Symantec 2002 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

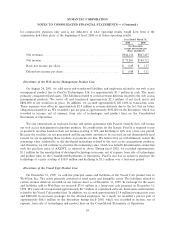

for comparative purposes only and is not indicative of what operating results would have been if the

acquisitions had taken place at the beginning of Ñscal 2000 or of future operating results.

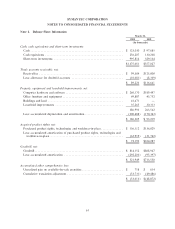

Year Ended March 31,

2001 2000

(In thousands,

except net income per

share; unaudited)

Net revenuesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $944,150 $867,437

Net incomeÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 75,841 $169,312

Basic net income per shareÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.49 $ 1.17

Diluted net income per share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.48 $ 1.11

Divestiture of the Web Access Management Product Line

On August 24, 2001, we sold assets and transferred liabilities and employees related to our web access

management product line to PassGo Technologies Ltd. for approximately $1.1 million in cash. The assets

primarily consisted of Ñxed assets. The liabilities related to certain revenue deferrals related to the web access

management products. We wrote oÅ and transferred approximately $2.3 million of net Ñxed assets and

$804,000 of net workforce-in place. In addition, we accrued approximately $311,000 in transaction costs.

These expenses were oÅset by approximately $2.9 million in revenue deferrals due to the fact that no future

obligations existed for us. We recorded a pre-tax gain of approximately $392,000 on the divestiture, which was

recorded in income, net of expense, from sale of technologies and product lines on the Consolidated

Statements of Operations.

We also entered into an exclusive license and option agreement with PassGo whereby they will license

our web access management technology products. In consideration for the license, PassGo is required to pay

us quarterly royalties based on their net revenue starting at 30% and declining to 10% over a four-year period.

Because the royalties are not guaranteed and the quarterly amounts to be received are not determinable until

earned, we are recognizing these royalties as payments are due. We believe that we will ultimately realize the

remaining value attributable to the developed technology related to the web access management products,

and, therefore, we will continue to amortize this remaining value, which was initially determined in connection

with the purchase price of AXENT, as referred to above. During Ñscal 2002, we recorded approximately

$1.1 million for the amortization of developed technology in income, net of expense, from sale of technologies

and product lines on the Consolidated Statements of Operations. PassGo also has an option to purchase the

technology at a price starting at $18.8 million and declining to $3.3 million over a four-year period.

Divestiture of the Visual Caf πe Product Line

On December 31, 1999, we sold the principal assets and liabilities of the Visual Cafπe product line to

WebGain, Inc. The assets primarily consisted of Ñxed assets and intangible assets. The liabilities related to

certain revenue deferrals recorded on our balance sheet as of December 31, 1999. In exchange for the assets

and liabilities sold to WebGain, we received $75.0 million in a lump-sum cash payment on December 31,

1999. We wrote oÅ or transferred approximately $4.7 million of capitalized software, Ñxed assets and inventory

related to the Visual Cafπe product line. In addition, we accrued approximately $1.4 million in transaction costs

and $400,000 in severance packages for the aÅected employees. As a result, we recorded a pre-tax gain of

approximately $68.5 million on the divestiture during Ñscal 2000, which was recorded in income, net of

expense, from sale of technologies and product lines on the Consolidated Statements of Operations.

65