Spirit Airlines 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

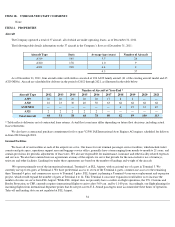

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion of our financial condition and results of operations in conjunction with the financial statements

and the notes thereto included elsewhere in this annual report.

Overview

We have been profitable for the last five years since we implemented our ULCC business model in 2007. Spirit Airlines is an ultra low-

cost, low-fare airline based in Fort Lauderdale, Florida that provides affordable travel opportunities principally to and from South Florida, the

Caribbean and Latin America. Our targeted growth markets have historically been underserved by low-cost carriers, which we believe provides

us sustainable expansion opportunities. Our ULCC business model allows us to offer a low-priced basic service combined with a range of

optional services for additional fees, targeting price-sensitive travelers. Notwithstanding the recent volatility in the cost of jet fuel and the severe

economic recession, we have been able to maintain relatively stable unit revenue while maintaining a low-cost structure. For 2011 , we had total

operating revenues of $1,071.2 million , operating income of $144.4 million and net income of $76.4 million . As of December 31, 2011, we

served 48 airports.

We have reduced our unit operating costs significantly since redefining Spirit as a ULCC in 2007. As a result, our operating cost structure

is among the lowest in the Americas, enabling us to offer very low fares in the markets we serve while delivering operating profitability. Key

elements of our low-cost structure include our efficient asset utilization, operation of an all Airbus single-aisle fleet with high-density seating

configurations, employee productivity, rigorous cost control and use of scalable outsourced services. Furthermore, our modern fleet and aircraft

seat configuration enable us to operate as one of the most fuel-efficient U.S. jet airline operators on a fuel burn per seat per hour basis. We have

demonstrated the ability to implement our ULCC business model and to adjust our capacity and routes in response to changing market conditions

as part of our focus on achieving consistent route profitability.

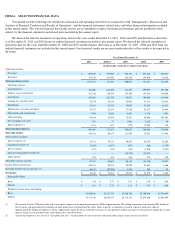

Our ULCC business model allows us to compete principally through offering low base fares. For 2011 , 2010 and 2009 our average base

fare was approximately $81 , $77 and $85 respectively, and we have offered promotional base fares of $9 or less. Since 2008 and 2007, when

our average base fare was approximately $94 and $98 we have unbundled components of our air travel service that have traditionally been

included in base fares, such as baggage and advance seat selection, and offer them as optional, ancillary services for additional fees (which we

record in our financial statements as non-ticket revenue) as part of a strategy to enable our passengers to identify, select and pay for the services

they want to use. While many domestic airlines have also adopted some aspects of our unbundled pricing strategy, unlike us, they generally have

not made a corresponding reduction in base fares.

We have lowered our base fares significantly since initiating our unbundling strategy in 2007, with the goal of stimulating additional

passenger demand in the markets we serve. We plan to continue to use low fares to stimulate demand, a strategy that generates additional non-

ticket revenue opportunities and, in turn, allows us to further lower base fares and stimulate demand even further. This unbundling and low base

fare strategy is designed to support profitable growth. For 2011 , our operating income margin was 13.5% , an increase over 2010 when our

operating income margin was 8.8%, highlighting the effects of increased fuel prices of 2010 and our June 2010 pilot strike. In 2009, our

operating income margin of 15.9% was among the highest in the U.S. airline industry.

As part of our low-cost strategy, we may incur costs that are recovered through fees charged to our customers. When this occurs, our

CASM may increase but without materially adversely affecting our results of operations due to the related revenue. In addition, our CASM will

generally increase and decrease inversely to our average stage length due to some operating costs, such as airport facilities and landing fees,

being fixed regardless of the stage length and related revenue. In turn, our average stage length will vary with the routes we elect to fly and has

been shortened in 2011 compared to prior years as we have added service on a number of domestic routes with shorter stage lengths, resulting in

upward pressure on CASM. Our fare pricing strategy is designed to take into account the costs incurred on each particular route.

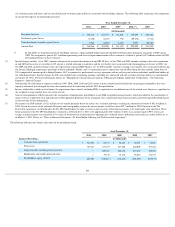

June 2010 Pilot Strike

On May 13, 2010, the NMB released us and the pilots’ union from mandatory supervised mediation, which commenced a 30-day “cooling

off” period as provided in the RLA. On June 12, 2010, following several negotiation sessions with the pilots’

union during the cooling off period

that did not result in an agreement, our pilots declared a strike, and we were forced to suspend all flight operations. The parties reached a

tentative agreement on June 16, 2010 under a Return to Work Agreement and a full flight schedule was resumed on June 18, 2010. On July 23,

2010, the pilots ratified a five-year collective bargaining agreement that became effective on August 1, 2010.

43