Symantec 2002 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

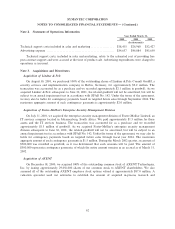

Acquisition of L-3 Network Security

On March 9, 2000, we acquired the operations of L-3 Network Security for a one-time cash payment of

approximately $20.1 million. The transaction was accounted for as a purchase. In connection with the

transaction, we recorded approximately $3.1 million for acquired in-process research and development,

$12.4 million for goodwill, $3.9 million for acquired product rights and $900,000 for other tangible and

intangible assets. A valuation specialist used our estimates to establish the amount of acquired in-process

research and development. The goodwill, acquired product rights and other intangibles are being amortized

over a Ñve-year period. Commencing in Ñscal 2003, however, the remaining balance of workforce-in-place and

goodwill will no longer be amortized. Instead they will be subject to an annual impairment test in accordance

with SFAS No. 142.

Acquisition of URLabs

On July 21, 1999, we purchased 100% of the outstanding common stock of URLabs for a one-time cash

payment of approximately $42.1 million. The transaction was accounted for as a purchase. In connection with

the transaction, we recorded approximately $1.2 million for acquired in-process research and development,

$37.0 million for goodwill, $5.2 million for acquired product rights, $1.4 million for other intangible assets and

$600,000 for other acquired assets, oÅset by approximately $2.7 million in related income tax liabilities. A

valuation specialist used our estimates to establish the amount of acquired in-process research and

development. The goodwill, acquired product rights and other intangibles are being amortized over a Ñve-year

period. Commencing in Ñscal 2003, however, the remaining balance of workforce-in-place and goodwill will no

longer be amortized. Instead they will be subject to an annual impairment test in accordance with SFAS

No. 142.

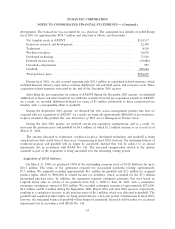

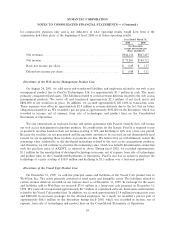

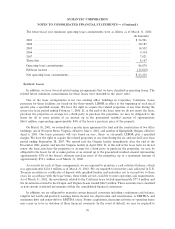

The following table outlines the values of the above referenced Ñscal 2000 acquisitions' net tangible and

intangible assets, adjusted for Ñnal purchase price allocations, as certain pre-acquisition contingencies that

existed upon acquisition have been resolved:

Allocated Purchase Price Components

Acquired Acquired Income Other

Purchase In-Process Product Other Tax Assets

Price R&D Rights Goodwill Intangibles Liabilities Acquired

(In thousands)

20/20 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $13,864 $ Ì $ 2,250 $12,437 $ Ì $ (900) $ 77

L-3 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 20,240 3,100 3,860 12,396 600 Ì 284

URLabs ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 42,700 1,200 5,210 37,000 1,400 (2,710) 600

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $76,804 $4,300 $11,320 $61,833 $2,000 $(3,610) $961

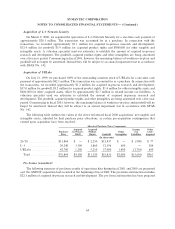

Pro Forma (unaudited)

The following summary of pro forma results of operations data during Ñscal 2001 and 2000 are presented

as if the AXENT acquisition had occurred at the beginning of Ñscal 2000. The pro forma information excludes

$22.3 million of acquired in-process research and development. The pro forma information has been prepared

64