Spirit Airlines 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

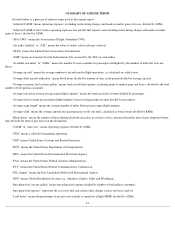

equity compensation paid to employees for their services, as well as the related expenses associated with employee benefit plans and employer

payroll taxes.

Aircraft Rent. Aircraft rent expense consists of monthly lease rents for aircraft and spare engines under the terms of the related operating

leases and is recognized on a straight line basis. Aircraft rent expense also includes that portion of maintenance reserves, also referred to as

supplemental rent, paid to aircraft lessors in advance of the performance of major maintenance activities that is not probable of being reimbursed

to us by the lessor. Aircraft rent expense is net of the amortization of gains and losses on sale and leaseback transactions on our flight equipment.

Presently, all of our aircraft and spare engines are financed under operating leases.

Landing Fees and Other Rents. Landing fees and other rents include both fixed and variable facilities expenses, such as the fees charged

by airports for the use or lease of airport facilities, overfly fees paid to other countries and the monthly rent paid for our headquarters facility.

Distribution. Distribution expense includes all of our direct costs to sell, including the cost of web support, our third-party call center,

travel agent commissions and related GDS fees, and credit card transaction fees, associated with the sale of our tickets and other products and

services.

Maintenance, Materials and Repairs. Maintenance, materials and repairs expense includes all parts, materials, repairs and fees for repairs

performed by third-party vendors directly required to maintain our fleet. It excludes direct labor cost related to our own mechanics, which is

included under salaries, wages and benefits. It also excludes the amortization of heavy maintenance expenses, which we defer under the deferral

method of accounting and amortize on a straight-line or usage basis until the next estimated overhaul event.

Depreciation and Amortization. Depreciation and amortization expense includes the depreciation of fixed assets we own and leasehold

improvements. It also includes the amortization of heavy maintenance expenses we defer under the deferral method of accounting for heavy

maintenance events and recognize into expense on a straight line or usage basis until the next overhaul event.

Loss on disposal of assets. Loss on disposal of assets includes the net losses on the disposal of our fixed assets, including losses on sale

and leaseback transactions.

Other Operating Expenses. Other operating expenses include airport operations expense and fees charged by third-party vendors for

ground handling services and commissary expenses, the cost of passenger liability and aircraft hull insurance, all other insurance policies except

for employee health insurance, travel and training expenses for crews and ground personnel, professional fees, personal property taxes and all

other administrative and operational overhead expenses. No individual item included in this category represented more than 5% of our total

operating expenses.

Special Charges. Special charges include termination costs, restructuring costs, and secondary offering costs.

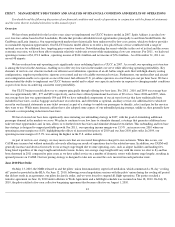

In the second quarter of 2011, we incurred $2.3 million of termination costs in connection with the IPO comprised of amounts paid to

Indigo Partners, LLC to terminate its professional services agreement with us and fees paid to three individual, unaffiliated holders of our

subordinated notes. The Company also incurred $0.8 million consisting principally of legal, accounting, printing, and filing fees connected with

the secondary offering which was consummated on January 25, 2012 .

In 2010, in an effort to gain efficiencies, we relocated all of our maintenance operations from Detroit, Michigan, to Fort Lauderdale,

Florida. The restructuring included the closure of facilities in Detroit, relocation of equipment and tools, and the relocation of a portion of the

former Detroit workforce. We determined that the relocation of these facilities and the relocation and reduction of certain employees met the

requirement of an exit activity, and, therefore, we recorded all of the related severance and exit costs in 2010. In 2011, we recorded $0.2 million

of additional restructuring charges that primarily relate to this relocation of our maintenance operations.

Our Other Expense (Income)

Interest Expense. Paid-in-kind interest on notes due to related parties and preferred stock dividends due to related parties account, on

average, for over 80% of interest expense incurred for the years 2011 , 2010 and 2009 . Non-related party interest expense accounted for the

remainder of interest expense in these periods. All of the notes and preferred stock were repaid or redeemed, or exchanged for common stock, in

connection with the 2011 Recapitalization.

Capitalized Interest. Capitalized interest represents interest cost to finance purchase deposits for future aircraft and the opportunity cost

(interest) incurred during the acquisition period of an aircraft that theoretically could have been avoided had

45