Symantec 2002 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

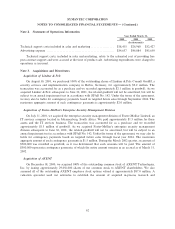

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Ì (Continued)

Goodwill

Goodwill is recorded through acquisitions and is stated at cost less accumulated amortization. For

acquisitions completed prior to July 1, 2001, amortization in each case was provided on a straight-line basis

over the estimated useful life of the respective goodwill, generally four to Ñve years, and was included in

operating expenses. EÅective April 1, 2002, the net balance of goodwill related to acquisitions completed prior

to July 1, 2001 will no longer be amortized but will be subject to an annual impairment test (see Recent

Accounting Pronouncements). For acquisitions completed subsequent to June 30, 2001, goodwill was not

amortized and will be subject to an annual impairment test.

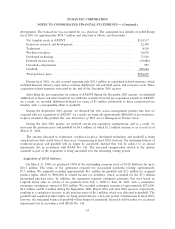

Long-Lived Assets

Long-lived assets, including property, equipment, leasehold improvements, acquired product rights and

goodwill, are evaluated for impairment whenever events or changes in circumstances indicate that the carrying

amount of an asset may not be recoverable. An impairment loss would be recognized when the sum of the

undiscounted future net cash Öows expected to result from the use of the asset and its eventual disposition is

less than its carrying amount. Such impairment loss would be measured as the diÅerence between the carrying

amount of the asset and its fair value based on the present value of estimated future cash Öows. No

impairments have been indicated to date. EÅective April 1, 2002, impairment of goodwill and other long-lived

assets will be assessed according to new accounting guidelines (see Recent Accounting Pronouncements).

Income Taxes

Income taxes are computed in accordance with Statement of Financial Accounting Standards, or SFAS,

No. 109, Accounting for Income Taxes.

Stock-Based Compensation

We account for stock-based awards to employees using the intrinsic value method in accordance with

Accounting Principles Board Opinion, or APB, No. 25, Accounting for Stock Issued to Employees, and to

nonemployees using the fair value method in accordance with SFAS No. 123, Accounting for Stock-Based

Compensation. In addition, we apply applicable provisions of Financial Accounting Standards Board, or

FASB, Interpretation, or FIN, No. 44, Accounting for Certain Transactions Involving Stock Compensation,

an interpretation of APB No. 25.

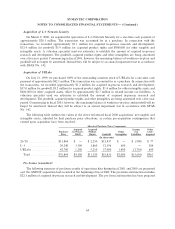

Net Income (Loss) Per Share

Basic net income (loss) per share is computed using the weighted average number of common shares

outstanding during the periods. Diluted net income (loss) per share is computed using the weighted average

number of common shares outstanding and potentially dilutive common shares during the periods. Diluted net

income (loss) per share also includes the assumed conversion of all of the outstanding convertible

subordinated debentures and assumed exercising of options, if dilutive in the period. Potentially dilutive

common shares are excluded in net loss periods, as their eÅect would be antidilutive.

Concentrations of Credit Risk

Our product revenues are concentrated in the software industry, which is highly competitive and rapidly

changing. SigniÑcant technological changes in the industry or customer requirements, or the emergence of

competitive products with new capabilities or technologies, could adversely aÅect operating results. In

addition, a signiÑcant portion of our revenues and net income (loss) is derived from international sales and

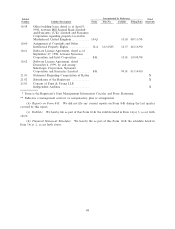

independent agents and distributors. Distributors that accounted for more than 10% of net revenues included:

Ingram Micro Inc. of 23%, 26% and 39% during Ñscal 2002, 2001 and 2000, respectively; Tech Data Group of

58