

.............................

1,

035 2

,

802 —

$

27,512 $6,465 $—

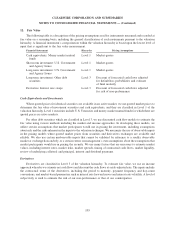

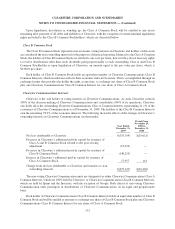

15. Stockholders’ Equit

y

Cl

ass A

C

ommon

S

toc

k

Th

eC

l

ass A Common Stoc

k

represents t

h

e common equ

i

t

y

o

f

C

l

earw

i

re. T

h

e

h

o

ld

ers o

f

t

h

eC

l

ass A Commo

n

S

toc

k

are ent

i

t

l

e

d

to one vote per s

h

are an

d

,asac

l

ass, are ent

i

t

l

e

d

to 100% o

f

an

ydi

v

id

en

d

sor

di

str

ib

ut

i

ons ma

d

e

by

Clearwire, with the exception of certain minimal liquidation ri

g

hts provided to the Class B Common Stockholders

,

w

hi

c

h

are

d

escr

ib

e

db

e

l

ow. Eac

h

s

h

are o

f

C

l

ass A Common Stoc

k

part

i

c

i

pates rata

bl

y

i

n proport

i

on to t

h

e tota

l

n

um

b

er o

f

s

h

ares o

f

C

l

ass A Common Stoc

ki

ssue

dby

C

l

earw

i

re. Ho

ld

ers o

f

C

l

ass A Common Stoc

kh

ave 100% o

f

the economic interest in Clearwire and are considered the controllin

g

interest for the purposes of financial reportin

g

.

111

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)