Symantec 2002 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

revenues being generated more evenly throughout the March 2002 quarter due primarily to the increase in

sales of consumer products, which resulted in higher cash collections. In prior quarters, we had generated a

larger percentage of net revenues during the last month of each quarter.

Net cash used in investing activities was approximately $869.3 million and was comprised primarily of

$721.7 million in net purchases of marketable securities and investments, and $140.9 million of capital

expenditures, including $62.0 million for the implementation of Oracle 11i and a CRM system and $25 million

in January 2002 and $18 million in November 2001 for land and a building in Maidenhead, United Kingdom

and Dublin, Ireland, respectively.

On January 16, 2001, the Board of Directors replaced an earlier stock repurchase program with a new

authorization to repurchase up to $700.0 million, not to exceed 30.0 million shares, of Symantec's common

stock with no expiration date. During the September 2001 quarter, we repurchased 9.6 million shares at prices

ranging from $17.78 to $24.50 per share, for an aggregate amount of approximately $204.4 million. During the

March 2001 quarter, we repurchased 10.0 million shares at prices ranging from $23.04 to $25.58 per share, for

an aggregate amount of approximately $244.4 million.

On October 24, 2001, we completed a private oÅering of $600.0 million of 3% convertible subordinated

debentures due November 1, 2006, the net proceeds of which were approximately $584.6 million. The

debentures are convertible into shares of Symantec's common stock by the holders at any time before maturity

at a conversion price of $34.14 per share, subject to certain adjustments. We may redeem the notes on or after

November 5, 2004, at a redemption price of 100.75% of stated principal during the period November 5, 2004

through October 31, 2005 and 100% thereafter. Interest will be paid semi-annually, commencing May 1, 2002.

We intend to use the net proceeds of the oÅering for general corporate purposes, including working capital,

potential acquisitions, stock repurchases and investments in our infrastructure.

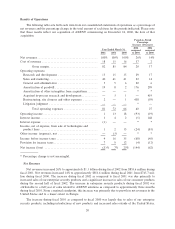

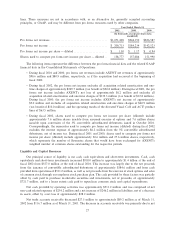

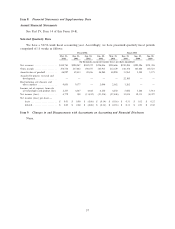

The following table displays our contractual obligations as of March 31, 2002:

Payments Due In

Total

Payments Fiscal 2004 Fiscal 2006 Fiscal 2008

Due Fiscal 2003 and 2005 and 2007 and Thereafter

(In thousands)

Convertible subordinated debentures ÏÏÏÏÏ $600,000 $ Ì $ Ì $600,000 $ Ì

Operating leases ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 86,070 26,901 34,687 16,335 8,147

Total contractual obligationsÏÏÏÏÏÏÏÏÏÏ $686,070 $26,901 $34,687 $616,335 $8,147

The above table assumes that the convertible subordinated debentures will be paid in cash upon maturity

and excludes the balance of our current liabilities.

We believe that existing cash and short-term investments, cash generated from operating results and cash

from the subordinated convertible debenture oÅering will be suÇcient to fund operations for at least the next

year.

Synthetic Leases

We currently have two real estate leasing arrangements that we have classiÑed as operating leases.

One of the lease arrangements is for two existing oÇce buildings in Cupertino, California. Lease

payments for these facilities are based on the three-month LIBOR in eÅect at the beginning of each Ñscal

quarter plus a speciÑed margin. We have the right to acquire the related properties at any time during the

seven-year lease period ending February 1, 2006. If, at the end of the lease term we do not renew the lease,

purchase the properties or arrange for a third party to purchase the properties, we may be obligated to the

lessor for all or some portion of an amount up to the guaranteed residual amount of approximately

$66.0 million, representing approximately 84% of the lessor's purchase price of the property.

On March 30, 2001, we entered into a master lease agreement for land and the construction of two oÇce

buildings, one in Newport News, Virginia, eÅective June 6, 2001, and another in SpringÑeld, Oregon, eÅective

28