Spirit Airlines 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

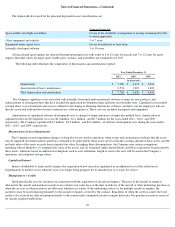

Notes to Financial Statements—(Continued)

In January 2010, the FASB issued Accounting Standards Update No. 2010-06, Fair Value Measurements Disclosures, which amends

Subtopic 820-10 of the FASB Accounting Standards Codification to require new disclosures for fair value measurements and provides

clarification for existing disclosure requirements. More specifically, this update will require (a) an entity to disclose separately the amounts of

significant transfers in and out of Level 1 and 2 fair value measurements and to describe the reasons for the transfers; and (b) information about

purchases, sales, issuances, and settlements to be presented separately (i.e., present the activity on a gross basis rather than net) in the

reconciliation for fair value measurements using significant unobservable inputs (Level 3 inputs). This update clarifies existing disclosure

requirements for the level of disaggregation used for classes of assets and liabilities measured at fair value and requires disclosures about the

valuation techniques and inputs used to measure fair value for both recurring and nonrecurring fair value measurements using Level 2 and

Level 3 inputs. Certain provisions requiring new disclosures and clarifications of existing disclosures of the guidance are effective for interim

and reporting periods beginning after December 15, 2009. Certain other provisions for new disclosures are effective for fiscal years beginning

after December 15, 2010. Adoption of those provisions of the accounting guidance that became effective for this interim period has resulted in

new fair value disclosures. See related fair value disclosures in Note 18.

In October 2009, the FASB issued an Accounting Standards Update (ASU No. 2009-13) pertaining to multiple-deliverable revenue

arrangements. The new guidance affects accounting and reporting for companies that enter into multiple-deliverable revenue arrangements with

their customers when those arrangements are within the scope of ASC 605-25, Revenue Recognition—Multiple-Element Arrangements. ASU

No. 2009

-13 eliminates the residual method of allocation and requires that arrangement consideration be allocated at the inception of the

arrangement to all deliverables using the relative selling price method. The new guidance is effective prospectively for revenue arrangements

entered into or materially modified in fiscal years beginning on or after June 15, 2010. On January 1, 2011, the Company adopted ASU

No. 2009

-13 and effective April 1, 2011, the Company entered into a new revenue arrangement. The amount of revenue that would have been

recognized during 2011 if the new revenue arrangement were subject to the previous acceptable guidance (residual method) is not materially

different compared to the revenue recognized applying ASU No. 2009-13. See New Affinity Card Program disclosures in Note 1.

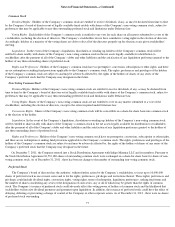

Special charges in the Company's Statement of Operations for the years ended 2011 and 2010 were $3.2 million and $0.6 million ,

respectively, which was primarily made up of termination, restructuring and secondary offering costs.

Termination Costs

In 2011, the Company incurred termination costs of $2.3 million in connection with its initial public offering of common stock during the

second fiscal quarter, which included $1.8 million paid to Indigo Partners, LLC to terminate its professional services agreement with the

Company and $0.5 million paid to three individual, unaffiliated holders of the Company’s subordinated notes.

Restructuring Costs

In 2010, in an effort to gain efficiencies, the Company relocated all of its Detroit, Michigan maintenance operations to Fort Lauderdale,

Florida, the Company’s largest city of operations. The restructuring included the closure of facilities in Detroit, relocation of equipment and

tools, and the relocation and reduction of workforce. The Company determined the relocation of these facilities and the planned relocation and

reduction of certain employees met the requirement of an exit activity . Included within Special charges in the Company's Statement of

Operations for the twelve months ended December 31, 2011 and 2010 were $0.2 million and $0.9 million, respectively, resulting from the

Detroit move.

Secondary Offering Costs

In 2011, the Company incurred $0.8 million consisting principally of legal, accounting, printing, and filing fees connected with the

secondary offering which was consummated on January 25, 2012 . The Company did not receive any proceeds from the secondary offering.

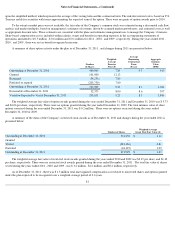

In connection with agreements with certain airports, the Company is required to post letters of credit, which totaled $0.2 million and $4.0

million as of December 31, 2011 and 2010 , respectively. The issuing banks require that the Company deposit funds at those banks to cover the

amounts that could be drawn under the letters of credit. These funds are generally invested in money market accounts and are classified as long-

term assets within security deposits and other long-term assets. Additionally, as of December 31, 2011 , the Company had a $10.0 million

unsecured standby letter of credit facility, representing an off balance-sheet commitment, of which $7.1 million had been drawn upon for issued

letters of credit.

75

3.

Special Charges

4.

Letters of Credit