Spirit Airlines 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Financial Statements—(Continued)

The Company has agreements with organizations that process credit card transactions arising from the purchase of air travel, baggage fees,

and other ancillary services by customers. As it is standard in the airline industry, the Company's contractual arrangements with credit card

processors permit them, under certain circumstances, to retain a holdback or other collateral, which the Company records as restricted cash,

when future air travel and other future services are purchased via credit card transactions. The required holdback is the percentage of the

Company's overall credit card sales that its credit card processors hold to cover refunds to customers if the Company fails to fulfill its flight

obligations.

As of December 31, 2010 , the Company had advance ticket sales and $9 Fare Club memberships purchased with credit cards of

approximately $101.1 million . The Company was in compliance with its credit card processing agreements, and the required holdback was

$87.7 million

, which was partially offset by a letter of credit (LC), issued in favor of the processor in the amount of $15.0 million. As such, as of

December 31, 2010 , the processors were holding back $72.7 million of remittances after considering the letter of credit (LC), issued in favor of

the processor.

During 2011, the Company amended its processing agreements with all of its processors. Prior to the amendments, the credit card

processors required the Company to maintain cash collateral equal to approximately 100% of the Company's air traffic liability. The

amendments were approved in light of the Company's improved balance sheet as a result of the recently completed IPO, the related

recapitalization and the elimination of the holdback held by the credit card processors, effectively bringing the Company's restricted cash balance

to zero, provided that the Company continues to satisfy certain liquidity and other financial covenants. Failure to meet these covenants would

provide the processors the right to reinstate a holdback, resulting in a commensurate reduction of unrestricted cash. As of December 31, 2011 ,

the Company continued to be in compliance with its credit card processing agreements, and the processors were holding back $0 of remittances.

The maximum potential exposure to cash holdbacks by the Company's credit card processors, based upon advance ticket sales and $9 Fare

Club memberships as of December 31, 2011 and 2010 , was $115.2 million and $86.1 million , respectively.

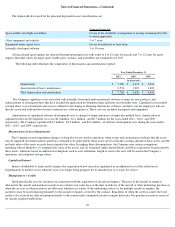

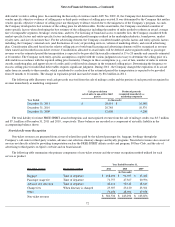

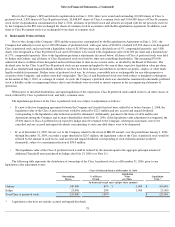

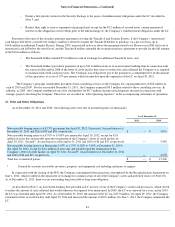

Accrued liabilities included in other current liabilities as of December 31, 2011 and 2010 consist of the following:

During 2010, based on new information that became available to the Company, a liability previously recorded was reduced by $1.0 million

resulting in recognition of $0.7 million within other operating and $0.3 million within salaries, wages, and benefits expenses in the statement of

operations.

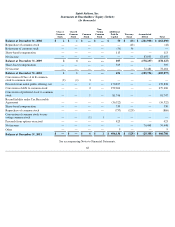

The Company’s amended and restated certificate of incorporation dated June 1, 2011, authorizes the Company to issue up to 240,000,000

shares of common stock, $0.0001 par value per share, 50,000,000 shares of non-voting common stock, $0.0001 par value per share, and

10,000,000 shares of preferred stock, $0.0001 par value per share. All of the Company’s issued and outstanding shares of common stock and

preferred stock are duly authorized, validly issued, fully paid and non-assessable. The Company’s shares of common stock and non-voting

common stock are not redeemable and do not have preemptive rights.

5.

Credit Card Processing Arrangements

6.

Accrued Liabilities

As of December 31,

2011

2010

(in thousands)

Current portion of Tax Receivable Agreement

$

27,399

$

—

Federal excise and other passenger taxes and fees payable

17,813

19,035

Salaries and wages

17,123

14,842

Aircraft maintenance

7,816

10,909

Airport expenses

10,682

9,523

Interest

1,142

6,885

Aircraft and facility rent

7,206

4,455

Restructuring

329

549

Other

9,346

6,843

Accrued liabilities

$

98,856

$

73,041

7.

Common Stock and Preferred Stock