Clearwire 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

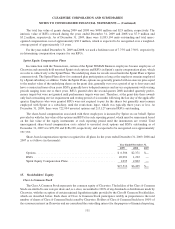

11. D

e

r

iva

t

ive

In

s

tr

u

m

e

nt

s

Dur

i

ng 2009 an

d

2008, we

h

e

ld

two

i

nterest rate swap contracts w

hi

c

h

were

b

ase

d

on 3-mont

h

LIBOR w

i

t

h

a

c

ombined notional value of $600 million. We used these swaps as economic hed

g

es of the interest rate risk related t

o

a portion of our Senior Term Loan Facility. The interest rate swaps were used to reduce the variability of futur

e

i

nterest payments on our LIBOR based debt. We were not holding these interest rate swap contracts for trading o

r

s

pecu

l

at

i

ve purposes. We

did

not app

ly h

e

dg

e account

i

n

g

to t

h

ese swaps, t

h

ere

f

ore t

h

e

g

a

i

ns an

dl

osses

d

ue to

c

han

g

es in fair value were reported in other income (expense), net in our consolidated statements of operations.

T

he followin

g

table sets forth information re

g

ardin

g

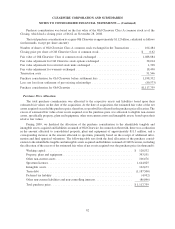

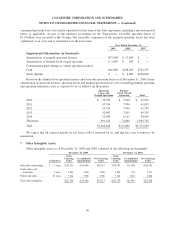

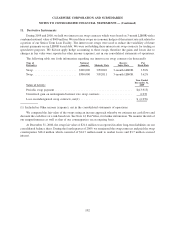

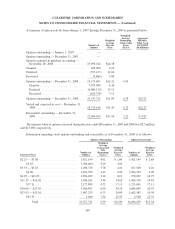

our interest rate swap contracts (in thousands):

T

yp

eo

f

Derivativ

e

N

ot

i

onal

Amount Maturity Date

R

eceive

Index Rate

P

a

y

Fixed Rat

e

S

wa

p

...........................

$

300,000 3/5/2010 3-month LIBOR 3.50%

S

wa

p

...........................

$

300,000 3/5/2011 3-month LIBOR 3.62%

N

ature o

f

Act

i

v

i

t

y:

Ye a

r

E

n

ded

December 31

,

2009

P

er

i

o

di

c swap paymen

t

................................................

$(

13,915

)

Unrea

li

ze

d

ga

i

nonun

d

es

i

gnate

di

nterest rate swap contracts . ...................

6,

939

Loss on undesignated swap contracts, net(1)

.

...............................

$

(

6,976

)

(1) Included in Other income (ex

p

ense), net in the consolidated statements of o

p

erations

.

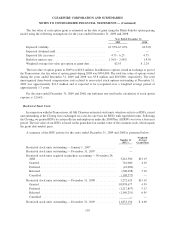

We computed the fair value of the swaps usin

g

an income approach whereb

y

we estimate net cash flows an

d

di

scount t

h

e cas

hfl

ows at a r

i

s

k

-

b

ase

d

rate. See Note 12

,

Fa

i

rVa

l

ue

,f

or

f

urt

h

er

i

n

f

ormat

i

on. We mon

i

tor t

h

er

i

s

k

o

f

our nonper

f

ormance as we

ll

as t

h

at o

f

our counterpart

i

es on an on

g

o

i

n

gb

as

i

s.

At December 31, 2008, the swap fair value of

$

21.6 million was reported in other lon

g

-term liabilities on ou

r

c

onsolidated balance sheet. Durin

g

the fourth quarter of 2009, we terminated the swap contracts and paid the swa

p

c

ounterparties

$

18.4 million which consisted of

$

14.7 million mark to market losses and

$

3.7 million accrue

d

i

nterest.

102

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)