Symantec 2002 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

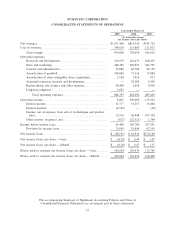

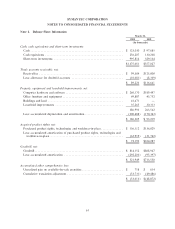

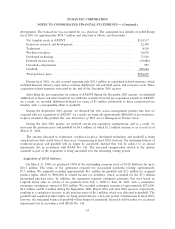

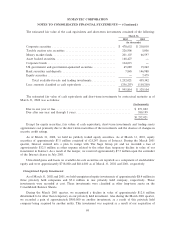

Note 2. Statement of Operations Information

Year Ended March 31,

2002 2001 2000

(In thousands)

Technical support costs included in sales and marketing ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $18,415 $26,968 $32,427

Advertising expense ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $34,657 $46,884 $43,630

Technical support costs, included in sales and marketing, relate to the estimated cost of providing free

post-contract support and were accrued at the time of product sale. Advertising expenditures were charged to

operations as incurred.

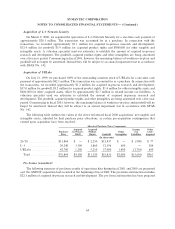

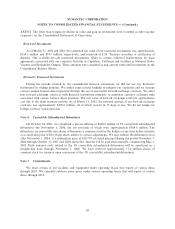

Note 3. Acquisitions and Divestitures

Acquisition of Lindner & Pelc

On August 30, 2001, we purchased 100% of the outstanding shares of Lindner & Pelc Consult GmbH, a

security services and implementation company in Berlin, Germany, for approximately $2.2 million. The

transaction was accounted for as a purchase and we recorded approximately $2.1 million in goodwill. As we

acquired Lindner & Pelc subsequent to June 30, 2001, the related goodwill will not be amortized, but will be

subject to an annual impairment test in accordance with SFAS No. 142. Under the terms of the agreement,

we may also be liable for contingency payments based on targeted future sales through September 2004. The

maximum aggregate amount of such contingency payments is approximately $2.0 million.

Acquisition of Foster-Melliar's Enterprise Security Management Division

On July 11, 2001, we acquired the enterprise security management division of Foster-Melliar Limited, an

IT services company located in Johannesburg, South Africa. We paid approximately $1.5 million for these

assets and the IT services business. The transaction was accounted for as a purchase and we recorded

approximately $1.5 million of goodwill. As we acquired Foster-Melliar's enterprise security management

division subsequent to June 30, 2001, the related goodwill will not be amortized, but will be subject to an

annual impairment test in accordance with SFAS No. 142. Under the terms of the agreement, we may also be

liable for contingency payments based on targeted future sales through Ñscal year 2004. The maximum

aggregate amount of such contingency payments is $1.5 million. During the March 2002 quarter, an amount of

$500,000 was recorded as goodwill, as it was determined that such amounts will be paid. The amount of

$500,000 represents contingency payments, of which the entire amount remains as an accrual as of March 31,

2002.

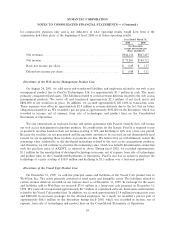

Acquisition of AXENT

On December 18, 2000, we acquired 100% of the outstanding common stock of AXENT Technologies,

Inc. by issuing approximately 29,056,000 shares of our common stock to AXENT shareholders. We also

assumed all of the outstanding AXENT employee stock options valued at approximately $87.0 million. A

valuation specialist used our estimates to establish the amount of acquired in-process research and

62