Symantec 2002 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

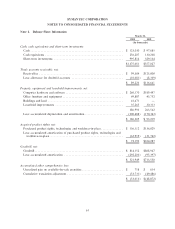

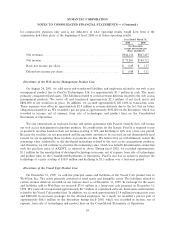

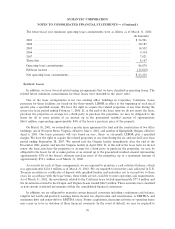

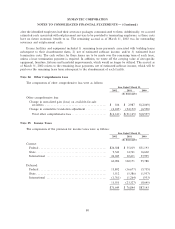

The future Ñscal year minimum operating lease commitments were as follows as of March 31, 2002:

(In thousands)

2003 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 26,901

2004 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 20,185

2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 14,502

2006 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,314

2007 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,021

ThereafterÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 8,147

Operating lease commitments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 86,070

Sublease income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (22,818)

Net operating lease commitments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 63,252

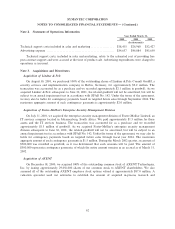

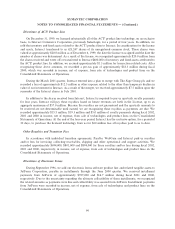

Synthetic Leases

In addition, we have two real estate leasing arrangements that we have classiÑed as operating leases. The

related future minimum commitments for these leases were included in the above table.

One of the lease arrangements is for two existing oÇce buildings in Cupertino, California. Lease

payments for these facilities are based on the three-month LIBOR in eÅect at the beginning of each Ñscal

quarter plus a speciÑed margin. We have the right to acquire the related properties at any time during the

seven-year lease period ending February 1, 2006. If, at the end of the lease term we do not renew the lease,

purchase the properties or arrange for a third party to purchase the properties, we may be obligated to the

lessor for all or some portion of an amount up to the guaranteed residual amount of approximately

$66.0 million, representing approximately 84% of the lessor's purchase price of the property.

On March 30, 2001, we entered into a master lease agreement for land and the construction of two oÇce

buildings, one in Newport News, Virginia, eÅective June 6, 2001, and another in SpringÑeld, Oregon, eÅective

April 6, 2001. Our lease payments will vary based on one-, three- or six-month LIBOR plus a speciÑed

margin. We have the right to acquire the related properties at any time during the six and one-half year lease

period ending September 28, 2007. We moved into the Oregon facility immediately after the end of the

December 2001 quarter and into the Virginia facility in April 2002. If, at the end of the lease term we do not

renew the lease, purchase the properties or arrange for a third party to purchase the properties, we may be

obligated to the lessor for all or some portion of an amount up to the guaranteed residual amount representing

approximately 85% of the lessor's ultimate purchase price of the properties, up to a maximum amount of

approximately $55.1 million as of March 31, 2002.

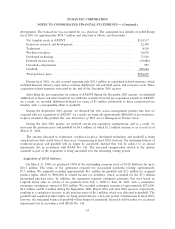

As security for each of these arrangements, we are required to maintain a cash collateral balance, which

was approximately $124.3 million as of March 31, 2002. We are required to invest the cash collateral in U.S.

Treasury securities or certiÑcates of deposit with speciÑed lenders and maturities not to exceed two to three

years. In accordance with the lease terms, these funds are not available to meet operating cash requirements.

As of March 31, 2002, the investments related to the California lease totaled approximately $77.4 million and

the investments related to the Oregon and Virginia leases totaled $46.9 million. These amounts were classiÑed

as non-current restricted investments within the consolidated Ñnancial statements.

In addition, we are obligated to maintain certain Ñnancial covenants including a minimum cash balance,

tangible net worth and quarterly earnings before income tax, depreciation and amortization, or EBITDA, and

maximum debt and senior debt to EBITDA ratios. Future acquisitions, Ñnancing activities or operating losses

may cause us to be in violation of these Ñnancial covenants. In the event of default, we may be required to

70