Spirit Airlines 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

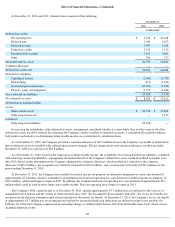

Company's ability to utilize net operating losses generated prior to the ownership change. Subsequent ownership changes could create additional

annual limitations on the amount of the carryforwards that can be utilized. The Company had approximately $10 million of net operating losses

generated prior to the ownership change. As of December 31, 2010, the Company determined that it was appropriate to write off $3.5 million of

deferred tax assets that were fully valued as of December 31, 2010 and the corresponding valuation allowance pertaining to the Section 382

limited net operating loss, since such amount will not be permissible under current law to offset future income.

In 2009, the Company adopted FASB issued Interpretation ASC 740-10, which clarifies the accounting for uncertainty in income taxes

recognized in an entity's financial statements in accordance with ASC 740, and prescribes a recognition threshold and measurement attributes for

financial statement disclosure of income tax positions taken or expected to be taken on a tax return. Effective January 1, 2009, the Company has

adopted the provisions of this Interpretation and there was no material effect on the financial statements. The Company accrues interest related to

unrecognized tax benefits in its provision for income taxes and any associated penalties are recorded in selling, general and administrative

expenses.

As of December 31, 2011, there were no ongoing audits of the Company's income tax returns by any taxing authority. In general, tax years

2004 and forward are subject to an examination in the U.S. due to net operating loss carryovers generated in such years.

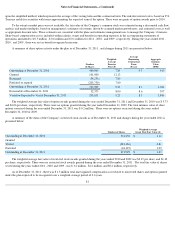

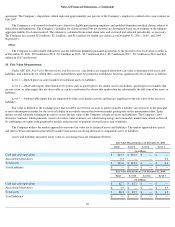

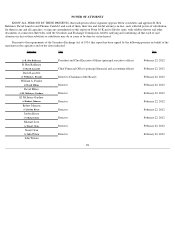

Aircraft-Related Commitments and Financing Arrangements

The Company’

s contractual purchase commitments consist primarily of aircraft and engine acquisitions through manufacturers and aircraft

leasing companies. As of December 31, 2011, firm aircraft orders with Airbus consisted of 106 A320 family aircraft (61 of the existing aircraft

model and 45 A320 NEOs) and five spare V2500 IAE International Aero Engines AG engines. Aircraft are scheduled for delivery in the period

of 2012 through 2021, and spare engines are scheduled for delivery in the period 2012 through 2018. Committed expenditures for these aircraft

and related flight equipment, including estimated amounts for contractual price escalations and pre-delivery payments, will be approximately

$304 million in 2012 , $325 million in 2013 , $348 million in 2014 , $520 million in 2015 , $510 million in 2016 and $3 billion in 2017 and

beyond .

Litigation

The Company is party to legal proceedings and claims that arise during the ordinary course of business. The Company believes the

ultimate outcome of these matters will not have a material adverse effect on the Company’s financial position, results of operations, or cash

flows.

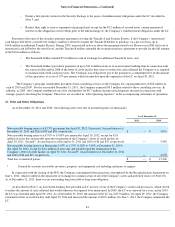

Credit Card Processing Arrangements

The Company has agreements with organizations that process credit card transactions arising from the purchase of air travel, baggage fees,

and other ancillary services by customers. As is standard in the airline industry, the Company’s contractual arrangements with cre dit card

processors permit them, under certain circumstances, to retain a holdback or other collateral, which the Company records as restricted cash,

when future air travel and other future services are purchased via credit card transactions. The required holdback is the percentage of the

Company’s overall credit card sales that its credit card processors hold to cover refunds to customers if the Company fails to fulfill its flight

obligations (see Note 5).

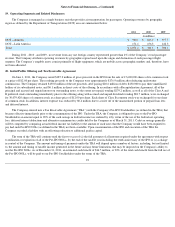

Employees

The Company has three union-represented employee groups that together represent approximately 52% of all employees at December 31,

2011 and 50% of all employees at December 31, 2010 . As of December 31, 2011 , the collective bargaining agreement between the Company

and the Company’s pilots, as represented by the Air Line Pilots Association International, represents approximately 20% of the Company’s

employees and became amendable on January 31, 2007. On May 14, 2010, the NMB released the Company and the pilots’ union from

mandatory supervised mediation, which release commenced a 30-day “cooling off” period as provided in the Railway Labor Act.

Early on June 12, 2010, following several negotiation sessions with the pilots’ union during the cooling off period that did not result in

reaching agreement, the pilots declared a strike, and the Company ceased all flight operations. The parties reconvened in negotiations on

June 15, 2010 and were able to reach a tentative agreement on June 16, 2010, which was ratified on July 23, 2010 and executed on August 1,

2010.

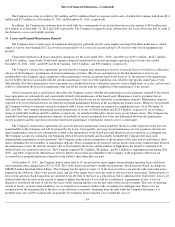

The collective bargaining agreement between the Company and the Company’s flight attendants, as represented by the Association of

Flight Attendants AFL-CIO, represents approximately 31% of the Company’s employees and became amendable on August 6, 2007. The

Company and the union are currently in negotiations to reach a new collective bargaining

89

17.

Commitments and Contingencies