Symantec 2002 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

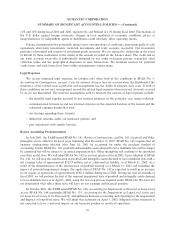

SYMANTEC CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

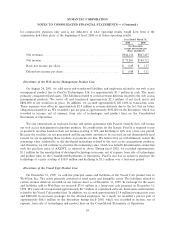

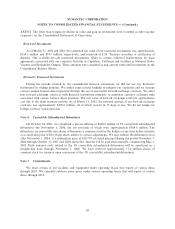

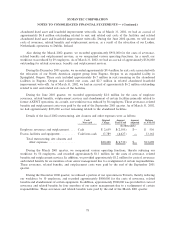

The estimated fair value of the cash equivalents and short-term investments consisted of the following:

March 31,

2002 2001

(In thousands)

Corporate securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 478,632 $ 218,010

Taxable auction rate securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 226,906 5,006

Money market fundsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 201,107 66,597

Asset backed securitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 168,427 Ì

Corporate bonds ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 104,015 Ì

US government and government-sponsored securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 65,089 15,262

Bank securities and deposits ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,845 146,988

Equity securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 7,479

Total available-for-sale and trading investments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,252,021 459,342

Less: amounts classiÑed as cash equivalents ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (256,207) (130,238)

$ 995,814 $ 329,104

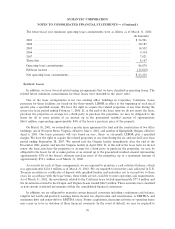

The estimated fair value of cash equivalents and short-term investments by contractual maturity as of

March 31, 2002 was as follows:

(In thousands)

Due in one year or lessÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 871,822

Due after one year and through 3 years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 380,199

$1,252,021

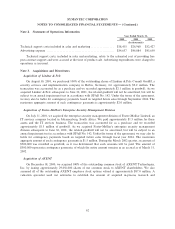

Except for equity securities, fair values of cash equivalents, short-term investments and trading assets

approximate cost primarily due to the short-term maturities of the investments and the absence of changes in

security credit ratings.

As of March 31, 2002, we held no publicly traded equity securities. As of March 31, 2001, equity

securities of approximately $7.5 million consisted of 623,247 shares of Interact. During the March 2001

quarter, Interact entered into a plan to merge with The Sage Group plc and we recorded a loss of

approximately $12.5 million as other expense related to the other than temporary decline in value of our

investment in Interact. As a result of the merger, we received approximately $7.5 million upon the surrender

of the Interact shares in July 2001.

Unrealized gains and losses on available-for-sale securities are reported as a component of stockholders'

equity and were approximately $718,000 and $614,000 as of March 31, 2002 and 2001, respectively.

Unregistered Equity Investments

As of March 31, 2002 and 2001, we held unregistered equity investments of approximately $8.4 million in

three privately held companies and $5.4 million in one privately held company, respectively. These

investments were recorded at cost. These investments were classiÑed as other long-term assets on the

Consolidated Balance Sheets.

During the March 2001 quarter, we recognized a decline in value of approximately $12.6 million

determined to be other than temporary on our privately held investment. Also during the March 2001 quarter,

we recorded a gain of approximately $900,000 on another investment, as a result of this privately held

company being acquired by another entity. This investment was acquired as a result of our acquisition of

68