Spirit Airlines 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

Pursuant to the terms of the securities purchase agreement covering the Tranche A and Tranche B notes, if the Company’s unrestricted

cash balance fell below a stated level, Indigo could have elected to require the Tranche B holders to purchase, on a pro rata basis, up to

$16.8 million in additional Tranche B notes. During 2009, unrestricted cash was above the minimum stated level. However in 2008, the level of

unrestricted cash fell below the stated level, and the Tranche B holders amended the securities purchase agreement to provide for the full amount

of the $16.8 million as follows:

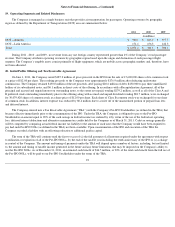

The Company’s principal stockholders provided certain consulting services to the Company for a management fee of $0.8 million in

each of 2010 and 2009 . For the year ended December 31, 2011 , the Company expensed $0.3 million related to these consulting services. In

addition, in 2009 , the Company reimbursed one of its stockholders for $0.7 million of professional expenses incurred in connection with

strategic projects involving the Company. These fees are recorded in “other operating expenses” in the accompanying statements of operations.

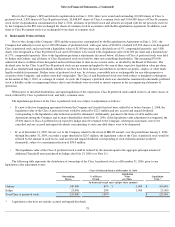

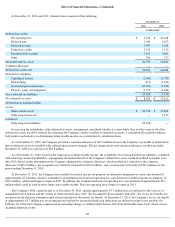

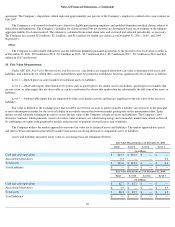

As of December 31, 2011 and 2010 , the following notes were due to unrelated parties (in thousands):

In connection with the closing of the IPO, the Company consummated the transaction contemplated by the Recapitalization Agreement on

June 1, 2011, which resulted in the repayment or exchange for common stock of all of the Company’s notes and preferred stock (see Note 20).

As of December 31, 2011, there was no outstanding long term debt or long term obligation.

As described in Note 5, an investment banking firm provided an LC in favor of one of the Company’

s credit card processors, which served

to reduce the amount of cash collateral that would otherwise be required to be maintained. In 2009, the LC was renewed for a year, and in 2010

the LC was extended until April 30, 2011. As of December 31, 2010, the amount of the LC was $15.0 million. On April 29, 2011, the Company

extended its letter of credit facility until April 30, 2014 and increased the amount to $30.0 million. On June 1, 2011, the Company terminated the

LC.

83

• Permit a first-priority interest in the Security Package to the payee of reimbursement obligations under the LC described in

Note 5, and

• Restrict their right to receive repayment of principal and, except for the $3.2 million of secured notes, current payment of

interest on the obligations owed to them prior to the full discharge of, the Company’

s reimbursement obligations under the LC.

•

The Tranche B holders funded $5.0 million in cash in exchange for additional Tranche B notes, and

• The Tranche B holders provided a guarantee of up to $11.8 million in favor of an investment banking firm in connection with

the renewal in December 2008 of the letter of credit facility that serves to reduce the cash collateral the Company was required

to maintain with credit card processors. The Company was obligated to pay to the guarantors a commitment fee on the amount

of this guarantee, at a rate of 17% per annum, which became due upon the expiration of the LC on April 30, 2011.

12.

Debt and Other Obligations

As of December 31,

2011

2010

Notes payable bearing interest at 8.75% per annum due April 30, 2012. Unsecured. Accrued interest at

December 31, 2011 and 2010 of $0 and $38, respectively.

$

—

$

5,056

Notes payable bearing interest at 8.70% to 19.00% per annum due April 30, 2012, except for $1.8

million of notes due and payable upon the termination of the Company’s letter of credit facility on

April 30, 2011. Secured*. Accrued interest at December 31, 2011 and 2010 of $0 and $55, respectively. —

5,492

Notes payable bearing interest at Prime plus 0.95% to 1.75% (4.20% to 5.00% at December 31, 2010)

due April 30, 2012, except for $1.4 million of notes due and payable upon the termination of the

Company’s letter of credit facility on April 30, 2011. Secured*. Accrued interest at December 31, 2011

and 2010 of $0 and $19, respectively. —

4,658

Total due to unrelated parties

$

—

$

15,206

* Secured by accounts receivable, inventory, property, and equipment, not including airframes or engines.