Symantec 2002 Annual Report Download - page 52

Download and view the complete annual report

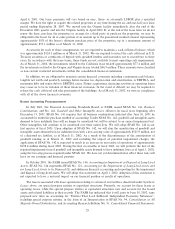

Please find page 52 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Based on public comments from the FASB to date, the proposed interpretation will provide guidance for

determining when an entity (such as us), the Primary BeneÑciary, should consolidate another entity, a special

purpose entity or equivalent structure (such as the lessor), that functions to support the activities of the

Primary BeneÑciary. The expected proposed Interpretation may result in us having to consolidate the

operating results of the special purpose entities and equivalent structures, which are the lessors under the

aforementioned operating lease agreements. The eÅective date of these proposed new rules on our current

operating leases could be as early as the beginning of our Ñscal year 2004, and sooner on any new leases

entered into after the new rules' eÅective date which utilize special purpose entities or equivalent structures.

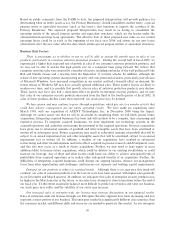

Business Risk Factors

There is uncertainty as to whether or not we will be able to sustain the growth rates in sales of our

products, particularly in consumer antivirus protection products. During the second half of Ñscal 2002, we

experienced a higher than expected rate of growth in sales of our consumer antivirus protection products, and

we may not be able to sustain this high growth rate on a consistent basis going forward. We believe that

consumer antivirus sales were spurred by a number of factors, including outbreaks of the well-publicized Code

Red and Nimda viruses and a reaction from the September 11 terrorist attacks. In addition, although the

release of new operating systems incorporating security and virus protection features, particularly past releases

of Microsoft Windows, have increased competition in our market and had a harmful eÅect on demand, the

recent release of Windows XP may have actually spurred additional sales. These positive factors are likely to

weaken over time, and it is possible that growth rates in sales of antivirus protection products may decline.

These factors may have also had a short-term eÅect on growth in enterprise security products, and we note

that sales of our enterprise security products decreased from the third to the fourth quarter of Ñscal 2002. If

sales of these products decline faster than expected, our stock price may be harmed.

We have grown, and may continue to grow, through acquisitions, which give rise to a number of risks that

could have adverse consequences for our future operating results. We have made six acquisitions since

March 1999, with our acquisition of AXENT Technologies, Inc. in December 2000 being the largest.

Although we cannot assure you that we will be successful in completing them, we will likely pursue future

acquisitions. Integrating acquired businesses has been and will continue to be a complex, time consuming and

expensive process. To integrate acquired businesses, we must implement our technology systems in the

acquired operations and assimilate and manage the personnel of the acquired operations. Our past acquisitions

have given rise to substantial amounts of goodwill and other intangible assets that have been amortized or

written oÅ in subsequent years. Future acquisitions may result in substantial amounts of goodwill that will be

subject to an annual impairment test and other intangible assets that will be amortized, subject to an annual

impairment test or written oÅ. In addition, a number of our acquisitions have resulted in substantial

restructuring and other related expenses and write-oÅs of acquired in-process research and development costs,

and this also may occur as a result of future acquisitions. Further, we may need to issue equity or incur

additional debt to Ñnance future acquisitions, which could be dilutive to our existing stockholders or could

increase our leverage. Any of these and other factors could harm our ability to achieve anticipated levels of

proÑtability from acquired operations or to realize other anticipated beneÑts of an acquisition. Further, the

diÇculties of integrating acquired businesses could disrupt our ongoing business, distract our management

focus from other opportunities and challenges, and increase our expenses and working capital requirements.

Demand for our products is subject to seasonal trends. Although there is no assurance this trend will

continue, our sales of consumer products over the last six years have been seasonal, with higher sales generally

in our December and March quarters. In addition, we anticipate that sales of enterprise security products may

be higher in the March quarter in the future, as our sales force attempts to close transactions before the end of

our Ñscal year. To the extent seasonality makes it more diÇcult to predict our revenues and value our business,

our stock price may suÅer and the volatility of our stock may increase.

Our increased sales of enterprise-wide site licenses may increase Öuctuations in our Ñnancial results.

Sales of enterprise-wide site licenses through our Enterprise Security segment have been increasing and now

represent a major portion of our business. This enterprise market has signiÑcantly diÅerent characteristics than

the consumer market and diÅerent skills and resources are needed to penetrate this market. As our enterprise

30