Clearwire 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

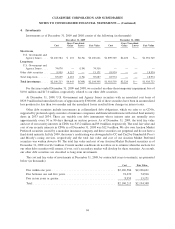

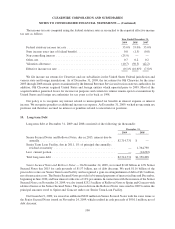

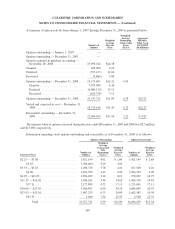

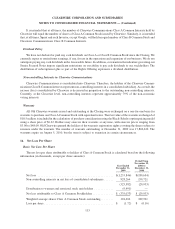

Th

e

f

o

ll

ow

i

ng ta

bl

e summar

i

zes our

fi

nanc

i

a

l

assets an

dli

a

bili

t

i

es

b

y

l

eve

l

w

i

t

hi

nt

h

eva

l

uat

i

on

hi

erarc

h

ya

t

D

ecem

b

er 31, 2009

(i

nt

h

ousan

d

s

):

Q

uoted

P

r

ices i

n

Act

i

v

e

M

ar

k

ets

(

Level 1

)

S

ignifican

t

O

the

r

O

bservable

I

nput

s

(

Level 2

)

S

i

g

nificant

U

nobservabl

e

I

nputs

(

Level 3

)

T

ota

l

F

air Valu

e

Financial assets:

C

ash and cash e

q

uivalent

s

...........

$

1,698,017 $ — $ — $1,698,01

7

Short-term investments

.

.............

$

2

,106,661 $ — $ — $2,106,66

1

L

on

g

-term investment

s

.

............. $

7

4,516 $ — $13,171 $ 87,687

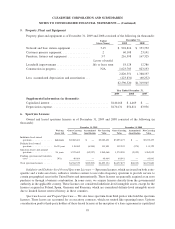

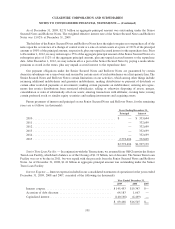

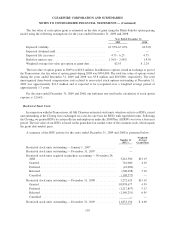

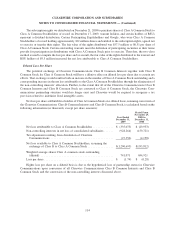

Th

e

f

o

ll

ow

i

n

g

ta

bl

e summar

i

zes our

fi

nanc

i

a

l

assets an

dli

a

bili

t

i

es

by l

eve

l

w

i

t

hi

nt

h

eva

l

uat

i

on

hi

erarc

hy

at

D

ecember 31, 2008 (in thousands):

Q

uoted

P

rices in

A

c

ti

ve

Ma

r

ke

t

s

(

Level 1

)

S

i

g

nifican

t

O

the

r

O

bservable

I

nput

s

(

Level 2

)

S

i

g

nificant

U

no

b

serva

ble

I

nputs

(

Level 3

)

To

t

al

F

a

i

r Valu

e

F

i

nanc

i

a

l

assets:

C

as

h

an

d

cas

h

equ

i

va

l

ent

s

.

..........

$

1

,

206

,

143

$

—

$

—

$

1

,

206

,

14

3

Short-term investments

.

.............

$

1,

901

,

749

$

—

$

—

$

1

,

901

,

74

9

L

ong-term investment

s

.

.............

$

—

$

—

$

18

,

974 $ 18

,

974

F

inancial liabilities

:

Interest rate swa

p

s................. $ — $ — $21,591 $ 21,591

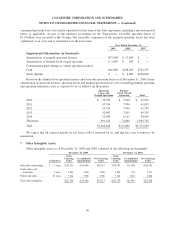

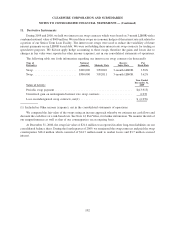

T

h

e

f

o

ll

ow

i

n

g

ta

bl

e prov

id

es a reconc

ili

at

i

on o

f

t

h

e

b

e

gi

nn

i

n

g

an

d

en

di

n

gb

a

l

ances

f

or t

h

ema

j

or c

l

asses o

f

assets and liabilities measured at fair value usin

g

si

g

nificant unobservable inputs (Level 3) (in thousands):

L

evel

3

Financial Asset

s

L

evel

3

Financial Liabilities

B

alance at Januar

y

1, 2008 ............................ $ — $

—

B

alances ac

q

uired from Old Clearwir

e

....................

3

6,011 (1

5

,

5

19)

T

otal losses for 2008 included in net loss(1

)

................

(

17,037) (

6

,072

)

B

a

l

ance at Decem

b

er 31

,

2008

.........................

18,974

(

21,591

)

T

ota

l

ga

i

ns (

l

osses)

f

or 2009

i

nc

l

u

d

e

di

n:

Net

l

oss

(

1

)

.

.....................................

(

10,01

5)

6,939

O

ther com

p

rehensive income .........................

4,

212

—

S

ettlement

s

........................................ —

1

4,6

5

2

B

alance at December 31, 200

9

.........................

$

13,171 $

—

Net unrealized losses included in net loss for 2009 relatin

g

t

o

financial assets held at December 31

,

200

9

.

.............

.

$(

10,015

)$

—

(1) Included in Other income (ex

p

ense), net in the consolidated statements of o

p

erations.

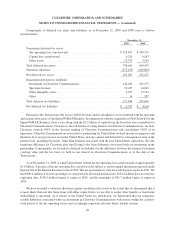

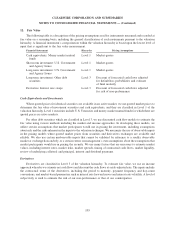

T

he followin

g

is the description of the fair value for financial instruments we hold that are not sub

j

ect to fai

r

va

l

ue recogn

i

t

i

on

.

104

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)