Spirit Airlines 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the aircraft until the completion of the maintenance of the aircraft. We paid $ 38.3 million , $ 35.7 million and $ 26.9 million in maintenance

reserves, net of reimbursement, to our lessors for the years ended December 31, 2011 , 2010 and 2009 , respectively.

At lease inception and at each balance sheet date, we assess whether the maintenance reserve payments required by the master lease

agreements are substantively and contractually related to the maintenance of the leased asset. Maintenance reserve payments that are

substantively and contractually related to the maintenance of the leased asset are accounted for as maintenance deposits. Maintenance deposits

expected to be recovered from lessors are reflected as prepaid maintenance deposits in the accompanying balance sheets. When it is not probable

we will recover amounts currently on deposit with a lessor, such amounts are expensed as supplemental rent. We expensed $1.5 million, $0.0

million and $0.2 million of maintenance reserves as supplemental rent during 2011 , 2010 and 2009 , respectively.

As of December 31, 2011, 2010 and 2009, we had prepaid maintenance deposits of $168.8 million, $132.0 million and $96.3 million,

respectively, on our balance sheets. We have concluded that these prepaid maintenance deposits are probable of recovery primarily due to the

rate differential between the maintenance reserve payments and the expected cost for the related next maintenance event that the reserves serve

to collateralize.

Our master lease agreements also provide that most maintenance reserves held by the lessor at the expiration of the lease are nonrefundable

to us and will be retained by the lessor. Consequently, we have determined that any usage-based maintenance reserve payments after the last

major maintenance event are not substantively related to the maintenance of the leased asset and therefore are accounted for as contingent rent.

We accrue contingent rent beginning when it becomes probable and reasonably estimable we will incur such nonrefundable maintenance reserve

payments. We make certain assumptions at the inception of the lease and at each balance sheet date to determine the recoverability of

maintenance deposits. These assumptions are based on various factors such as the estimated time between the maintenance events, the date the

aircraft is due to be returned to the lessor and the number of flight hours the aircraft is estimated to be utilized before it is returned to the lessor.

Maintenance reserves held by lessors that are refundable to us at the expiration of the lease are accounted for as prepaid maintenance deposits on

the balance sheet when they are paid.

Gains and Losses on Sale and Leaseback . For aircraft acquired through a sale and leaseback transaction that is determined to be an

operating lease, any profit or loss on the sale is deferred and amortized over the term of the lease, unless the fair value of the aircraft at the time

of the transaction is less than its acquisition cost, in which case a loss is recognized immediately up to the amount of the difference between

acquisition cost and fair value.

Fuel Derivatives

. We account for derivative financial instruments at fair value and recognize them in the balance sheet as an asset or other

current liability. Accordingly, changes in the fair value of such derivative contracts are recorded as a component of aircraft fuel expense. These

amounts include both realized gains and losses and mark-to-market adjustments of the fair value of the derivative instruments at the end of each

period.

Share-Based Compensation. We recognize cost of employee services received in exchange for awards of equity instruments based on the

fair value of each instrument at the date of grant. Compensation expense is recognized on a straight-line basis over the period during which an

employee is required to provide service in exchange for an award. Restricted stock awards are valued at the fair value of the shares on the date of

grant if vesting is based on a service or a performance condition. To the extent a market price was not available, the fair value of stock awards

were estimated using a discounted cash flow analysis based on management’s estimates of revenue, driven by assumed market growth rates, and

estimated costs as well as appropriate discount rates. These estimates are consistent with the plans and estimates that management uses to

manage the Company’s business. The fair value of share option awards is estimated on the date of grant using the Black-Scholes valuation

model. As of December 31, 2011, there was $1.3 million of total unrecognized compensation cost related to non-vested restricted stock and

options granted under the plan expected to be recognized over a weighted-average period of 2.6 years.

Income Taxes. We account for income taxes using the liability method. We record a valuation allowance against deferred tax assets

reported if, based on the weight of the evidence, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

Deferred taxes are recorded based on differences between the financial statement basis and tax basis of assets and liabilities and available tax

loss and credit carryforwards. In assessing the realizability of the deferred tax assets, our management considers whether it is more likely than

not that some or all of the deferred tax assets will be realized. In evaluating our ability to utilize our deferred tax assets, we consider all available

evidence, both positive and negative, in determining future taxable income on a jurisdiction by jurisdiction basis.

RESULTS OF OPERATIONS

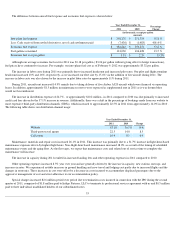

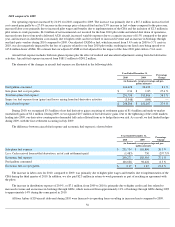

In 2011 , we recorded our fifth consecutive profitable year under our ULCC business model. In 2011, we generated operating income of

$144.4 million and net income of $76.4 million on $1,071.2 million of operating revenues, compared to

50