Symantec 2002 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2002 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

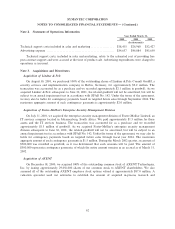

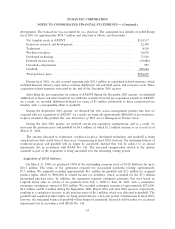

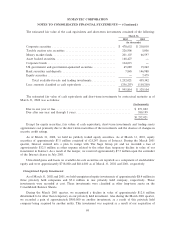

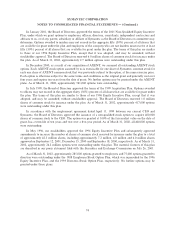

The components of income, net of expense, from sale of technologies and product lines were as follows:

Year Ended March 31,

2002 2001 2000

(In thousands)

Royalties from Interact ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $15,500 $19,250 $ 5,000

Gain on divestiture of:

Web access management product line ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 392 Ì Ì

Visual Cafπe product line ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 68,523

ACT! product lineÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 18,285

Amortization of developed technology related to web access

management product lineÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (1,050) Ì Ì

Other royalties and transition fees ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 694 801 894

Payments from JetFormÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 397 14,656

Income, net of expense, from sale of technologies and product

lines ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $15,536 $20,448 $107,358

Note 4. Acquired Product Rights

During Ñscal 2002, we recorded approximately $1.1 million of non-acquisition product rights. This

increase was oÅset by a write oÅ of $804,000 for net workforce-in-place related to our divestiture of our web

access management product line. During Ñscal 2001, we recorded approximately $86.2 million of acquired

product rights, related to our acquisition of AXENT. During Ñscal 2000, we recorded approximately

$11.3 million of acquired product rights, primarily related to our acquisitions of 20/20, L-3 and URLabs.

During Ñscal 2002, amortization of acquired product rights totaled approximately $32.2 million, of which

$31.1 million and $1.1 million was recorded in cost of revenues and income (net of expense) from sale of

technologies and product lines, respectively. During Ñscal 2001 and 2000, amortization of acquired product

rights totaled approximately $17.3 million and $9.7 million during Ñscal 2001 and 2000, respectively, and was

recorded in cost of revenues. Acquired product rights, with the exception of workforce-in-place, will be

amortized over the next four years. EÅective April 1, 2002, the remaining balance of workforce-in-place of

approximately $3.9 million, net of a deferred tax liability, will no longer be amortized but will be subject to an

annual impairment test in accordance with SFAS No. 142. See Note 3 of Notes to Consolidated Financial

Statements.

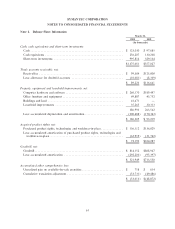

Note 5. Investments

Cash Equivalents, Short-term Investments and Trading Investments

All cash equivalents and short-term investments were classiÑed as available-for-sale securities, except for

our trading securities. We maintain a trading asset portfolio in connection with our executive deferred

compensation arrangements that consists of marketable equity securities, which had a fair value of

approximately $1.1 million and $1.2 million as of March 31, 2002 and 2001, respectively. Any activity related

to these trading assets has a corresponding eÅect on the carrying value of the related deferred compensation

liability. These trading assets have not been separately disclosed on the balance sheet due to their immaterial

amounts and were instead included in the following tabular disclosures.

67