Spirit Airlines 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER

PURCHASES OF EQUITY SECURITIES

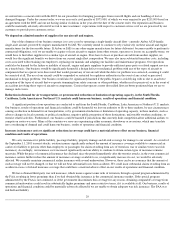

Market Price of our common stock

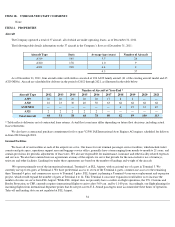

Our common stock has been listed and traded on the NASDAQ Global Select Market under the symbol SAVE since May 26, 2011 when

our IPO priced at $12.00 per share. Prior to that time, there was no public market for our common stock. The following table shows, for the

periods indicated, the high and low per share sales prices for our common stock on the NASDAQ Global Select Market.

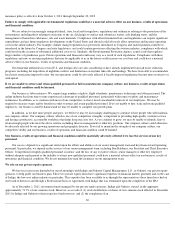

As of February 10, 2012, there were approximately 77 holders of record of our common stock. Because many of our shares are held by

brokers and other institutions on behalf of stockholders, we are unable to estimate the total number of stockholders represented by these record

holders.

The information under the caption “Equity Compensation Plan Information” in Part III, Item 12 of this Annual Report on Form 10-K is

incorporated herein by reference.

Dividend Policy

We have never declared or paid, and do not anticipate declaring or paying, any cash dividends on our common stock. Any future

determination as to the declaration and payment of dividends, if any, will be at the discretion of our board of directors and will depend on then

existing conditions, including our financial condition, operating results, contractual restrictions, capital requirements, business prospects and

other factors our board of directors may deem relevant.

Our Repurchases of Equity Securities

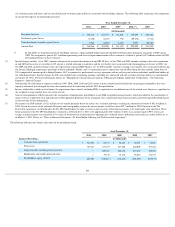

The following table reflects our repurchases of our common stock during the fourth quarter of 2011. All stock repurchases during this

period were made from employees who received restricted stock grants. All stock repurchases were made at the election of each employee

pursuant to an offer to repurchase by us. In each case, the shares repurchased constituted the portion of vested shares necessary to satisfy

minimum withholding tax requirements.

During the first three quarters of 2011, we repurchased and retired 72,114 shares for a total of $0.8 million. All stock repurchases were

made at the election of each employee pursuant to an offer to repurchase by us. In each case, the shares repurchased constituted the portion of

vested shares necessary to satisfy withholding tax requirements. We did not make any open market stock repurchases during the fourth quarter of

2011.

36

Fiscal year ending December 31, 2011 High

Low

Second Quarter (from May 26, 2011)

$

12.33

$

11.11

Third Quarter

14.43

10.18

Fourth Quarter

17.48

11.45

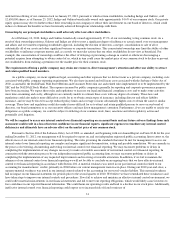

ISSUER PURCHASES OF EQUITY SECURITIES

Period

Total

Number of

Shares

Purchased

Average

Price Paid

per Share

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs

Approximate Dollar

Value of Shares that

May Yet be

Purchased Under

Plans or Programs.

October 1-31, 2011

—

N/A

—

—

November 1-30, 2011

—

N/A

—

—

December 1-31, 2011

8,215

$

15.70

—

—

Total

8,215

$

15.70

—

—