Spirit Airlines 2011 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

upon the simplified method, which represents the average of the vesting term and the contractual term. The risk-

free interest rate is based on U.S.

Treasury yields for securities with terms approximating the expected term of the option. There were no grants of option awards prior to 2010.

To the extent a market price was not available, the fair value of the Company’s common stock was estimated using a discounted cash flow

analysis and market multiples, based on management’

s estimates of revenue, driven by assumed market growth rates, and estimated costs as well

as appropriate discount rates. These estimates are consistent with the plans and estimates management uses to manage the Company’s business.

Share-based compensation cost is included within salaries, wages and benefits in operating expenses in the accompanying statements of

operations amounted to $ 0.5 million , $ 0.6 million and $ 0.1 million for 2011 , 2010 , and 2009 , respectively. During the years ended 2011 ,

2010 , and 2009 , there was no tax benefit recognized in income.

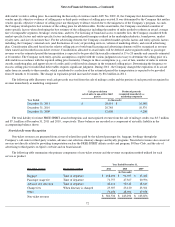

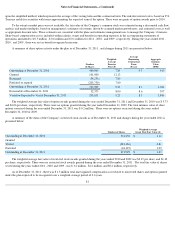

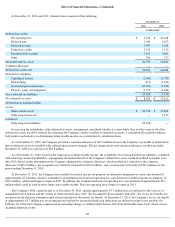

A summary of share option activity under the plan as of December 31, 2011 , and changes during 2011 are presented below:

The weighted-average fair value of option awards granted during the years ended December 31, 2011 and December 31, 2010 was $ 5.73

and $4.06 per share, respectively. There were no options granted during the year ended December 31, 2009. The total intrinsic value of share

options exercised during the year ended December 31, 2011 was $ 0.2 million . There were no options exercised during the years ended

December 31, 2010 or 2009.

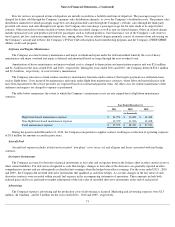

A summary of the status of the Company’s restricted stock awards as of December 31, 2011 and changes during the year ended 2011 is

presented below:

The weighted-average fair value of restricted stock awards granted during the years ended 2010 and 2009 was $6.39 per share, and $1.10

per share, respectively. There were no restricted stock awards granted during the year ended December 31, 2011 . The total fair value of shares

vested during the years ended 2011 , 2010 and 2009 , was $ 3.2 million , $2.2 million, and $0.2 million, respectively.

As of December 31, 2011 , there was $ 1.3 million total unrecognized compensation cost related to nonvested shares and options granted

under the plan expected to be recognized over a weighted-average period of 2.6 years.

81

Number

of Shares

Weighted-

Average

Exercise

Price ($)

Average

Remaining

Contractual

Term

(Years)

Aggregate

Intrinsic

Value

($000)

Outstanding at December 31, 2010

469,000

7.89

9.3

910

Granted

101,000

12.13

Exercised

(54,250

)

7.80

Forfeited or expired

(203,750

)

7.80

Outstanding at December 31, 2011

312,000

9.33

8.9

1,946

Exercisable at December 31, 2011

52,375

8.00

8.6

397

Vested or Expected to Vest at December 31, 2011

293,811

9.29

8.9

1,846

Number of Shares

Weighted-Average

Grant Date Fair Value ($)

Outstanding at December 31, 2010

573,250

$

1.12

Granted —

—

Vested

(283,126

)

0.81

Forfeited

(18,125

)

1.09

Outstanding at December 31, 2011

271,999

$

1.43