Clearwire 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

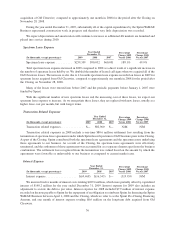

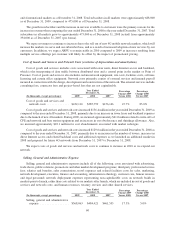

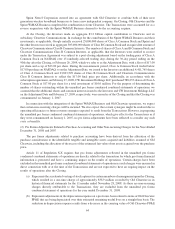

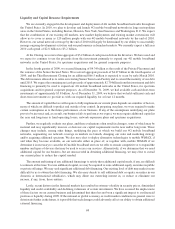

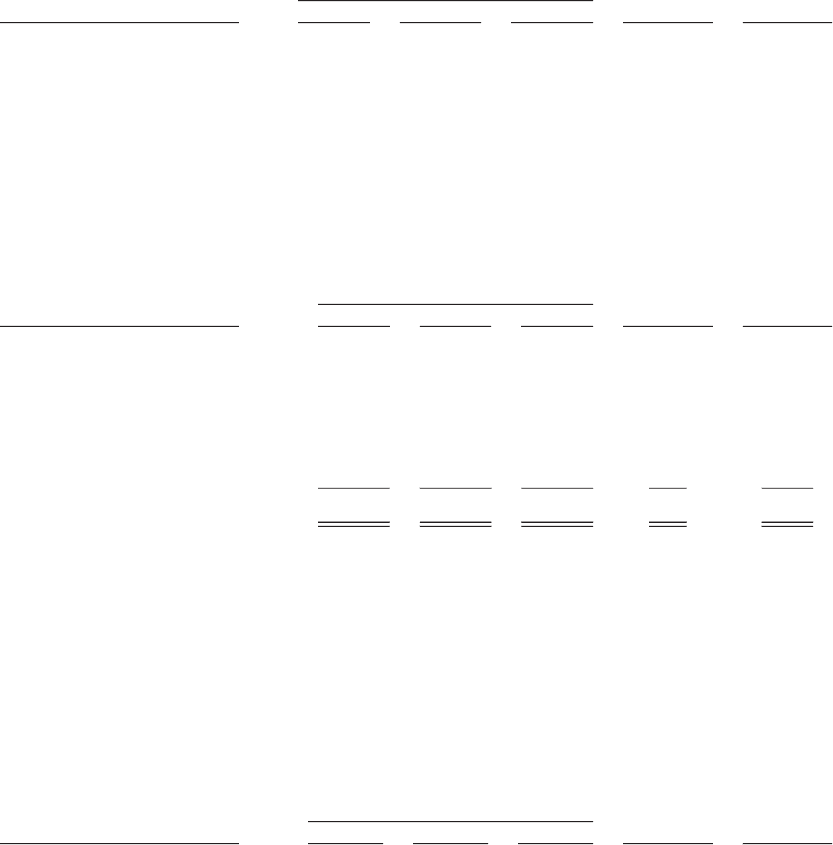

I

nterest Ex

p

ens

e

(

In thousands, except percentages

)

2009 2008 200

7

P

ercenta

g

e

C

han

g

e 2009

Versus

2008

P

ercenta

ge

C

han

g

e 2008

Versus

200

7

Y

ea

rEn

ded

December

31,

I

nterest ex

p

ens

e

.............

$(69,468) $(192,588) $(192,624) 63.9% N/

M

We incurred twelve months of interest costs totalin

g$

209.6 million, which were partiall

y

offset b

y

capitalized

interest of $140.2 million for the

y

ear ended December 31, 2009. Interest expense for 2009 also includes an

ad

j

ustment to accrete the debt to par value. Interest expense decreased in 2009 when compared to 2008 and 2007, as

more

i

nterest expense

i

n 2009 was cap

i

ta

li

ze

d

re

fl

ect

i

ng t

h

e

i

ncrease

i

n our cap

i

ta

l

expen

di

tures assoc

i

ate

d

w

i

t

h

t

he

increase in the build-out of our network.

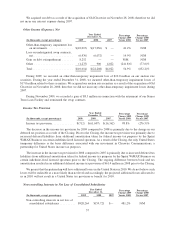

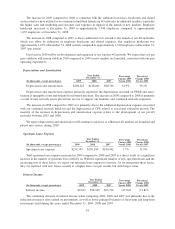

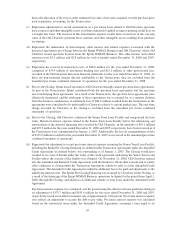

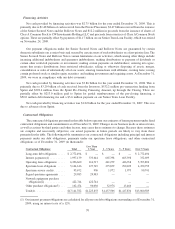

Ot

h

er Income (Ex

p

ense), Ne

t

(

In thousands, except percenta

g

es

)

2009 2008 2007

P

ercenta

g

e

Change 2009

Versus 2008

P

ercenta

ge

C

hange 2008

Versus 2007

Y

ear Ended

D

ecember

31,

O

ther-than-temporary impairmen

t

l

oss on in

v

estments

.

