Symantec 2002 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

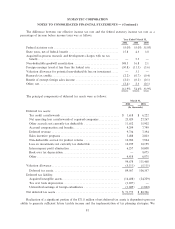

believe that it is more likely than not that the net deferred tax assets will be realized based on historical

earnings, expected levels of future taxable income in the U.S. and certain foreign jurisdictions, and the

implementation of tax planning strategies. The valuation allowance remained unchanged during Ñscal 2002

and increased by $5.1 million during Ñscal 2001 due to a write-down of an equity investment, the loss of which

may not be deductible for tax purposes.

As of March 31, 2002, we have tax credit carryforwards of approximately $1.6 million that expire during

Ñscal 2004 through 2005. In addition, we have net operating loss carryforwards attributable to Quarterdeck of

approximately $40.8 million that expire during Ñscal 2011 through 2019. We also have net operating loss

carryforwards attributable to AXENT of approximately $19.1 million that expire during Ñscal 2007 through

2018. Because of the ""change in ownership'' provisions of the Internal Revenue Code of 1986, the net

operating loss carryforwards of Quarterdeck and AXENT are subject to an annual limitation of approximately

$2.4 million and $10.6 million, respectively, regarding their utilization against taxable income in future

periods.

Pretax income from international operations was approximately $168.4 million, $144.9 million and

$116.8 million during Ñscal 2002, 2001 and 2000, respectively.

No provision has been made for federal or state income taxes on approximately $287.2 million of

cumulative unremitted earnings of certain of our foreign subsidiaries as of March 31, 2002, since we plan to

indeÑnitely reinvest these earnings. As of March 31, 2002, the unrecognized deferred tax liability for these

earnings was approximately $74.7 million.

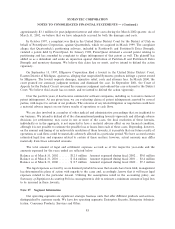

Note 16. Litigation

On August 15, 2001, a customer Ñled a lawsuit in Michigan state court, purportedly on behalf of a class of

customers who had experienced a particular error message when using the Symantec LiveUpdate feature. The

complaint alleged violations of the Michigan Consumer Protection Act and breach of implied warranty. The

parties agreed to dismiss the lawsuit with no payment by us, and the court ordered the matter dismissed on

January 9, 2002.

On December 23, 1999, Altiris Inc. Ñled a lawsuit against us in the United States District Court, District

of Utah, alleging that unspeciÑed Symantec products including Norton Ghost Enterprise Edition, infringed a

patent owned by Altiris. The lawsuit requests damages, injunctive relief, costs and attorney fees. In October

2001, a stipulated judgment of non-infringement was entered following the court's ruling construing the claims

of the Altiris patent, and Altiris has appealed the ruling. We believe this claim has no merit, and we intend to

defend the action vigorously.

On May 12, 1999, a venture capital entity and a former stockholder owning less than a majority share of

CKS Limited, which AXENT acquired in March 1999, commenced an action in the SuÅolk County Superior

Court in Boston, Massachusetts against AXENT and its directors. The action alleged violations of the

Massachusetts Uniform Securities Act, negligent misrepresentation and unfair trade practices. We inherited

this case upon our acquisition of AXENT. The case was settled and dismissed during the September 2001

quarter on conÑdential terms not material to us.

In July 1998, the Ontario Court of Justice (General Division) ruled that we should pay a total of

approximately $4.7 million for damages, plus interest, to Triolet Systems, Inc. and Brian Duncombe in a

decade-old copyright action, for damages arising from the grant of a preliminary injunction against them. The

damages were awarded following the court's ruling that evidence presented later in the case showed the

injunction was not warranted. We inherited this case through our acquisition of Delrina Corporation, which

was the plaintiÅ in this lawsuit. Our appeal of the decision was denied, and we have requested leave to seek

further review of that decision. We recorded a charge of approximately $5.8 million during the June 1998

quarter, representing the unaccrued portion of the judgment plus costs, and an additional charge of

82