Spirit Airlines 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

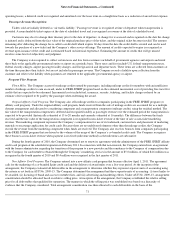

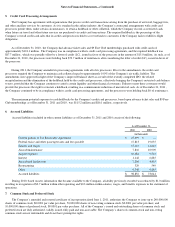

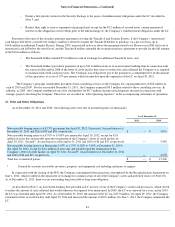

The following table illustrates the liquidation adjustment as triggered by the excess of MD-80 charges over the target:

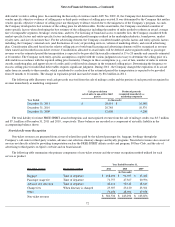

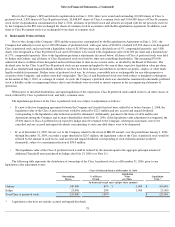

As of December 31, 2010, accrued and unpaid dividends for the Class A and Class B preferred stock totaled $14.5 million and

$4.2 million, respectively. The maximum amount the Company could be required to pay to redeem the Class A and Class B preferred stock as of

the mandatory redemption date of July 1, 2012, is estimated to be $78.6 million and $9.2 million, respectively.

During the years ended 2010 and 2009, Class A preferred stock accrued dividends of $3.5 million or $35.21 per share and $4.3 million or

$43.10 per share, respectively, while the Class B preferred stock accrued dividends of $1.1 million or $381.04 per share and $0.9 million or

$322.60 per share, respectively.

In connection with the closing of the IPO, the Company consummated the transaction contemplated by the Recapitalization Agreement on

June 1, 2011, which resulted in the repayment or exchange for common stock of all of the Company’s notes and preferred stock (see Note 20).

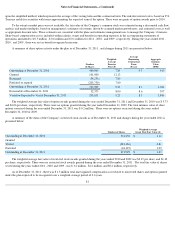

The Company’s board of directors adopted, and the Company’s stockholders approved, the Amended and Restated 2005 Incentive Stock

Plan, or the 2005 Stock Plan, effective January 1, 2008. The total number of shares of common stock authorized for issue pursuant to awards

granted under the 2005 Stock Plan was 2,500,000 shares. The 2005 Stock Plan provided for the grant of non-qualified stock options, stock

appreciation rights, restricted stock, performance shares, phantom stock, restricted stock units and other awards that are valued in whole or in

part by reference to the Company’s stock.

On May 9, 2011, the Company’s board of directors adopted, and the Company’s stockholders approved, the 2011 Equity Incentive Award

Plan, or 2011 Plan. The principal purpose of the 2011 Plan is to attract, retain and engage selected employees, consultants and directors through

the granting of stock-based compensation awards and cash-based performance bonus awards. Under the 2011 Plan, 3,000,000 shares of common

stock are reserved for issuance pursuant to a variety of stock-based compensation awards, including stock options, stock appreciation rights, or

SARs, restricted stock awards, restricted stock unit awards, deferred stock awards, dividend equivalent awards, stock payment awards and

performance awards and other stock-based awards, plus the number of shares remaining available for future awards under the Company’s 2005

Stock Plan. The number of shares reserved for issuance or transfer pursuant to awards under the 2011 Plan will be increased by the number of

shares represented by awards outstanding under the Company’s 2005 Stock Plan that are forfeited or lapse unexercised and which, following the

effective date of the 2011 Plan, are not issued under the 2005 Stock Plan. No further awards will be granted under the 2005 Stock Plan, and all

outstanding awards will continue to be governed by their existing terms. As of December 31, 2011 , 3,336,614 shares of the Company’

s common

stock remained available for future issuance under the 2011 Plan.

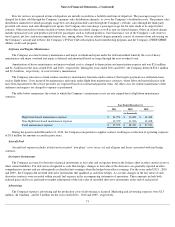

Restricted stock awards are valued at the fair value of the shares on the date of grant if vesting is based on a service or a performance

condition. Granted shares vest 25% per year on each anniversary of issuance. Compensation expense is recognized on a straight-line basis over

the requisite service period.

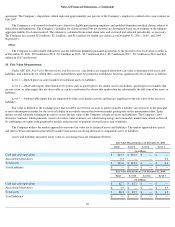

Stock option awards are granted with an exercise price equal to the fair market value of the Company’s common stock at the date of grant

and graded vest based on four years of continuous service and have 10-year contractual terms. The fair value of each stock option award is

estimated on the date of grant using the Black-Scholes model. For option grants during 2011 , the Company’s weighted average assumptions for

expected volatility, dividends, term, and risk-free interest rate were 46.25 %, 0 %, 6.25 years and 2.03

%, respectively. For option granted during

2010, the Company’s weighted average assumptions for expected volatility, dividends, term, and risk-free interest rate were 51.6%, 0%, 6.25

years and 2.12%, respectively. Expected volatilities are based on the historical volatility of a group of peer entities within the same industry. The

expected term of options is based

80

$16.7 Million Liquidation Value Adjustment

Outstanding

Shares

Liquidation Value Prior to

Adjustment

Liquidation Value

Adjustment

Liquidation Value per Share After

Adjustment

Liquidation Value as of

December 31, 2009 *

(in thousands except share and per share amounts)

Oaktree

100,000

$

74,821

$

(16,664

)

$

582

$

58,157

Indigo

—

—

—

—

—

Total Class A

preferred stock

100,000

$

74,821

$

(16,664

)

$

58,157

* Liquidation value does not include accrued and unpaid dividends.

9. Stock-

Based Compensation