Spirit Airlines 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

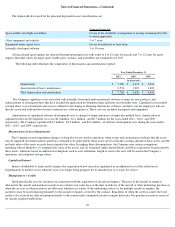

Notes to Financial Statements—(Continued)

operating leases, a deferred credit is recognized and amortized over the lease term on a straight-line basis as a reduction of aircraft rent expense.

Passenger Revenue Recognition

Tickets sold are initially deferred as “air traffic liability.” Passenger revenue is recognized at time of departure when transportation is

provided. A nonrefundable ticket expires at the date of scheduled travel and is recognized as revenue at the date of scheduled travel.

Customers may elect to change their itinerary prior to the date of departure. A change fee is assessed and recognized on the date the change

is initiated and is deducted from the face value of the original purchase price of the ticket, and the original ticket becomes invalid. The amount

remaining after deducting the change fee is called a credit shell which expires 60 days from the date the credit shell is created and can be used

towards the purchase of a new ticket and the Company’s other service offerings. The amount of credits expected to expire is recognized as

revenue upon issuance of the credit and is estimated based on historical experience. Estimating the amount of credits that will go unused

involves some level of subjectivity and judgment.

The Company is also required to collect certain taxes and fees from customers on behalf of government agencies and airports and remit

these back to the applicable governmental entity or airport on a periodic basis. These taxes and fees include U.S. federal transportation taxes,

federal security charges, airport passenger facility charges, and foreign arrival and departure taxes. These items are collected from customers at

the time they purchase their tickets, but are not included in passenger revenue. The Company records a liability upon collection from the

customer and relieves the liability when payments are remitted to the applicable governmental agency or airport.

Frequent Flier Program

Flown Miles. The Company accrues for mileage credits earned by passengers, including mileage credits for members with an insufficient

number of mileage credits to earn an award, under its FREE SPIRIT program based on the estimated incremental cost of providing free travel for

credits that are expected to be redeemed. Incremental costs include fuel, insurance, security, ticketing, and facility charges reduced by an

estimate of fees required to be paid by the passenger when redeeming the award.

Original Affinity Card Program. The Company also sells mileage credits to companies participating in the FREE SPIRIT program (or

affinity card program). Under the original affinity card program, funds received from the sale of mileage credits are accounted for as a multiple

element arrangement and allocated to a marketing component and a transportation component (mileage credits) using the residual method. The

fair value of the transportation component is deferred and recognized ratably as passenger revenue over the estimated period the transportation is

expected to be provided (historically estimated at 15 to 20 months and currently estimated at 16 months). The difference between the funds

received and the fair value of the transportation component is recognized in non-ticket revenue at the time of sale as non-ticket marketing

revenue. The marketing component represents the Company’s compensation for use of its trademark, customer lists and placement of marketing

materials to encourage application for credit cards. Because there are no undelivered elements other than the mileage credits, the Company

records the revenue from the marketing component when funds are received. The Company also receives bonuses from companies participating

in the FREE SPIRIT program that are driven by the volume of the usage of the Company’s co-branded credit cards. The Company recognizes

these bonuses as non-ticket revenue when payment is received (milestone method) as the milestones are substantive.

During the fourth quarter of 2010, the Company determined not to renew its agreement with the administrator of the FREE SPIRIT affinity

credit card program at the scheduled expiration in February 2011. In connection with that non-renewal, the Company entered into an agreement

with the former administrator regarding the transition of the program to a new provider and the remittance to the Company of compensation due

to the Company for card members obtained through the Company’s marketing services in the amount of $5.0 million, of which $4.6 million was

recognized in the fourth quarter of 2010 and $0.4 million was recognized in the first quarter of 2011.

New Affinity Card Program. The Company entered into a new affinity card program that became effective April 1, 2011. The agreement

calls for the marketing of a co-branded Spirit credit card and the delivery of award miles over a five-year period. At the inception of the

arrangement, the Company evaluated all deliverables in the arrangement to determine whether they represent separate units of accounting using

the criteria as set forth in ASU No. 2009-

13. The Company determined the arrangement had three separate units of accounting: (i) travel miles to

be awarded, (ii) licensing of brand and access to member lists, and (iii) advertising and marketing efforts. Under ASU No. 2009-

13, arrangement

consideration should be allocated based on relative selling price. At inception of the arrangement, the Company established the relative selling

price for all deliverables that qualified for separation. The manner in which the selling price was established was based on a hierarchy of

evidence that the Company considered. Total arrangement consideration was then allocated to each deliverable on the basis of the

71