Symantec 2002 Annual Report Download - page 48

Download and view the complete annual report

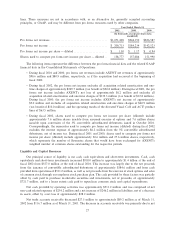

Please find page 48 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.approximately $1.3 million during Ñscal 2000 and was primarily comprised of net gains from non-functional

currency transactions.

Income, Net of Expense, from Sale of Technologies and Product Lines

Income, net of expense, from sale of technologies and product lines was approximately $15.5 million,

$20.4 million, and $107.4 million during Ñscal 2002, 2001 and 2000, respectively. During Ñscal 2002 and 2001,

income, net of expense, from sale of technologies and product lines was related primarily to royalties from

Interact Commerce Corporation, who subsequently merged with The Sage Group plc, as a result of the

divestiture of our ACT! product line in December 1999.

Income, net of expense, from sale of technologies and product lines during Ñscal 2000 related primarily to

gains of $68.5 million and $18.3 million on the divestiture of our Visual Cafπe and ACT! product lines,

respectively, in December 1999. In addition, income, net of expense, from sale of technologies and product

lines during Ñscal 2000 included $14.7 million related to payments from JetForm Corporation, associated with

our sale of certain software products, technologies and tangible assets to JetForm during Ñscal 1997, and

$5.0 million related to royalties from Interact.

Income Taxes

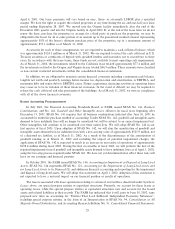

Our eÅective tax rate on income before one-time charges (acquired in-process research and development,

restructuring, site closures and other expenses), goodwill amortization expense and gain on sale of product

lines was 32% during Ñscal 2002, 2001 and 2000. Our Ñscal 2002, 2001 and 2000 eÅective rates were lower

than the U.S. federal and state combined statutory rate primarily due to a lower statutory tax rate on income

generated by our Irish operations.

Our eÅective tax rate on income before taxes was 162%, 55% and 34% during Ñscal 2002, 2001 and 2000,

respectively. The higher eÅective tax rate during Ñscal 2002 and 2001 reÖects the non-deductibility of acquired

in-process research and development and substantially all of the goodwill amortization. In addition, during

Ñscal 2000, tax was provided on the gain on sale of product lines at an eÅective tax rate of 34%. This rate is

lower than the U.S. federal and state combined statutory rate because a portion of the gain is attributable to

our Irish operations and accordingly subject to a lower Irish tax rate.

Realization of approximately $46.0 million of our net deferred tax asset as of March 31, 2002 is

dependent primarily upon future U.S. taxable income of $131.0 million. Realization of the remaining

$12.0 million of our net deferred tax asset as of March 31, 2002 is dependent in part on future taxable income

in certain foreign jurisdictions and on our implementation of tax planning strategies. We believe it is more

likely than not that the net deferred tax assets will be realized based on historical earnings and expected levels

of future taxable income as well as the implementation of tax planning strategies.

Levels of future taxable income are subject to the various risks and uncertainties discussed in the

Business Risk Factors set forth in this Item 7. Additional valuation allowance against net deferred tax assets

may be necessary if it is more likely than not that all or a portion of the net deferred tax assets will not be

realized. We will assess the need for additional valuation allowance on a quarterly basis.

We project our eÅective tax rate to be 32% for Ñscal 2003 as a result of the discontinuation of goodwill

amortization (see Recent Accounting Pronouncements for further discussion). This projection, however, is

subject to change due to potential tax law changes and Öuctuations in the geographic allocation of earnings.

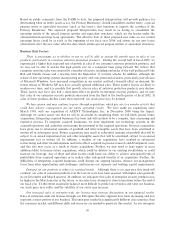

Selected Pro Forma Financial Data

For comparative purposes, the following table displays, on a pro forma basis, our results of operations as if

the acquisition of AXENT had occurred at the beginning of Ñscal 2000 and excluding all acquisition related

amortization and one-time charges and the operating results of the divested Visual Cafπe and ACT! product

26