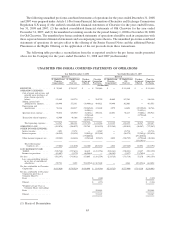

Clearwire 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.d

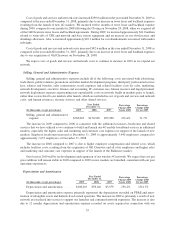

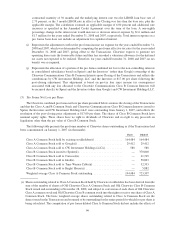

ue to t

h

ea

ll

ocat

i

on o

f

t

h

e excess o

f

t

h

e est

i

mate

df

a

i

rva

l

ue o

f

net assets acqu

i

re

d

over t

h

e purc

h

ase pr

i

c

e

used in purchase accountin

g

for the Transactions.

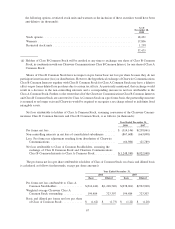

(c) Represents a

dj

ustments to recor

d

amort

i

zat

i

on on a pro

f

orma

b

as

i

sre

l

ate

d

to O

ld

C

l

earw

i

re spectrum

l

ease contracts an

d

ot

h

er

i

ntan

gibl

e assets over t

h

e

i

r est

i

mate

d

we

igh

te

d

avera

g

e rema

i

n

i

n

g

use

f

u

lli

ves on

a

strai

g

ht-line basis. The increase in the amortization expense results from an increase in the carr

y

in

g

v

a

l

ue o

f

t

h

eO

ld

C

l

earw

i

re spectrum

l

ease contracts an

d

ot

h

er

i

ntang

ibl

e assets resu

l

t

i

ng

f

rom purc

h

as

e

a

ccount

i

n

g.

(d) Represents the elimination of intercompany other income and related expenses associated with th

e

hi

stor

i

ca

l

a

g

reements pre-C

l

os

i

n

gb

etween t

h

e Spr

i

nt W

i

MAX Bus

i

ness an

d

O

ld

C

l

earw

i

re, w

h

ere O

ld

Cl

earw

i

re

l

ease

d

s

p

ectrum

li

censes

f

rom t

h

eS

p

r

i

nt W

i

MAX Bus

i

ness. T

h

eot

h

er

i

ncome an

d

re

l

ate

d

ex

p

enses were $2.6 million and $2.8 million for twelve months ended December 31, 2008 and 2007,

respect

i

ve

l

y.

(e) Represents the reversal of transaction costs of $48.6 million for the

y

ear ended December 31, 2008,

comprised of

$

33.4 million of investment banking fees and

$

15.2 million of other professional fees,

recor

d

e

di

nt

h

eO

ld

C

l

earw

i

re

hi

stor

i

ca

lfi

nanc

i

a

l

statements

f

or t

h

e year en

d

e

d

Decem

b

er 31, 2008. A

s

t

hese are non-recurrin

g

char

g

es directl

y

attributable to the Transactions, the

y

are excluded from th

e

unau

di

te

d

pro

f

orma com

bi

ne

d

statement o

f

operat

i

ons

f

or t

h

e year en

d

e

d

Decem

b

er 31, 2008.

(

f

)Pr

i

or to t

h

eC

l

os

i

n

g

, Spr

i

nt

l

ease

d

spectrum to O

ld

C

l

earw

i

re t

h

rou

gh

var

i

ous spectrum

l

ease a

g

reements

.

As part of the Transactions, Sprint contributed both the spectrum lease a

g

reements and the spectrum

a

ssets underlying those agreements. As a result of the Transactions, the spectrum lease agreements wer

e

e

ff

ect

i

ve

ly

term

i

nate

d

,an

d

t

h

e sett

l

ement o

f

t

h

ose a

g

reements was accounte

df

or as a separate e

l

emen

t

f

rom the business combination. A settlement loss of $80.6 million resulted from the termination as the

a

greements were considered to be unfavorable to Clearwire relative to current market rates. This one-time

c

h

ar

g

e recor

d

e

dby

C

l

earw

i

re at t

h

ec

l

os

i

n

gi

sexc

l

u

d

e

df

rom t

h

e unau

di

te

d

pro

f

orma com

bi

ne

d

statements o

f

o

p

erat

i

ons

.

