Spirit Airlines 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

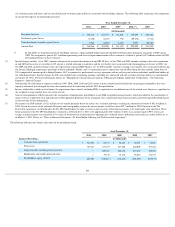

The results of operations for 2010 were materially adversely affected by the pilot strike. The pilot strike resulted in reduced bookings in the

period leading up to the strike as our customers became aware of the impending end of the cooling off period, and lost revenues while flight

operations were shut down and while we recovered from the strike. We also experienced additional expenses related to the strike, including costs

to reaccommodate passengers, offset by reduced variable expenses, such as reduced fuel consumption and employee costs for flights not

operated. We estimate that the strike had a net negative impact on our operating income for 2010 of approximately $24 million, consisting of an

estimated $28 million in lost revenues and approximately $4 million of incremental costs resulting from the strike, offset in part by a reduction

of variable expenses during the strike of approximately $8 million for flights not flown. The strike resulted in a reduction of approximately 145.8

million ASMs from our scheduled flying that was suspended during the five-

day strike period. Additionally, under the terms of the pilot contract,

we also paid $2.3 million in return-to-work payments during the second quarter of 2010, which are not included in the strike impact costs

described above.

The agreement with our pilots increased our pilot labor costs by approximately 11% in 2011 compared to the estimated cost of the

previous collective bargaining agreement and includes additional pay rate increases and modified work rules, which will increase the

productivity of our pilots. We believe the five-year term is valuable in providing stability to our labor costs, and that the other terms will also

provide us with competitive pilot labor costs compared to other U.S.-based low-cost carriers.

June 2011 IPO

On June 1, 2011, we completed our initial public offering of common stock, or IPO, which raised net proceeds of $150.0 million after

repayment of debt, payment of transaction expenses and other fees. In connection with the IPO, we effected a recapitalization, which we refer to

as the 2011 Recapitalization, that resulted in the repayment or conversion of all of our notes and shares of preferred stock into shares of common

stock.

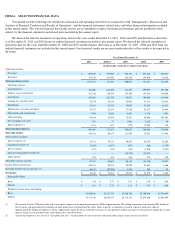

Our Operating Revenues

Our operating revenues are comprised of passenger revenues and non-ticket revenues.

Passenger Revenues . Passenger revenues consist of the base fares that customers pay for air travel.

Non-ticket Revenues. Non-ticket revenues are generated from air travel-related fees paid by the ticketed passenger for baggage, bookings

through our distribution channels, advance seat selection, itinerary changes, hotel travel packages, and loyalty programs such as our FREE

SPIRIT affinity credit card program and $9 Fare Club. Non-ticket revenues also include revenues derived from services not directly related to

providing transportation such as the sale of advertising to third parties on our website and on board our aircraft.

Substantially all of our revenues are denominated in U.S. dollars. Passenger revenues are recognized once the related flight departs.

Accordingly, the value of tickets sold in advance of travel is included under our current liabilities as “air traffic liability,” or ATL, until the

related air travel is provided. Non-ticket revenues are generally recognized at the time the ancillary products are purchased or ancillary services

are provided. Non-ticket revenues also include revenues from our subscription-based $9 Fare Club, which we recognize on a straight-line basis

over 12 months. Revenue is generated from the FREE SPIRIT credit card affinity program through the sale of FREE SPIRIT miles, card

acquisitions, ongoing use of the FREE SPIRIT credit cards, milestone payments in connection with the achievement of specific usage and user

volumes, and renewals, which we currently recognize in accordance with the criteria as set forth in Accounting Standards Update ASU

No. 2009

-13. Please see “—Critical Accounting Policies and Estimates—Frequent Flier Program”.

We recognize revenues net of certain taxes and airport passenger fees, which are collected by us on behalf of airports and governmental

agencies and remitted to the applicable governmental entity or airport on a periodic basis. These taxes and fees include U.S. federal

transportation taxes, federal security charges, airport passenger facility charges, and foreign arrival and departure taxes. These items are

collected from customers at the time they purchase their tickets, but are not included in our revenues. We record a liability upon collection from

the customer and relieve the liability when payments are remitted to the applicable governmental agency or airport.

Our Operating Expenses

Our operating expenses consist of the following line items.

Aircraft Fuel. Aircraft fuel expense is our single largest operating expense. It includes the cost of jet fuel, related federal taxes, fueling

into-plane fees and transportation fees. It also includes realized and unrealized gains and losses arising from any fuel price hedging activity.

Salaries, Wages and Benefits. Salaries, wages and benefits expense includes the salaries, hourly wages, bonuses and

44