Spirit Airlines 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

maintenance events that are covered by reserves on deposit with the relevant lessor, or routine maintenance costs that are recorded in

maintenance expense.

During 2011, the Company entered into sale and leaseback transactions with third party aircraft lessors for the sale and leaseback of two

Airbus A320 aircraft and one spare engine which resulted in deferred losses of $10.6 million, which are included in security deposits and other

long term assets within the balance sheet. The deferred losses will be recognized as rent expense on a straight line basis over the term of the

respective operating leases. The Company had agreements in place prior to the delivery of these aircraft which resulted in the settlement of the

purchase obligation by the lessor and the refund of $6.7 million in pre-delivery deposits from Airbus. The refunded pre-delivery deposits have

been disclosed in the statement of cash flows as investing activities within pre-delivery deposits, net of refunds. On the engine sale and

leaseback, the Company took delivery of the engine and subsequently completed a sale and leaseback of the engine. Cash outflows related to the

purchase of the engine have been disclosed in the statement of cash flows as investing activities within purchases of property and equipment and

the cash inflows from the sale of the engine as financing activities within proceeds received on sale lease back transactions. All of the leases

from these sale and leaseback transactions are accounted for as operating leases. Under the terms of the lease agreements, the Company will

continue to operate and maintain the aircraft. Payments under the lease agreements are fixed for the term of the lease. The lease agreements

contain standard termination events, including termination upon a breach of the Company's obligations to make rental payments and upon any

other material breach of the Company's obligations under the leases, and standard maintenance and return condition provisions. Upon a

termination of the lease due to a breach by the Company, the Company would be liable for standard contractual damages, possibly including

damages suffered by the lessor in connection with remarketing the aircraft or while the aircraft is not leased to another party.

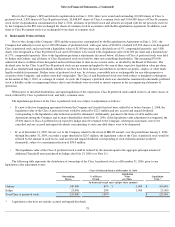

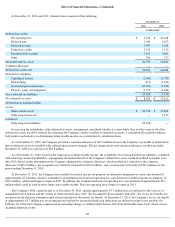

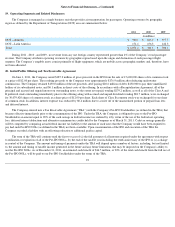

Future minimum lease payments under noncancelable operating leases with initial or remaining terms in excess of one year at

December 31, 2011 were as follows:

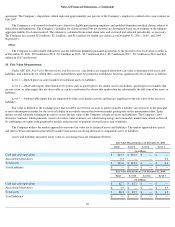

As part of the Company’s risk management program, the Company from time to time uses a variety of financial instruments, primarily

costless collar contracts, to reduce its exposure to fluctuations in the price of jet fuel. The Company does not hold or issue derivative financial

instruments for trading purposes.

The Company is exposed to credit losses in the event of nonperformance by counterparties to these financial instruments. The Company

periodically reviews and seeks to mitigate exposure to the counterparty’s financial deterioration and nonperformance by monitoring the absolute

exposure levels, the counterparty’s credit rating, and the counterparty’s historical performance relating to hedge transactions. The credit

exposure related to these financial instruments is limited to the fair value of contracts in a net receivable position at the reporting date. The

Company also maintains security agreements that require the Company to post collateral if the value of selected instruments falls below

specified mark-to-market thresholds. To mitigate this requirement, the Company ratably builds its hedge portfolio to targeted levels to avoid

excess exposure to specific market conditions.

The Company records financial derivative instruments at fair value, which includes an evaluation of the counterparty’s credit risk. Fair

value of the instruments is determined using standard option valuation models. Management chose not to elect hedge accounting on any of the

derivative instruments purchased through the end of 2011, 2010, and 2009 and, as a result, changes in the fair value of these fuel hedge contracts

are recorded each period in aircraft fuel expense.

85

Operating Leases

As of December 31,

Aircraft

and Spare Engine

Leases

Property Facility

Leases

Total Operating

Leases

(in thousands)

2012

$

138,532

$

8,372

$

146,904

2013

144,476

7,781

152,257

2014

144,494

5,711

150,205

2015

144,879

3,115

147,994

2016

145,725

1,025

146,750

2017 and thereafter

434,811

14,825

449,636

Total minimum lease payments

$

1,152,917

$

40,829

$

1,193,746

14.

Financial Instruments and Risk Management