Spirit Airlines 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements

Basis of Presentation

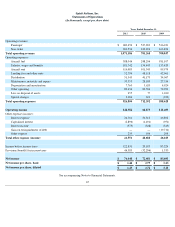

Spirit Airlines, Inc. (Spirit or the Company) headquartered in Miramar, Florida, is an ultra low-cost, low-fare airline based in Fort

Lauderdale, Florida that provides affordable travel opportunities principally throughout the domestic United States, the Caribbean and Latin

America. The Company manages operations on a system-wide basis due to the interdependence of its route structure in the various markets

served. As only one service is offered (i.e., air transportation), management has concluded that there is only one reportable segment.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles in the United States of America

requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes.

Actual results could differ from these estimates.

Cash and Cash Equivalents

The Company considers all highly liquid investments with maturities of less than three months at the date of acquisition to be cash

equivalents. Investments included in this category primarily consist of money market funds.

Restricted Cash

Restricted cash primarily consists of funds held by credit card processors as collateral for future travel paid with a credit card.

Accounts Receivable

Accounts receivable primarily consist of amounts due from credit card processors associated with the sales of tickets and amounts due

from counterparties associated with fuel derivative instruments that have settled. The allowance for doubtful accounts represents the estimated

losses expected to be incurred on receivables based on age and specific analysis.

The amount of accounts receivable write offs for 2011, 2010 and 2009 was not material. In addition, the recorded charges/(recoveries)

related to the allowance for doubtful accounts for 2011, 2010 and 2009 were not material.

Inventories

Spare parts, materials, and supplies relating to flight equipment are carried at average acquisition cost and are expensed when used in

operations. Allowances for obsolescence are provided over the estimated lease life of the related aircraft and engines (as 100% of the fleet is

financed via operating leases) for spare parts expected to be on hand at the date aircraft are retired from service.

Deferred Offering Costs

The Company complies with the requirements of SEC Staff Accounting Bulletin (SAB) Topic 5A—“Expenses of Offering.” Deferred

offering costs of approximately $4.0 million as of December 31, 2010 presented in the accompanying balance sheet in other current assets,

consisted principally of legal, accounting, printing, and underwriting fees incurred through the balance sheet date related to an initial public

offering (the IPO). A total of $6.1 million in deferred offering costs was charged to additional paid-in capital net of proceeds in connection with

the consummation of the IPO in 2011 .

Property and Equipment

Property and equipment are stated at cost, less accumulated depreciation and amortization. Depreciation of operating property and

equipment is computed using the straight-line method applied to each unit of property, except on flight equipment (major rotable parts, avionics,

and assemblies), which are depreciated on a group basis over the average life of the applicable equipment.

69

1.

Summary of Significant Accounting Policies