Symantec 2002 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

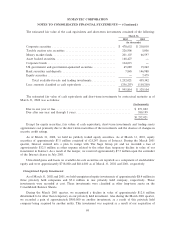

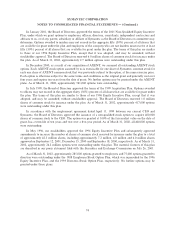

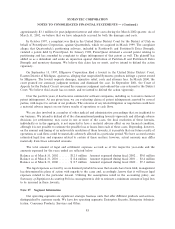

A summary of our stockholder approved and non-approved equity compensation plans as of March 31,

2002 was as follows (in thousands, except exercise price):

Number of Securities Number of Securities

to be Issued Weighted Average Remaining Available for

Upon Exercise of Exercise Price of Issuance Under Equity

Plan Category Outstanding Options Outstanding Options Compensation Plans

Equity compensation plans approved by

security holders* ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 24,528 $23.03 11,611

Equity compensation plans not approved by

security holders ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 3,514 $21.87 4,046

TotalÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 28,042 $22.88 15,657

* Our 1998 Employee Stock Purchase Plan contains an ""evergreen'' provision whereby the number of shares

available for issuance increases automatically on January 1 of each year (beginning in 2000) by 1% of our

outstanding shares of common stock on each immediately preceding December 31 during the term of the

plan.

The total number of shares to be issued upon exercise does not include approximately 742,000

outstanding options as of March 31, 2002 that were assumed as part of various acquisitions. The weighted

average exercise price of these outstanding options was $18.52 as of March 31, 2002. In connection with these

acquisitions, we have only assumed outstanding options and rights, but not the plans themselves, and

therefore, no further options may be granted under these acquired-company plans.

Our non-stockholder approved equity compensation plans include the following:

‚ 2001 Non-QualiÑed Equity Incentive Plan

‚ 1999 Acquisition Plan

‚ 1994 Patent Incentive Plan

‚ Non-qualiÑed stock option and restricted shares granted to John Thompson, CEO of Symantec

‚ Options assumed in connection with our acquisition of AXENT

See above in this Note 12 of Notes to Consolidated Financial Statements for descriptions of these plans.

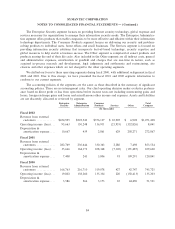

Note 13. Restructuring, Site Closures and Other Expenses

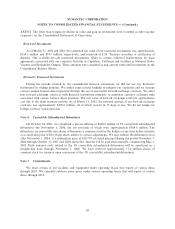

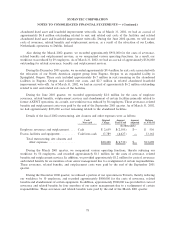

Restructuring, site closures and other expenses consisted of the following:

Year Ended March 31,

2002 2001 2000

(In thousands)

Employee severance and outplacement ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 2,639 $3,524 $8,065

Excess facilities and equipmentÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 17,789 140 953

Total restructuring, site closures and other expenses ÏÏÏÏÏÏÏÏÏÏÏ $20,428 $3,664 $9,018

During the March 2002 quarter, we recorded approximately $8.1 million for exit costs associated with the

expansion of our Newport News, Virginia site to a larger facility in Newport News, consolidation of most of

our United Kingdom facilities to Maidenhead, UK, and relocation of our Leiden, Netherlands operations to

Dublin, Ireland, in eÅorts to consolidate our European support functions. These costs included approximately

$5.8 million in rent remaining on the abandoned facilities and related exit costs, and $2.3 million in related

77