Symantec 2002 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

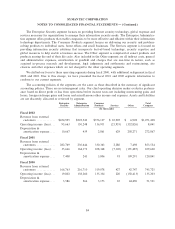

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

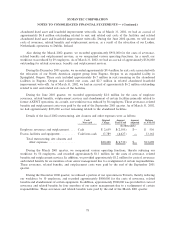

In January 2001, the Board of Directors approved the terms of the 2001 Non-QualiÑed Equity Incentive

Plan, under which we grant options to employees, oÇcers, directors, consultants, independent contractors and

advisors to us, or of any parent, subsidiary or aÇliate of Symantec as the Board of Directors or committee may

determine. Options awarded to insiders may not exceed in the aggregate Ñfty (50%) percent of all shares that

are available for grant under the plan and employees of the company who are not insiders must receive at least

Ñfty (50%) percent of all shares that are available for grant under the plan. The terms of this plan are similar

to those of our 1996 Equity Incentive Plan, except that it was adopted, and may be amended, without

stockholder approval. The Board of Directors reserved 6.0 million shares of common stock for issuance under

the plan. As of March 31, 2002, approximately 2.7 million options were outstanding under this plan.

In December 2000, as a result of our acquisition of AXENT, we assumed all outstanding AXENT stock

options. Each AXENT stock option assumed by us is exercisable for one share of Symantec common stock for

each one share of AXENT common stock that was previously subject to the option, at the same exercise price.

Each option is otherwise subject to the same terms and conditions as the original grant and generally vest over

four years and expires ten years from the date of grant. No further options may be granted under the AXENT

plans. As of March 31, 2002, approximately 741,000 options were outstanding.

In July 1999, the Board of Directors approved the terms of the 1999 Acquisition Plan. Options awarded

to oÇcers may not exceed in the aggregate thirty (30%) percent of all shares that are available for grant under

the plan. The terms of this plan are similar to those of our 1996 Equity Incentive Plan, except that it was

adopted, and may be amended, without stockholder approval. The Board of Directors reserved 1.0 million

shares of common stock for issuance under the plan. As of March 31, 2002, approximately 417,000 options

were outstanding under this plan.

In accordance with the employment agreement dated April 11, 1999 between our current CEO and

Symantec, the Board of Directors approved the issuance of a non-qualiÑed stock option to acquire 400,000

shares of common stock to the CEO. The option was granted at 100% of the fair market value on the date of

grant, has a term life of ten years and vest over a Ñve-year period. As of March 31, 2002, all 400,000 options

were outstanding.

In May 1996, our stockholders approved the 1996 Equity Incentive Plan and subsequently approved

amendments to increase the number of shares of common stock reserved for issuance under the plan to a total

of approximately 42.5 million shares, including approximately 7.2 million, 4.8 million and 6.0 million shares

approved on September 12, 2001, December 15, 2000 and September 18, 2000, respectively. As of March 31,

2002, approximately 24.2 million options were outstanding under this plan. The material features of this plan

are described in our proxy statement Ñled with the Securities and Exchange Commission on July 26, 2001.

As of March 31, 2002, approximately 285,000 options granted to employees and 75,000 options granted to

directors were outstanding under the 1988 Employees Stock Option Plan, which was superseded by the 1996

Equity Incentive Plan, and the 1993 Directors Stock Option Plan, respectively. No further options may be

granted under these plans.

74