Symantec 2002 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

release the cash collateral and take possession of the buildings. As of March 31, 2002, we were in compliance

with all Ñnancial covenants.

Rent expense charged to operations totaled approximately $25.2 million, $22.9 million and $15.5 million

during Ñscal 2002, 2001 and 2000, respectively.

Note 8. Stock Split

On December 14, 2001, the Board of Directors approved a two-for-one stock split of Symantec's common

stock eÅected as a stock dividend, which became eÅective as of January 31, 2002 to stockholders of record on

January 17, 2002. Based on the number of shares outstanding on January 17, 2002, the stock dividend resulted

in the issuance of approximately 70.7 million additional shares of Symantec's common stock. All Symantec

share and per share amounts in prior periods have been adjusted to give retroactive eÅect to the stock

dividend.

Note 9. Common Stock Repurchases

On January 16, 2001, the Board of Directors replaced the March 22, 1999 stock repurchase program with

a new authorization to repurchase up to $700.0 million, not to exceed 30.0 million shares, of Symantec's

common stock with no expiration date. During Ñscal 2002, we repurchased 9.6 million shares at prices ranging

from $17.78 to $24.50 per share, for an aggregate amount of approximately $204.4 million. During Ñscal 2001,

we repurchased 10.0 million shares at prices ranging from $23.04 to $25.58 per share, for an aggregate amount

of approximately $244.4 million.

On March 22, 1999, the Board of Directors authorized the repurchase of up to $75.0 million of Symantec

common stock with no expiration date. During Ñscal 2000, we repurchased 2.0 million shares at prices ranging

from $8.95 to $9.94, for an aggregate amount of approximately $18.7 million.

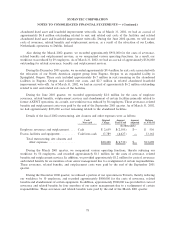

Note 10. Net Income (Loss) Per Share

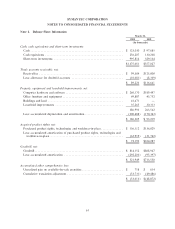

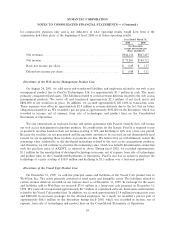

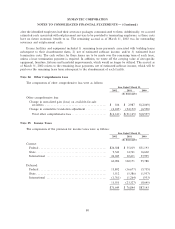

The components of net income (loss) per share were as follows:

Year Ended March 31,

2002 2001 2000

(In thousands, except per share data)

Basic Net Income (Loss) Per Share

Net income (loss) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(28,151) $ 63,936 $170,148

Weighted average number of common shares outstanding during the

period ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 143,604 129,474 115,740

Basic net income (loss) per share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ (0.20) $ 0.49 $ 1.47

Diluted Net Income (Loss) Per Share

Net income (loss) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(28,151) $ 63,936 $170,148

Weighted average number of common shares outstanding during the

period ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 143,604 129,474 115,740

Shares issuable from assumed exercise of options ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 7,000 8,688

Total shares for purpose of calculating diluted net income (loss) per

share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 143,604 136,474 124,428

Diluted net income (loss) per shareÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ (0.20) $ 0.47 $ 1.37

71