Spirit Airlines 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

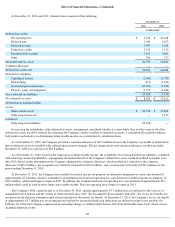

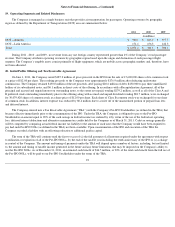

21. Quarterly Financial Data (Unaudited)

Quarterly results of operations for the years ended December 31 are summarized below:

(1) Net income for the three months ended September 30, 2010 includes a $53.0 million net tax benefit primarily due to the release of a valuation

allowance resulting in a deferred tax benefit of $53.5 million. Absent the release of the valuation allowance and corresponding tax benefit, our net income would have

been $8.2 million for the three months ended September 30, 2010.

22. Subsequent Events

On January 13, 2012, the Company executed the Fourth Amendment to Second Amended and Restated Investor Rights Agreement. The

amendment provides for certain changes in registration rights for future offerings and provides for reimbursement by Indigo and Oaktree for up

to $500,000 to the Company of a portion of expenses in connection with a secondary offering.

On January 25, 2012 , the Company completed a secondary offering of 12,650,000 shares of common stock (including 1,650,000 shares

sold upon the underwriters' exercise in full of their over-allotment option) at a price to the public of $14.50 per share. All of the shares of

common stock were sold by existing stockholders of the Company, including affiliates of Oaktree Capital Management and Indigo Partners and

certain members of the Company's executive team. The Company did not receive any proceeds from the secondary offering.

On January 31, 2012, the Company's Board of Directors approved the effectiveness of Amendment No. 1. to Side Letter No. 6 to the

V2500-A5 Fleet Hour Agreement between IAE International Aero Engines AG (“ IAE ”) and the Company dated April 11, 2005 (the “ IAE

Agreement ”) and Side Letter No. 7 to the IAE Agreement (collectively, the “ IAE Amendments ”). The IAE Amendments provide that the

Company and IAE will renegotiate in good faith certain new and revised terms of the IAE Agreement including, among other things, provisions

for engine repair and associated fees and costs. The Company and IAE have agreed to negotiate definitive documentation of such changes by

March 31, 2012.

93

Three Months Ended

March 31

June 30

September 30

December 31

(in thousands, except per share amounts)

2011

Operating revenue

$

232,662

$

275,891

$

288,714

$

273,919

Operating income

26,844

34,959

44,556

38,023

Net income (loss)

7,883

16,917

27,657

23,991

Basic earnings (loss) per share

0.30

0.41

0.38

0.33

Diluted earnings (loss) per share

0.30

0.41

0.38

0.33

2010

Operating revenue

$

184,051

$

177,359

$

203,655

$

216,200

Operating income

24,124

1,791

20,982

21,976

Net income (loss) (1)

11,276

(10,066

)

61,740

9,531

Basic earnings (loss) per share

0.43

(0.38

)

2.35

0.36

Diluted earnings (loss) per share

0.42

(0.38

)

2.33

0.36