Symantec 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7A. Quantitative and Qualitative Disclosures About Market Risk

We do not undertake any speciÑc actions to cover our exposure to interest rate risk and we are not a party

to any interest rate risk management transactions. We do not purchase or hold any derivative Ñnancial

instruments for trading purposes.

Interest Rate Sensitivity

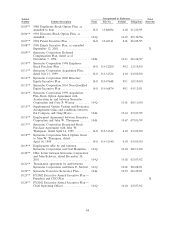

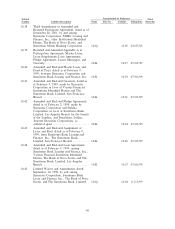

As of March 31, 2002, the fair market value of our Ñnancial instruments with exposure to interest risk was

approximately USD 1.2 billion, Euro 388.0 million, and CAD 12.5 million. Sensitivity analysis for a six-month

horizon was performed on our Öoating rate and Ñxed rate Ñnancial investments and Öoating rate liabilities.

Parallel shifts in the yield curve of both °/-50 basis points would result in changes in fair market values for

these investments and Öoating rate liabilities of less than USD 1.0 million, less than Euro 1.0 million and less

than CAD 1.0 million.

Exchange Rate Sensitivity

We conduct business in 30 international currencies through our worldwide operations. We have

established a foreign exchange risk management program, utilizing forward exchange contracts with one

Ñscal-month duration to oÅset various non-functional currency exposures. Under this program, increases or

decreases in the value of our non-functional currency assets and liabilities are oÅset by gains and losses on the

forward exchange contracts to mitigate the risk associated with foreign exchange market Öuctuations. We do

not use forward exchange contracts for trading purposes. At the end of each Ñscal month, all non-functional

currency assets and liabilities are revalued using the spot rate of the maturing forward exchange contracts and

the realized and unrealized gains and losses are included in net income (loss) as a component of other income

(expense).

We believe that the use of forward exchange contracts should reduce the risks that arise from conducting

business in international markets. We employ established policies and procedures governing the use of

Ñnancial instruments to manage our exposure to such risks. However, signiÑcant changes in exchange rates

may still result in adverse eÅects on our operating results.

We use sensitivity analyses to quantify the impact that market risk exposures may have on the fair market

values of our Ñnancial instruments. The Ñnancial instruments included in the sensitivity analyses consist of all

of our foreign currency assets and liabilities and all derivative instruments, principally forward exchange

contracts. The sensitivity analyses assesses the risk of loss in fair market values from the impact of

hypothetical changes of instantaneous, parallel shifts in exchange rates and interest rates yield curves on

market sensitive instruments over a six-month horizon.

As of March 31, 2002, the notional amount of our forward contracts was approximately USD

239.6 million. A 10% appreciation or devaluation in foreign currencies would result in a decrease in the fair

value of our forward exchange contracts by approximately USD 12.5 million and an increase in the fair value

of our forward exchange contracts by USD 11.0 million, respectively.

As of March 31, 2002, the fair value of our investments in marketable securities denominated in foreign

currencies was approximately USD 345.4 million. A 10% appreciation or devaluation would result in an

increase in the fair value of our investments by approximately USD 37.1 million and a decrease in the fair

value of our investments by USD 32.8 million, respectively.

36