Spirit Airlines 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Use of Proceeds from the Sale of Registered Securities

On May 25, 2011, the SEC declared effective our registration statement on Form S-1 (File No. 333-169474), as amended, filed in

connection with the IPO. Pursuant to the registration statement, we registered the offer and sale of 17,940,000 shares of our common stock at a

public offering price of $12.00 per share, consisting of the sale by us of 15,600,000 shares of common stock for an aggregate offering price of

$187.2 million and the sale of up to an additional 2,340,000 shares of common stock by selling stockholders pursuant to the underwriters' over-

allotment option. We sold and issued 15,600,000 shares of our common stock for an aggregate offering price of $187.2 million, and the selling

stockholders sold on June 29, 2011 256,513 shares of common stock pursuant to the underwriters' over-allotment option, for an aggregate

offering price of approximately $3.1 million. We did not receive any proceeds from the sale of shares sold by the selling stockholders. The

overallotment option has expired. The joint book-running managing underwriters of the IPO were Citigroup Global Markets Inc. and Morgan

Stanley & Co. Incorporated. After deducting underwriting discounts, commissions and offering expenses paid or payable by us of approximately

$16.4 million, the net proceeds to us from the IPO were approximately $170.8 million. No offering expenses were paid, directly or indirectly, to

our directors or officers, to persons owning ten percent or more of any class of our equity securities or to any of our affiliates.

The net proceeds from the IPO have been invested in high quality, short-term money market accounts. There has been no material change

in the expected use of the remaining net proceeds from the IPO as described in our registration statement on Form S-1.

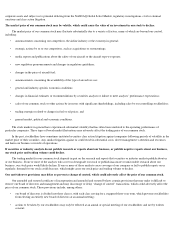

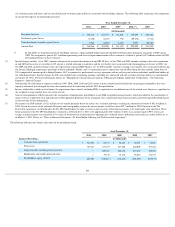

Stock Performance Graph

The following graph compares the cumulative total stockholder return on our common stock with the cumulative total return on the

NASDAQ Composite Index and the NYSE ARCA Airline Index for the period beginning on May 26, 2011 (the date our common stock was first

traded) and ending on the last day of 2011. The graph assumes an investment of $100 in our stock and the two indices, respectively, on May 26,

2011, and further assumes the reinvestment of all dividends. The May 26, 2011 stock price used for our stock is the initial public offering price.

Stock price performance, presented for the period from May 26, 2011 to December 31, 2011, is not necessarily indicative of future results.

37

5/26/2011

12/31/2011

SAVE

$

100.00

$

130.00

NASDAQ Composite Index

$

100.00

$

93.61

NYSE ARCA Airline Index

$

100.00

$

75.49