Symantec 2002 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

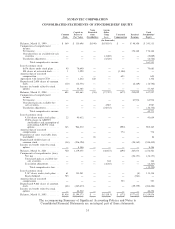

SYMANTEC CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

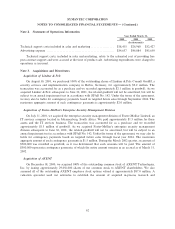

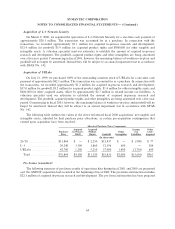

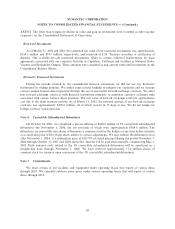

development. The transaction was accounted for as a purchase. The acquisition was initially recorded during

Ñscal 2001 for approximately $924.7 million and allocated as follows (in thousands):

Net tangible assets of AXENTÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $130,517

In-process research and development ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 22,300

TradenameÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4,100

Workforce-in-place ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 10,670

Developed technologyÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 75,500

Deferred income taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (19,080)

Unearned compensation ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 992

GoodwillÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 699,660

Total purchase price ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $924,659

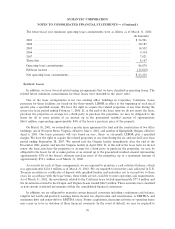

During Ñscal 2001, we also accrued approximately $18.3 million in acquisition related expenses, which

included Ñnancial advisory, legal and accounting, duplicative site and Ñxed assets, and severance costs. These

acquisition related expenses were paid by the end of the December 2001 quarter.

After Ñling the pre-acquisition tax returns of AXENT during the December 2001 quarter, we identiÑed

additional tax losses and other beneÑcial tax attributes available from the pre-acquisition periods of AXENT.

As a result, we recorded additional deferred tax assets of $5 million attributable to these carryforward tax

beneÑts, with a corresponding oÅset to goodwill.

During the September 2001 quarter, we divested the web access management product line that we

acquired with our acquisition of AXENT. As a result, we wrote oÅ approximately $804,000 of net workforce-

in-place related to this product line (see Divestiture of Web Access Management Product Line).

During the June 2001 quarter, we resolved certain pre-acquisition contingencies, and as a result, we

increased the purchase price and goodwill by $4.5 million, of which $1.2 million remains as an accrual as of

March 31, 2002.

The amount allocated to tradename, workforce-in-place, developed technology and goodwill is being

amortized over their useful lives of four years. Commencing in Ñscal 2003, however, the remaining balance of

workforce-in-place and goodwill will no longer be amortized. Instead they will be subject to an annual

impairment test in accordance with SFAS No. 142. The unearned compensation related to the options

assumed as part of the acquisition is being amortized over the remaining vesting period.

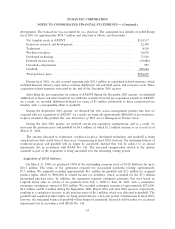

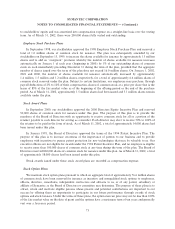

Acquisition of 20/20 Software

On March 31, 2000, we purchased 100% of the outstanding common stock of 20/20 Software for up to

$16.5 million. The terms of the agreement required two guaranteed payments totaling approximately

$7.5 million. We originally recorded approximately $6.1 million for goodwill and $2.3 million for acquired

product rights, oÅset by $900,000 in related income tax liabilities, which accounted for the $7.5 million

guaranteed purchase price. In addition, the agreement required contingent payments that were based on

targeted future sales of certain of our products from July 1, 2000 to June 30, 2001, with a cumulative

maximum contingency amount of $9.0 million. We recorded contingent amounts of approximately $523,000,

$4.2 million and $1.6 million during the September 2000, March 2001 and June 2001 quarters, respectively,

resulting in a cumulative increase in the purchase price of $6.3 million, which was allocated to goodwill. The

goodwill and acquired product rights are being amortized over a Ñve-year period. Commencing in Ñscal 2003,

however, the remaining balance of goodwill will no longer be amortized. Instead it will be subject to an annual

impairment test in accordance with SFAS No. 142.

63