(g) Pr

i

or to t

h

eC

l

os

i

ng, O

ld

C

l

earw

i

re re

fi

nance

d

t

h

e Sen

i

or Term Loan Fac

ili

ty an

d

renegot

i

ate

d

t

h

e

l

oan

t

erms. H

i

stor

i

ca

li

nterest expense re

l

ate

d

to t

h

e Sen

i

or Term Loan Fac

ili

ty

b

e

f

ore t

h

ere

fi

nanc

i

ng an

d

a

mortization of the deferred financin

g

fees recorded b

y

Old Clearwire, in the amounts of $94.1 million

a

nd

$

95.3 million for the years ended December 31, 2008 and 2007, respectively, have been reversed as if

th

e Transact

i

ons were consummate

d

on January 1, 2007. A

ddi

t

i

ona

ll

y, t

h

e

l

oss on ext

i

ngu

i

s

h

ment o

fd

e

b

t

o

f $159.2 million recorded for the

y

ear ended December 31, 2007 was reversed in the unaudited pro forma

com

bi

ne

d

statement o

f

operat

i

ons.

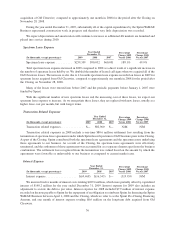

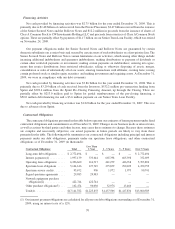

(h) Represents the ad

j

ustment to record pro forma interest expense assumin

g

the Senior Term Loan Facilit

y,

includin

g

the Sprint Pre-Closin

g

financin

g

(as defined in the Transaction A

g

reement) under the Amended

C

re

di

t Agreement (as

d

e

fi

ne

db

e

l

ow), was outstan

di

ng as o

f

January 1, 2007. T

h

eC

l

os

i

ng wou

ld h

av

e

resu

l

te

di

n an event o

fd

e

f

au

l

tun

d

er t

h

e terms o

f

t

h

e cre

di

ta

g

reement un

d

er

lyi

n

g

t

h

e Sen

i

or Term Loa

n

F

acilit

y

unless the consent of the lenders was obtained. On November 21, 2008, Old Clearwire entered

into the Amended and Restated Credit Agreement with the lenders to obtain their consent and to satisf

y

o

t

h

er con

di

t

i

ons to c

l

os

i

n

g

un

d

er t

h

e Transact

i

on A

g

reement, w

hi

c

h

we re

f

er to as t

h

e Amen

d

e

d

Cre

di

t

A

g

reement. The Amended Credit A

g

reement resulted in additional fees to be paid and ad

j

ustments to the

underlying interest rates. The Sprint Pre-Closing Financing was assumed by Clearwire on the Closing, a

s

a

resu

l

to

f

t

h

e

fi

nanc

i

n

g

o

f

t

h

e Spr

i

nt W

i

MAX Bus

i

ness operat

i

ons

by

Spr

i

nt

f

or t

h

e per

i

o

df

rom Apr

il

1,

2

008, throu

g

h the Closin

g

, and added as an additional tranche of term loans under the Amended Credit

A

g

reement.

Pro

f

orma

i

nterest expense was ca

l

cu

l

ate

d

over t

h

e per

i

o

d

us

i

ng t

h

ee

ff

ect

i

ve

i

nterest met

h

o

d

resu

l

t

i

ng

i

n

an ad

j

ustment of $175.7 million and $191.6 million for the

y

ears ended December 31, 2008 and 2007,

respect

i

ve

l

y,

b

ase

d

on an e

ff

ect

i

ve

i

nterest rate o

f

approx

i

mate

l

y 14.0 percent. Pro

f

orma

i

nterest expense

a

l

so re

fl

ects an a

dj

ustment to accrete t

h

e

d

e

b

t to par va

l

ue. Pro

f

orma

i

nterest expense was ca

l

cu

l

ate

d

b

ased on the contractual terms under the Amended Credit A

g

reement, assumin

g

a term equal to it

s

65