Symantec 2002 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

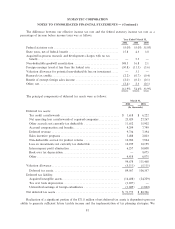

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

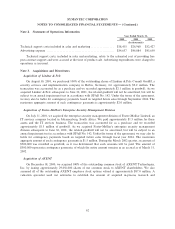

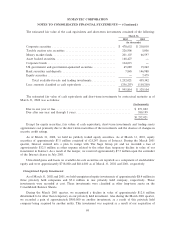

During Ñscal 2002, approximately 7.6 million shares issuable upon conversion of the 3% convertible

subordinated debentures were excluded from the computation of diluted net income (loss) per share, as their

eÅect would have been anti-dilutive.

During Ñscal 2002, 2001, and 2000, approximately 13.8 million, 8.3 million and 928,000 shares,

respectively, issuable from assumed exercise of options were excluded from the computation of diluted net

income (loss) per share, as their eÅect would have been anti-dilutive.

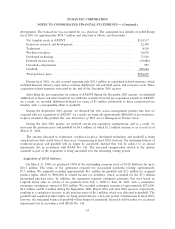

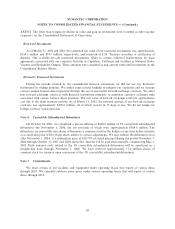

Note 11. Adoption of Stockholder Rights Plan

On August 11, 1998, the Board of Directors adopted a stockholder rights plan designed to ensure orderly

consideration of any future unsolicited acquisition attempt to ensure fair value of us for our stockholders.

In connection with the plan, the Board of Directors declared and paid a dividend of one preferred share

purchase right for each share of Symantec common stock outstanding on the Record Date, August 21, 1998.

Each right entitles the holder, under certain circumstances, to purchase from us one two-thousandth of a share

of our Series A Junior Participating Preferred Stock, par value $0.01 per share, at a price of $150.00 per one

one-thousandth of a share of Series A Junior Participating Preferred Stock, subject to adjustment.

The rights are initially attached to Symantec common stock and will not trade separately. If a person or a

group, an Acquiring Person, acquires 20% or more of our common stock, or announces an intention to make a

tender oÅer for 20% or more of our common stock, the rights will be distributed and will thereafter trade

separately from the common stock.

If the rights become exercisable, each right (other than the Acquiring Person) will entitle the holder to

purchase, at a price equal to the exercise price of the right, a number of shares of our common stock having a

then-current value of twice the exercise price of the right. If, after the rights become exercisable, we agree to

merge into another entity or we sell more than 50% of our assets, each right will entitle the holder to purchase,

at a price equal to the exercise price of the right, a number of shares of common stock of such entity having a

then-current value of twice the exercise price.

We may exchange the rights at a ratio of one share of common stock for each right (other than the

Acquiring Person) at any time after an Acquiring Person acquires 20% or more of our common stock but

before such person acquires 50% or more of our common stock. We may also redeem the rights at our option

at a price of $0.001 per right at any time before an Acquiring Person has acquired 20% or more of our common

stock. The rights will expire on August 12, 2008.

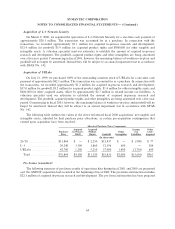

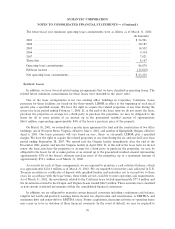

Note 12. Employee BeneÑts

401(k) Plan

We maintain a salary deferral 401(k) plan for all of our domestic employees. This plan allows employees

to contribute up to 20% of their pretax salary up to the maximum dollar limitation prescribed by the Internal

Revenue Code. We match 100% of the Ñrst $500 of employees' contributions and then 50% of the employees'

contribution. The maximum employer match in any given plan year is 3% of the employees' eligible

compensation. Our contributions under the plan were approximately $4.1 million, $3.0 million and $2.4 mil-

lion during Ñscal 2002, 2001 and 2000.

Restricted Shares

During Ñscal 1999, we issued 200,000 restricted shares to our current CEO for a purchase price of $0.005

per share, vesting 50% at each anniversary date, with the Ñrst anniversary date being April 14, 2000. Unearned

compensation equivalent to the market value of the common stock on the date of grant, less par, was charged

72