.........

.

$(

10,015

)$(

78,447

)$(

35,020

)

87.2%

(

124.0

)

%

L

oss on undesi

g

nated swa

p

con

t

rac

t

s

,

ne

t

..............

.

(

6,976

)(

7,008

)

—0.

5

% N/M

Gain on debt extin

g

uishment

......

8,2

5

2 — — N/M N/M

Other

.......................

(1,27

5

) (3,960) (1,284) 67.8% (208.4)%

Tota

l

.......................

$(10,014) $(89,415) $(36,304) 88.8% (146.3)%

Ot

h

er

i

ncome (expense)

d

ecrease

di

n 2009 compare

d

to 2008,

b

ecause we recor

d

e

d

an ot

h

er-t

h

an-temporar

y

impairment loss of only

$

10.0 million on our auction rate securities during 2009 compared to an other-than-tem

-

porar

y

impairment loss of

$

78.4 million related to these securities durin

g

2008. Durin

g

2007 we recorded a

n

o

ther-than-temporar

y

impairment loss of onl

y

$35.0 million related to our auction rate securities

.

During November 2009, we recorded a gain of

$

8.3 million in connection with the retirement of our Senior

T

erm Loan Fac

ili

t

y.

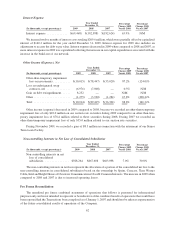

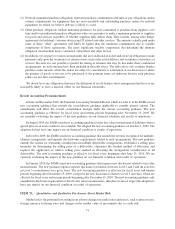

N

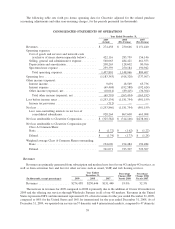

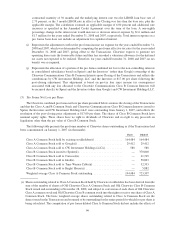

on-contro

ll

ing Interests in Net Loss o

f

Conso

l

i

d

ate

d

Su

b

si

d

iarie

s

(

In thousands, except percentages

)

2009 2008 200

7

P

ercenta

g

e

Chan

g

e 2009

V

ersus

2008

P

ercenta

ge

C

han

g

e 2008

V

ersus

200

7

Year Ende

d

December

31,

Non-controllin

g

interests in ne

t

loss o

f

co

n

so

li

dated

subs

i

d

i

a

ri

es

...............

.

$

928

,

264

$

867

,

608

$

663

,

098 7.0% 30.8

%

T

he non-controllin

g

interests in net loss represent the allocation of a portion of the consolidated net loss to the

n

on-contro

lli

ng

i

nterests

i

n conso

lid

ate

d

su

b

s

idi

ar

i

es

b

ase

d

on t

h

e owners

hi

p

b

y Spr

i

nt, Comcast, T

i

me Warner

Ca

bl

e, Inte

l

an

d

Br

i

g

h

t House o

f

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass B Common Interests. T

h

e

i

ncrease

i

n 2009 w

h

en

c

ompared to 2008 and 2007 is due to increased operatin

g

losses.

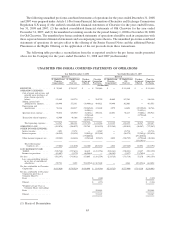

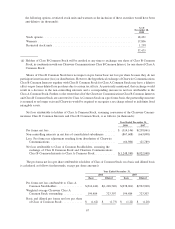

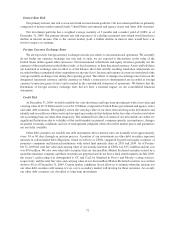

P

r

o

F

o

rm

a

R

eco

n

ci

l

ia

t

ion

T

he unaudited

p

ro forma combined statements of o

p

erations that follows is

p

resented for informational

p

urposes on

ly

an

di

s not

i

nten

d

e

d

to represent or

b

e

i

n

di

cat

i

ve o

f

t

h

e com

bi

ne

d

resu

l

ts o

f

operat

i

ons t

h

at wou

ld h

ave

b

een reporte

dh

a

d

t

h

e Transact

i

ons

b

een comp

l

ete

d

as o

f

Januar

y

1, 2007 an

d

s

h

ou

ld

not

b

eta

k

en as representat

i

ve

of the future consolidated results of operations of the Compan

y

.

6

2