Symantec 2002 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

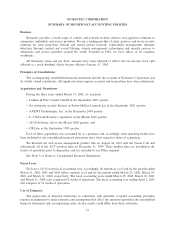

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business

Symantec provides a broad range of content and network security software and appliance solutions to

enterprises, individuals and service providers. We are a leading provider of client, gateway and server security

solutions for virus protection, Ñrewall and virtual private network, vulnerability management, intrusion

detection, Internet content and e-mail Ñltering, remote management technologies and security services to

enterprises and service providers around the world. Founded in 1982, we have oÇces in 38 countries

worldwide.

All Symantec share and per share amounts have been adjusted to reÖect the two-for-one stock split

eÅected as a stock dividend, which became eÅective January 31, 2002.

Principles of Consolidation

The accompanying consolidated Ñnancial statements include the accounts of Symantec Corporation and

its wholly owned subsidiaries. All signiÑcant intercompany accounts and transactions have been eliminated.

Acquisitions and Divestitures

During the three years ended March 31, 2002, we acquired:

‚ Lindner & Pelc Consult GmbH in the September 2001 quarter;

‚ the enterprise security division of Foster-Melliar Limited also in the September 2001 quarter;

‚ AXENT Technologies, Inc. in the December 2000 quarter;

‚ L-3 Network Security's operations in the March 2000 quarter;

‚ 20/20 Software also in the March 2000 quarter; and

‚ URLabs in the September 1999 quarter.

Each of these acquisitions was accounted for as a purchase and, accordingly, their operating results have

been included in our consolidated Ñnancial statements since their respective dates of acquisition.

We divested our web access management product line on August 24, 2001 and the Visual Cafπe and

substantially all of the ACT! product lines on December 31, 1999. These product lines are included in the

results of operations prior to disposition and are included in our Other segment.

See Note 3 of Notes to Consolidated Financial Statements.

Fiscal Years

We have a 52/53-week Ñscal accounting year. Accordingly, all references as of and for the periods ended

March 31, 2002, 2001 and 2000 reÖect amounts as of and for the periods ended March 29, 2002, March 30,

2001 and March 31, 2000, respectively. The Ñscal accounting years ended March 29, 2002, March 30, 2001

and March 31, 2000 each comprised 52 weeks of operations. The Ñscal accounting year ending April 2, 2003

will comprise of 53 weeks of operations.

Use of Estimates

The preparation of Ñnancial statements in conformity with generally accepted accounting principles

requires management to make estimates and assumptions that aÅect the amounts reported in the consolidated

Ñnancial statements and accompanying notes. Actual results could diÅer from those estimates.

55