Spirit Airlines 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

deliverable’s relative selling price. In considering the hierarchy of evidence under ASU No. 2009-13, the Company first determined whether

vendor specific objective evidence of selling price or third-

party evidence of selling price existed. It was determined by the Company that neither

vendor specific objective evidence of selling price nor third-party evidence existed due to the uniqueness of the Company’s program. As such,

the Company developed its best estimate of the selling price for all deliverables. For the award miles, the Company considered a number of

entity-specific factors when developing the best estimate of the selling price including the number of miles needed to redeem an award, average

fare of comparable segments, breakage, restrictions, and fees. For licensing of brand and access to member lists, the Company considered both

market-specific factors and entity-specific factors including general profit margins realized in the marketplace/industry, brand power, market

royalty rates, and size of customer base. For the advertising element, the Company considered market-specific factors and entity-specific factors

including, the Company’s internal costs (and fluctuations of costs) of providing services, volume of marketing efforts, and overall advertising

plan. Consideration allocated based on the relative selling price to both brand licensing and advertising elements will be recognized as revenue

when earned and recorded in non-ticket revenue. Consideration allocated to award miles will be deferred and recognized ratably as passenger

revenue over the estimated period the transportation is expected to be provided (historically estimated at 15 to 20 months and currently estimated

at 16 months). The Company used entity-specific assumptions coupled with the various judgments necessary to determine the selling price of a

deliverable in accordance with the required selling price hierarchy. Changes in these assumptions (e.g., cost of fare, number of miles to redeem

awards, marketing plan, and approval rate of credit cards) could result in changes in the estimated selling prices. Determining the frequency to

reassess selling price for individual deliverables requires significant judgment. During 2011 , the Company changed the expiration of its award

miles from six months to three months, which contributed to a reduction of the estimated period the transportation is expected to be provided

from 20 months to 16 months. The change in expiration period increased revenues by $0.2 million in 2011.

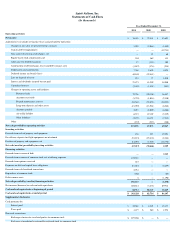

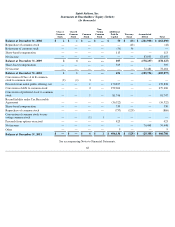

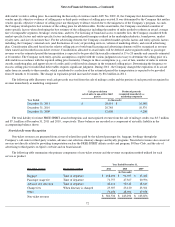

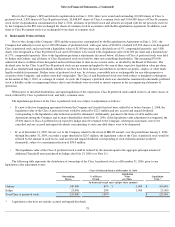

The following table illustrates total cash proceeds received from the sale of mileage credits and the portion of such proceeds recognized in

revenue immediately as marketing component:

The total liability for future FREE SPIRIT award redemptions and unrecognized revenue from the sale of mileage credits was $3.7 million

and $7.1 million at December 31, 2011 and 2010 , respectively. These balances are recorded as a component of air traffic liability in the

accompanying balance sheets.

Non-ticket Revenue Recognition

Non-ticket revenues are generated from air travel-related fees paid by the ticketed passenger for, baggage, bookings through the

Company’s call center or third-party vendors, advance seat selection, itinerary changes and loyalty programs. Non-

ticket revenues also consist of

services not directly related to providing transportation such as the FREE SPIRIT affinity credit card program, $9 Fare Club, and the sale of

advertising to third parties on Spirit’s website and on board aircraft.

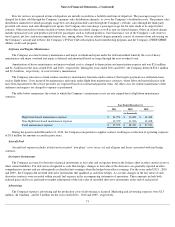

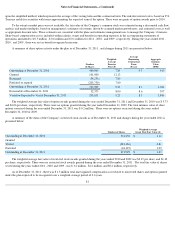

The following table summarizes the primary components of non-ticket revenue and the revenue recognition method utilized for each

service or product:

72

Cash proceeds from

sale of miles to non-airline third

parties

Portion of proceeds

recognized immediately as

marketing component

Year Ended (in thousands)

December 31, 2011

$

20,954

$

16,580

December 31, 2010

20,748

10,576

December 31, 2009

12,008

5,209

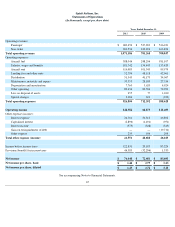

Non-ticket revenue Recognition method

Year Ended December 31,

2011

2010

2009

(in thousands)

Baggage Time of departure

$

168,290

$

91,393

$

63,222

Passenger usage fee Time of departure

71,757

47,367

20,596

Advance seat selection Time of departure

42,112

32,512

18,819

Change fees When itinerary is changed

25,927

23,120

23,561

Other

73,450

48,904

37,658

Non-ticket revenue

$

381,536

$

243,296

$

163,856