Spirit Airlines 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

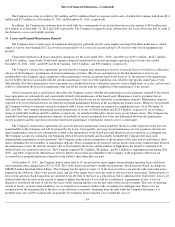

Notes to Financial Statements—(Continued)

Prior to the Company’s IPO and related recapitalization on June 1, 2011, there were issued and outstanding 100,000 shares of Class A

preferred stock, 2,850 shares of Class B preferred stock, 20,848,847 shares of Class A common stock and 5,964,489 shares of Class B common

stock. In the recapitalization consummated on June 1, 2011, all shares of preferred stock and all notes not repaid with the net proceeds received

by the Company in the IPO were exchanged for shares of common stock in accordance with the Recapitalization Agreement. In addition, each

share of Class B common stock was exchanged for one share of common stock.

Prior to the closing of the Company’s IPO and the transactions contemplated by the Recapitalization Agreement on June 1, 2011, the

Company had authority to issue up to 1,000,000 shares of preferred stock, with a par value of $0.0001, of which 125,000 shares were designated

Class A preferred stock and issued with a liquidation value of $1,000 per share and a dividend rate of 5%, compounded quarterly, and 5,000

shares were designated as Class B preferred stock and 2,850 shares were issued with a liquidation value of $1,000 per share and a dividend rate

of 17%, compounded quarterly. Prior to the liquidation preference adjustments discussed below, all shares of Class A preferred stock were held

by Indigo and Oaktree, and all shares of Class B preferred stock were held by other non-controlling shareholders. The remaining 870,000

authorized shares could have been designated and issued from time to time in one or more series, as decided by the Board of Directors. The

dividend rates for the Class A and Class B preferred stock are per annum and applied to the sum of their respective liquidation value per share

plus all accumulated and unpaid dividends whether or not they have been declared and whether or not there are profits, surplus, or other funds

legally available for payment. Neither series of preferred stock was, by its terms, convertible into or exchangeable for any other property or

securities of the Company, and neither series had voting rights. The Class A and B preferred stock were both subject to mandatory redemption

on the earlier of July 1, 2012, or a change of control. As such, the Company’

s preferred stock was classified as mandatorily redeemable preferred

stock (a liability) in the accompanying balance sheets and dividends were recorded as interest expense in the accompanying statements of

operations.

With respect to dividend distributions and upon liquidation of the corporation, Class B preferred stock ranked senior to all other classes of

stock, followed by Class A preferred stock, and lastly, common stock.

The liquidation preference of the Class A preferred stock was subject to adjustments as follows:

