Spirit Airlines 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

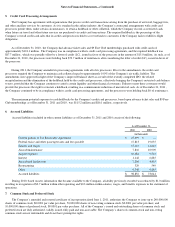

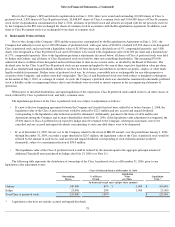

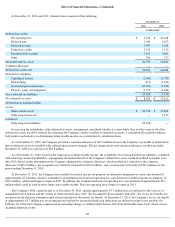

The following table sets forth the computation of basic and diluted earnings per common share (in thousands, except for share and per

share amounts):

The Company has excluded 70,268 shares from its calculations of diluted earnings per common share in 2011 as they represented

antidilutive stock awards for the respective period. There were no shares excluded in 2010 or 2009.

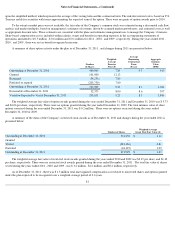

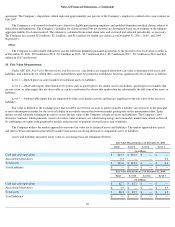

As of December 31, 2011 and 2010 , the following amounts were due to related parties (in thousands):

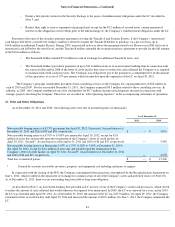

In connection with the closing of the IPO, the Company consummated the transaction contemplated by the Recapitalization Agreement on

June 1, 2011, which resulted in the repayment or exchange for common stock of all of the Company’s notes and preferred stock (see Note 20).

All Tranche A and B notes were held by Indigo and Oaktree. Interest on these notes was not paid in cash but accrued on a periodic basis on

both the Tranche A and Tranche B notes at a rate of 17% per annum, compounded annually on December 31. All Tranche A and Tranche B

notes would have matured on April 30, 2012 except for $20.0 million of Tranche A notes which were due December 30, 2011.

Tranche A and B notes and approximately $3.2 million of other secured notes due to unrelated parties had a first-priority security interest

in substantially all assets of the company (the “Security Package”). Certain other secured notes held by unrelated parties, aggregating

approximately $12.0 million in principal amount, had a second-priority security interest in the Security Package. Pursuant to intercreditor and

other security agreements, the holders of Tranche A and B notes, and of the $3.2 million of other secured notes, agreed to:

82

10.

Net Income per Share

Year Ended December 31,

2011

2010

2009

(in thousands, except for share and per share amounts)

Numerator

Net income

$

76,448

$

72,481

$

83,693

Denominator

Weighted-average shares outstanding, basic

53,240,898

26,183,772

25,910,766

Effect of dilutive stock awards

274,450

506,083

404,355

Adjusted weighted-average shares outstanding, diluted

53,515,348

26,689,855

26,315,121

Net Income per Share

Basic earnings per common share

$

1.44

$

2.77

$

3.23

Diluted earnings per common share

$

1.43

$

2.72

$

3.18

11. Related-

Party Debt and Transactions

As of December 31,

2011

2010

Tranche A notes payable bearing interest at 17% due April 30, 2012, except for $20.0 million of Tranche

A notes which are due December 30, 2011. Secured*. Accrued interest at December 31, 2010 and 2011

was $0 and $0 million, respectively

$

—

$

137,360

Tranche B notes payable bearing interest at 17% due April 30, 2012. Secured*. Accrued interest at

December 31, 2010 and 2011 was $0 and $0 million, respectively —

128,261

Total due to related parties

$

—

$

265,621

*

Secured by accounts receivable, inventory, property and equipment, not including airframes or engines.