Clearwire 2009 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Th

e

dil

ute

d

we

i

g

h

te

d

average s

h

ares

did

not

i

nc

l

u

d

et

h

ee

ff

ects o

f

t

h

e

f

o

ll

ow

i

ng potent

i

a

l

common s

h

ares a

s

th

e

i

r

i

nc

l

us

i

on wou

ld h

ave

b

een ant

idil

ut

i

ve

(i

nt

h

ousan

d

s

)

:

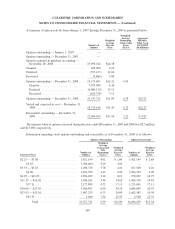

Y

ear Ended

December

31

,

2

009

P

e

ri

od

Fr

om

N

ovember 29

,

2008

to

December

31,

2008

Stoc

k

opt

i

ons

.

..........................................

.

2

2

,

1

5

419

,

317

Rest

ri

cted stoc

k

u

ni

ts

.

.....................................

9,

488 3

,

0

5

4

W

arrants

...............................................

1

7,806 17,806

C

ontin

g

ent share

s

........................................

12

,7

4

7

28

,

824

6

2,19

66

9,001

T

he contin

g

ent shares for the

y

ear ended December 31, 2009, primaril

y

relate to Clearwire Communications

Class B Common Interests and Clearwire Communications Voting Interests that will be issued to Participatin

g

Equ

i

t

yh

o

ld

ers upon t

h

e Secon

d

an

d

T

hi

r

d

Investment C

l

os

i

n

g

s as suc

hi

nterests, on a com

bi

ne

db

as

i

s, can

b

e

e

xc

h

an

g

e

df

or C

l

ass A Common Stoc

k

.T

h

e Secon

d

Investment C

l

os

i

n

g

was Decem

b

er 21, 2009. We expect t

h

e

T

hird Investment Closing to occur during the first quarter of 2010.

Th

e cont

i

ngent s

h

ares

f

or t

h

e year en

d

e

d

Decem

b

er 31, 2008, re

l

ate to purc

h

ase pr

i

ce s

h

are a

dj

ustment o

f

28,235,294 million shares and equity issuance to CW Investment Holdings of 588,235 shares, all of which wer

e

i

ssue

di

nFe

b

ruar

y

o

f

2009

.

Th

esu

b

scr

i

pt

i

on r

igh

ts to purc

h

ase

i

na

gg

re

g

ate approx

i

mate

ly

114 m

illi

on s

h

ares o

f

C

l

ass A Common Stoc

k

are not included in the computation of diluted loss per share because the ri

g

hts’ subscription price of $7.33 per shar

e

was greater t

h

an t

h

e average mar

k

et pr

i

ce o

f

C

l

ass A Common Stoc

kd

ur

i

ng t

h

e per

i

o

d

suc

h

r

i

g

h

ts are outstan

di

ng

i

n

2009 (out-of-the-mone

y

)

.

We

h

ave ca

l

cu

l

ate

d

an

dp

resente

db

as

i

can

d dil

ute

d

net

l

oss

p

er s

h

are o

f

C

l

ass A Common Stoc

k

.C

l

ass

B

Common Stock loss per share is not calculated since it does not contractuall

y

participate in distributions of

Clearwire. Prior to the Closing, we had no equity as we were a wholly-owned division of Sprint. As such, we did not

c

a

l

cu

l

ate or present net

l

oss per s

h

are

f

or t

h

e per

i

o

df

rom Januar

y

1, 2008 to Novem

b

er 28, 2008 an

d

t

h

e

y

ear en

d

e

d

D

ecember 31, 2007

.

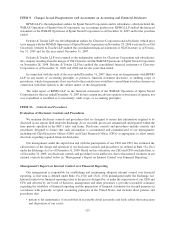

17. Business

S

egments

I

n

f

ormat

i

on a

b

out operat

i

n

g

se

g

ments

i

s

b

ase

d

on our

i

nterna

l

or

g

an

i

zat

i

on an

d

report

i

n

g

o

f

revenue an

d

operatin

g

income (loss) based upon internal accountin

g

methods. Operatin

g

se

g

ments are defined as components o

f

an enterprise about which separate financial information is available that is evaluated regularly by the chief

operat

i

n

gd

ec

i

s

i

on ma

k

er, or

d

ec

i

s

i

on ma

ki

n

gg

roup,

i

n

d

ec

idi

n

gh

ow to a

ll

ocate resources an

di

n assess

i

n

g

p

er

f

ormance. Our c

hi

e

f

operat

i

n

gd

ec

i

s

i

on ma

k

er

i

s our C

hi

e

f

Execut

i

ve O

ffi

cer. As o

f

Decem

b

er 31, 2009 an

d

2008, we have identified two reportable segments: the United States and the International businesses. In 2007 we

on

l

y

h

a

d

one reporta

bl

e

b

us

i

ness segment: t

h

eUn

i

te

d

States, as we

h

a

d

no

i

nternat

i

ona

l

operat

i

ons pr

i

or to t

he

C

l

os

i

n

g.

11

5

C

LEARWIRE

CO

RP

O

RATI

O

N AND

SU

B

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)