Symantec 2002 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

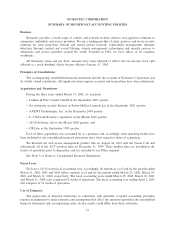

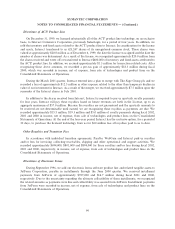

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Ì (Continued)

11% and 12% during Ñscal 2002 and 2000, respectively; and Merisel of 11% during Ñscal 2000. Fluctuations of

the U.S. dollar against foreign currencies, changes in local regulatory or economic conditions, piracy or

nonperformance by independent agents or distributors could adversely aÅect operating results.

Financial instruments that potentially subject us to concentrations of credit risk consist principally of cash

equivalents, short-term investments, restricted investments and trade accounts receivable. Our investment

portfolio is diversiÑed and consists of investment grade securities. We are exposed to credit risks in the event

of default by these institutions to the extent of the amount recorded on the balance sheet. The credit risk in

our trade accounts receivable is substantially mitigated by our credit evaluation process, reasonably short

collection terms and the geographical dispersion of sales transactions. We maintain reserves for potential

credit losses and such losses have been within management's expectations.

Legal Expenses

We accrue estimated legal expenses for lawsuits only when both of the conditions of SFAS No. 5,

Accounting for Contingencies, are met. Costs for external attorney fees are accrued when the likelihood of the

incurrence of the related costs is probable and management has the ability to estimate such costs. If both of

these conditions are not met, management records the related legal expenses when incurred. Amounts accrued

by us are not discounted. The material assumptions used to estimate the amount of legal expenses include:

‚ the monthly legal expense incurred by our external attorneys on the particular case being evaluated;

‚ communication between us and our external attorneys on the expected duration of the lawsuit and the

estimated expenses during that time;

‚ our strategy regarding these lawsuits;

‚ deductible amounts under our insurance policies; and

‚ past experiences with similar lawsuits.

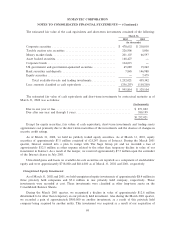

Recent Accounting Pronouncements

In July 2001, the FASB issued SFAS No. 141, Business Combinations, and No. 142, Goodwill and Other

Intangible Assets, eÅective for Ñscal years beginning after December 15, 2001. SFAS No. 141 requires that all

business combinations initiated after June 30, 2001 be accounted for under the purchase method of

accounting. Under SFAS No. 142, goodwill and intangible assets deemed to have indeÑnite lives will no longer

be amortized but will be subject to an annual impairment test. Other intangibles will continue to be amortized

over their useful lives. We will adopt SFAS No. 142 in our Ñrst quarter of Ñscal 2003. Upon adoption of SFAS

No. 142, we will stop the amortization of goodwill and intangible assets deemed to have indeÑnite lives with a

net carrying value of approximately $525.9 million, net of a deferred tax liability, as of March 31, 2002. As a

result of the discontinuance of the amortization of goodwill existing as of March 31, 2002 and excluding the

impact of potential impairment charges, the application of SFAS No. 142 is expected to result in an increase

in our results of operations of approximately $198.4 million during Ñscal 2003. During the Ñrst six months of

Ñscal 2003, we will perform the Ñrst of the required impairment tests of goodwill and intangible assets deemed

to have indeÑnite lives as of April 1, 2002, using the two-step process required under SFAS 142. We have not

yet determined what eÅect these tests will have on our earnings and Ñnancial position.

In October 2001, the FASB issued SFAS No. 144, Accounting for Impairment or Disposal of Long-Lived

Assets. SFAS No. 144 supersedes SFAS No. 121, Accounting for the Impairment of Long-Lived Assets and

for Long-Lived Assets to be Disposed Of, and addresses Ñnancial accounting and reporting for the impairment

and disposal of long-lived assets. We will adopt this statement on April 1, 2002. Adoption of this statement is

not expected to have a material impact on our Ñnancial position or results of operations.

59