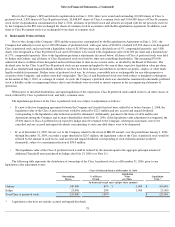

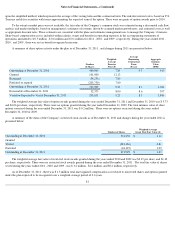

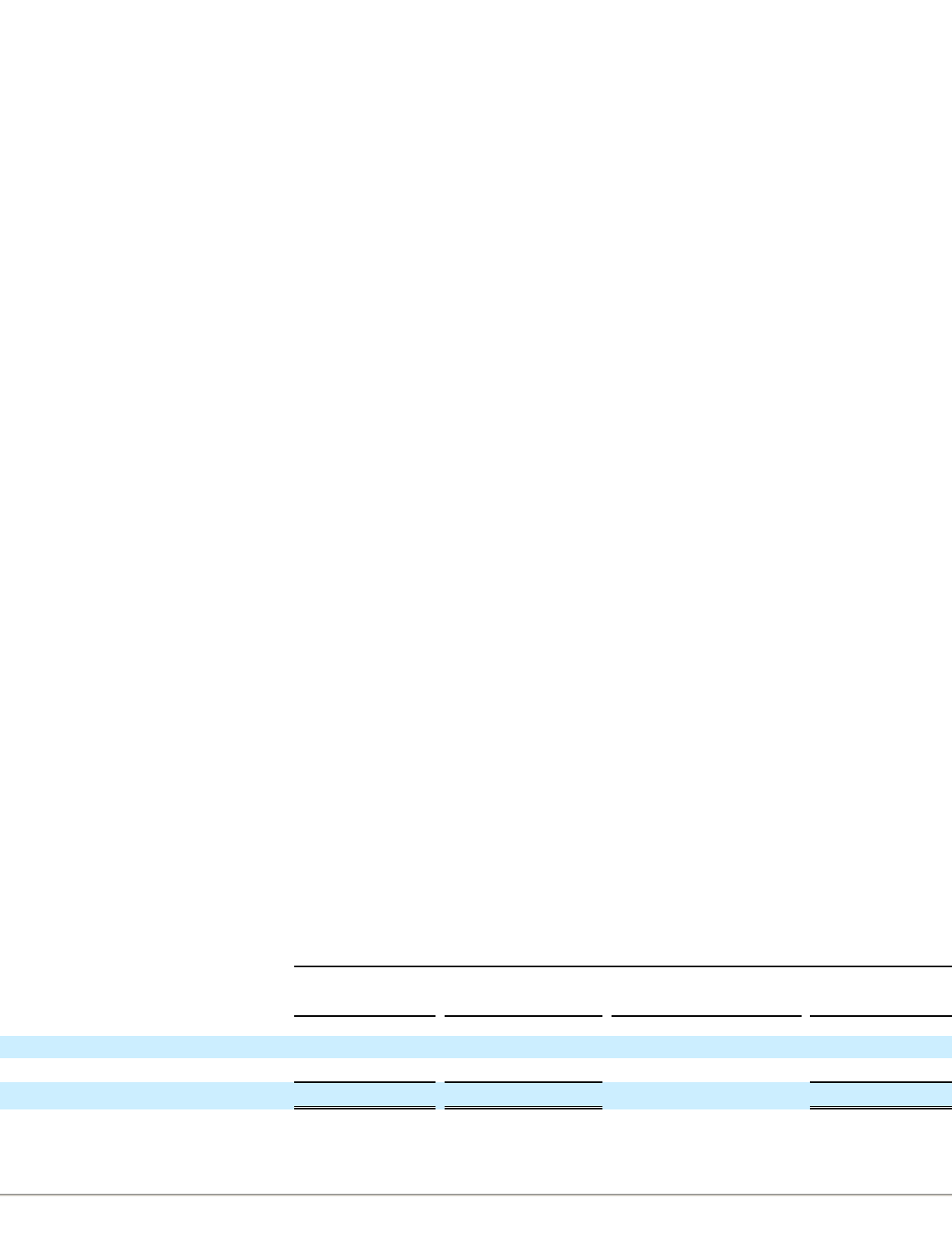

The following table represents the distribution of ownership of the Class A preferred stock as of December 31, 2006, prior to any

liquidation value adjustment events:

78

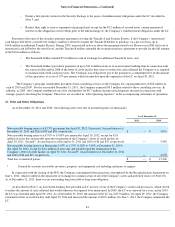

8.

Redeemable Preferred Stock

• If a new collective bargaining agreement between the Company and its pilots had not been ratified by or before January 1, 2008, the

liquidation value of the Class A preferred stock would be reduced by $22.5 million and any accrued and unpaid dividends

corresponding to the liquidation value reduction would be eliminated. Additionally, pursuant to the terms of a Put and Escrow

Agreement among the Company and its major shareholders dated July 13, 2006, if this liquidation value adjustment was triggered, the

25,000 shares of Class A preferred stock owned by Indigo must be returned to the Company, whereupon such shares were to be

cancelled and any accrued and unpaid dividends corresponding to such cancelled shares were to be eliminated.

• If, as of December 31, 2009, the net cost to the Company related to the return of MD-80 aircraft, over the period from January 1, 2006

through December 31, 2009, exceeded a target threshold of $20.7 million, the liquidation value of the Class A preferred stock would be

reduced by the amount of such excess (and accrued and unpaid dividends corresponding to such reduction amount would be

eliminated), subject to a maximum reduction of $30.0 million.

• The liquidation value of the Class A preferred stock would be reduced by the amount equal to the aggregate principal amount of

additional Tranche B notes purchased by Indigo after July 13, 2006 (see Note 11).

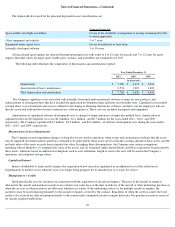

Class A Preferred Stock as of December 31, 2006

Outstanding

Shares

% of Shares

Owned

Liquidation

Value

per Share

Liquidation

Value *

(in thousands except share and per share amounts)

Oaktree

100,000

80

%

$

1,000

$

100,000

Indigo

25,000

20

%

1,000

25,000

Total Class A preferred stock

125,000

100

%

$

125,000

* Liquidation value does not include accrued and unpaid dividends.