Spirit Airlines 2011 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Customers

Our customers are primarily those that pay for their own travel. Regardless of whether they are visiting friends and relatives (VFR) or

traveling for leisure or business, because they pay for their own travel, they tend to be price-sensitive. We believe VFR traffic makes up the

largest component of our international traffic and the second-largest component of our domestic traffic. Additionally, we believe our VFR

customers are the most price-sensitive of all of our travelers. Our VFR markets tend to complement our leisure-driven markets from both a

seasonal and day of the week perspective. VFR traffic is strongest during the Christmas and New Year season, followed by Easter and summer

when children are out of school.

We believe leisure traffic makes up the second-largest component of our international traffic but the majority of our domestic customers.

This segment responds well to demand stimulation based on low fares, and South Florida, Myrtle Beach, Atlantic City and Las Vegas all provide

among the best values among leisure destinations in the United States. Leisure traffic to South Florida and the Caribbean is strongest in the

winter season, as many seek to leave cold weather where they live, and in the summer, when children are out of school. Traffic to Myrtle Beach

and Atlantic City tends to have a single high season that begins in the spring and continues through the fall.

We do not actively target corporate travelers. We believe that many of our customers who use us for business travel are small business

travelers who bear their own travel costs, as opposed to those who work at larger companies and very likely have their travel reimbursed. We

believe we have limited penetration with large companies due to the fact we do not support high-cost corporate sales efforts directed to this

consumer segment. To market to larger corporate travelers generally, our schedule, product and distribution mechanisms would have to be

modified driving up our overall costs and potentially requiring an increase in fares overall.

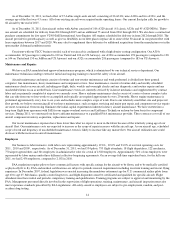

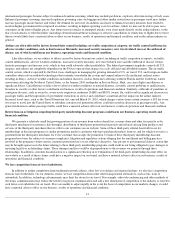

Customer Service

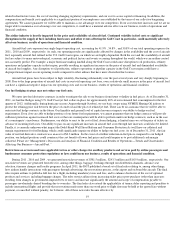

We are committed to building a successful airline by taking care of our customers. We believe focus on excellent customer service in every

aspect of our operations including personnel, flight equipment, in-flight and ancillary amenities, on-time performance, flight completion ratios

and baggage handling will strengthen customer loyalty and attract new customers. We proactively aim to improve our operations to ensure

further improvement in customer service. The Department of Transportation, or DOT, publishes statistics regarding measures of customer

satisfaction for domestic airlines and can assess civil penalties for failure to comply with certain customer service obligations. For example, we

were assessed a civil penalty relating to our prior procedures for bumping passengers from oversold flights and for the handling of lost or

damaged baggage in 2009. Our performance under customer service measures for the years ended December 31, 2011 , 2010 and 2009 was as

follows:

In response to customer and other demands, we recently modified our online booking process to allow our customers to see all available

options and their prices prior to purchasing a ticket, and have initiated a campaign that illustrates our total prices are lower, on average, than our

competitors, even when options are included.

Fleet

We fly only Airbus A320 family aircraft, which provides us significant operational and cost advantages compared to airlines that operate

multiple fleet types. By operating one fleet type, we avoid the incremental costs of training crew across multiple fleet types. Flight crews are

entirely interchangeable across all of our aircraft, and maintenance, spare parts inventories and other operational support is highly simplified

relative to more complex fleets. Due to this commonality among Airbus single-aisle aircraft, we can retain the benefits of a fleet comprised of a

single type of aircraft while still having the flexibility to match the capacity and range of the aircraft to the demands of each route.

13

2011

2010

2009

On-Time Performance (1)(2)

71.2

%

73.1

%

75.0

%

Completion Factor (2)(3)

99.2

%

97.2

%

99.3

%

Mishandled Baggage (2)(4)

2.25

2.61

3.09

(1) Percentage of our scheduled flights that were operated by us that were on-

time (within 15 minutes).

(2)

As per Part 234 of the DOT regulations, we are not required to report this information to the DOT.

(3) Percentage of our scheduled flights that were operated by us, whether or not delayed (i.e., not cancelled). Includes the impact of

cancelled flights due to the June 2010 pilot strike.

(4)

Our incidence of delayed, mishandled or lost baggage per 1,000 passengers.