Symantec 2002 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

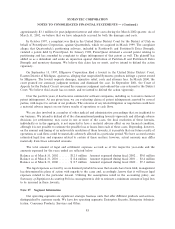

after the identiÑed employees had their severance packages communicated to them. Additionally, we accrued

estimated costs associated with outplacement services to be provided to terminating employees, as these costs

have no future economic beneÑt to us. The remaining accrual as of March 31, 2002 was for outstanding

severance and outplacement costs.

Excess facilities and equipment included 1) remaining lease payments associated with building leases

subsequent to their abandonment dates, 2) net of estimated sublease income, and/or 3) estimated least

termination costs. The cash outlays for these leases are to be made over the remaining term of each lease,

unless a lease termination payment is required. In addition, we wrote oÅ the carrying value of site-speciÑc

equipment, furniture, Ñxtures and leasehold improvements, which would no longer be utilized. The accrual as

of March 31, 2002 relates to the remaining lease payments, net of estimated sublease income, which will be

paid over the remaining lease term subsequent to the abandonment of each facility.

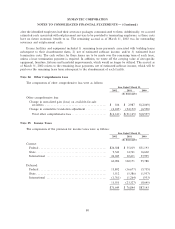

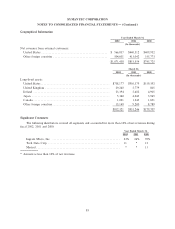

Note 14. Other Comprehensive Loss

The components of other comprehensive loss were as follows:

Year Ended March 31,

2002 2001 2000

(In thousands)

Other comprehensive loss:

Change in unrealized gain (loss) on available-for-sale

securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 104 $ 2,987 $(2,069)

Change in cumulative translation adjustment ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (4,245) (24,152) (6,528)

Total other comprehensive loss ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(4,141) $(21,165) $(8,597)

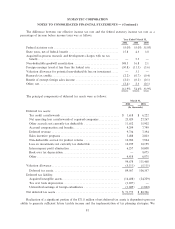

Note 15. Income Taxes

The components of the provision for income taxes were as follows:

Year Ended March 31,

2002 2001 2000

(In thousands)

Current:

Federal ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $24,508 $ 55,019 $51,193

State ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,543 14,741 16,600

International ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 26,045 30,411 27,995

60,096 100,171 95,788

Deferred:

Federal ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 13,802 (16,677) (5,735)

State ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,512 (5,386) (1,957)

International ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (1,761) (1,264) (953)

13,553 (23,327) (8,645)

$73,649 $ 76,844 $87,143

80