Spirit Airlines 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

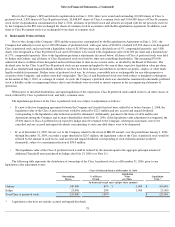

As of January 1, 2008, there was no new collective bargaining agreement with the Company’s pilots. Accordingly, Indigo returned all

25,000 shares of its Class A preferred stock, which were then cancelled by the Company along with any accrued and unpaid dividends thereon.

After giving effect to this cancellation, the liquidation value of the remaining 100,000 outstanding shares of Class A preferred stock was reduced

by an aggregate $22.5 million, or from $1,000 to $775 per share, and accrued and unpaid dividends corresponding to the liquidation value

reduction were eliminated. The Company recognized as debt extinguishment a net gain of $50.7 million, effective January 1, 2008, on the

cancellation of shares and liquidation value adjustment, including the elimination of $3.6 million of corresponding accrued and unpaid

dividends. After January 1, 2008, all Class A preferred stock is held by Oaktree.

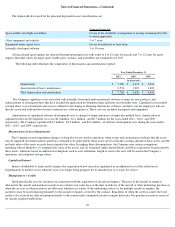

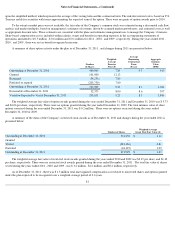

The following tables illustrate the execution of the Put and Escrow Agreement and liquidation value adjustment of the remaining Class A

preferred stock triggered by not having a collective bargaining agreement as of January 1, 2008:

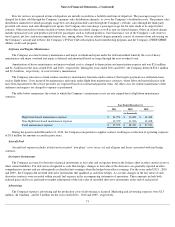

On December 28, 2008, Indigo purchased an additional $2.7 million of Tranche B notes and triggered a liquidation value adjustment.

Accordingly, the Company recognized as debt extinguishment a net gain of $3.0 million, effective December 28, 2008, on the liquidation value

adjustment, including the elimination of $0.3 million of corresponding accrued and unpaid dividends.

The following table illustrates the liquidation adjustment as triggered by the additional Tranche B notes purchased:

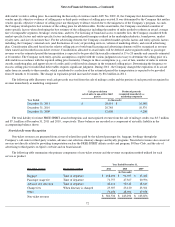

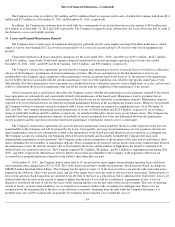

As of December 31, 2009, the net cost related to the disposal of MD-80 aircraft exceeded the $20.7 million target threshold by

$16.7 million and as a result triggered a liquidation value adjustment, which resulted in a debt extinguishment gain of $19.7 million on

December 31, 2009, including the elimination of $3.1 million of accrued and unpaid dividends.

79

Execution of Put and Escrow Agreement

Transfer of

Indigo Class A

Preferred Stock

to Spirit

Outstanding

Shares

Liquidation

Value

per Share

Liquidation

Value *

(in thousands except share and per share amounts)

Oaktree —

100,000

$

1,000

$

100,000

Indigo

(25,000

)

—

N/A

—

Total Class A preferred stock

(25,000

)

100,000

$

100,000

* Liquidation value does not include accrued and unpaid dividends.

$22.5 Million Liquidation Value Adjustment

Outstanding

Shares

Liquidation

Value

Prior to

Adjustment

Liquidation

Value

Adjustment

Liquidation

Value per

Share After

Adjustment

Liquidation

Value as of

January 1,

2008 *

(in thousands except share and per share amounts)

Oaktree

100,000

$

100,000

$

(22,500

)

$

775

$

77,500

Indigo

—

—

—

—

—

Total Class A

preferred stock

100,000

$

100,000

$

(22,500

)

$

77,500

* Liquidation value does not include accrued and unpaid dividends.

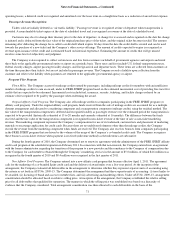

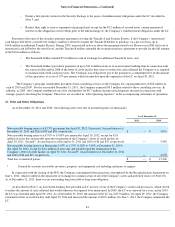

$2.7 Million Liquidation Value Adjustment

Outstanding

Shares

Liquidation

Value

Prior to

Adjustment

Liquidation

Value

Adjustment

Liquidation

Value per

Share After

Adjustment

Liquidation

Value as of

December 31,

2008 *

(in thousands except share and per share amounts)

Oaktree

100,000

$

77,500

$

(2,679

)

$

748

$

74,821

Indigo

—

—

—

—

—

Total Class A

preferred stock

100,000

$

77,500

$

(2,679

)

$

74,821

* Liquidation value does not include accrued and unpaid dividends.