Spirit Airlines 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

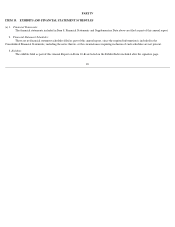

Notes to Financial Statements—(Continued)

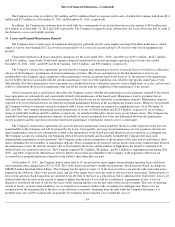

Significant components of the provision for income taxes from continuing operations are as follows:

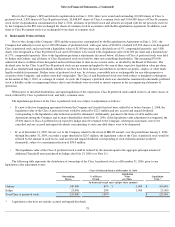

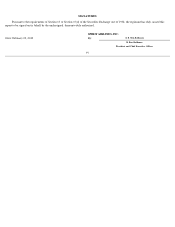

The reconciliation of income tax expense computed at the federal statutory tax rates to income tax expense from continuing operations is as

follows:

The Company accounts for income taxes using the asset and liability method. Deferred taxes are recorded based on differences between the

financial statement basis and tax basis of assets and liabilities and available tax loss and credit carryforwards.

87

16.

Income Taxes

For the Years Ended December 31,

2011

2010

2009

(in thousands)

Current:

Federal

$

1,866

$

258

$

1,100

State and local

74

68

118

Foreign

263

189

315

Total current expense

2,203

515

1,533

Deferred:

Federal

42,148

(48,934

)

—

State and local

2,032

(3,877

)

—

Total deferred expense (benefit)

44,180

(52,811

)

—

Total income tax expense (benefit)

$

46,383

$

(52,296

)

$

1,533

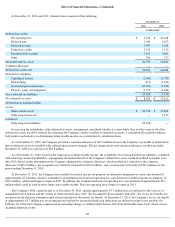

For the Years Ended December 31,

2011

2010

2009

(in thousands)

Expected provision at federal statutory tax rate

$

42,991

$

7,062

$

29,830

State and foreign tax expense, net of federal benefit

2,255

413

1,220

Interest and dividend on preferred stock

710

1,612

(5,015

)

Change in valuation allowance —

(

65,248

)

(22,814

)

Meals and entertainment

469

315

273

Fines and penalties

(36

)

9

135

Federal credits

(103

)

(156

)

—

Adjustment to deferred tax assets and liabilities

(3

)

3,486

(2,472

)

Other

100

211

376

Total income tax expense

$

46,383

$

(52,296

)

$

1,533