Spirit Airlines 2011 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2011 Spirit Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

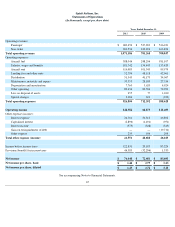

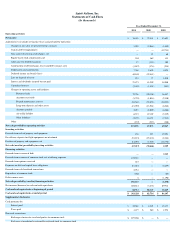

Net Cash Provided By Financing Activities. During 2011, we received $150.0 million in proceeds, net of underwriting fees, transaction

costs and our repayment of $20.6 million of shareholder debt of which $2.3 million was paid in kind interest and included in operating activities.

Remaining shareholder debt was exchanged for newly issued shares of our common stock. In addition, we received $4.5 million in proceeds

from the sale of one engine as part of a sale leaseback transaction.

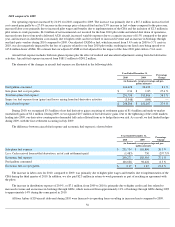

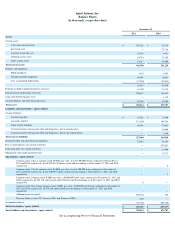

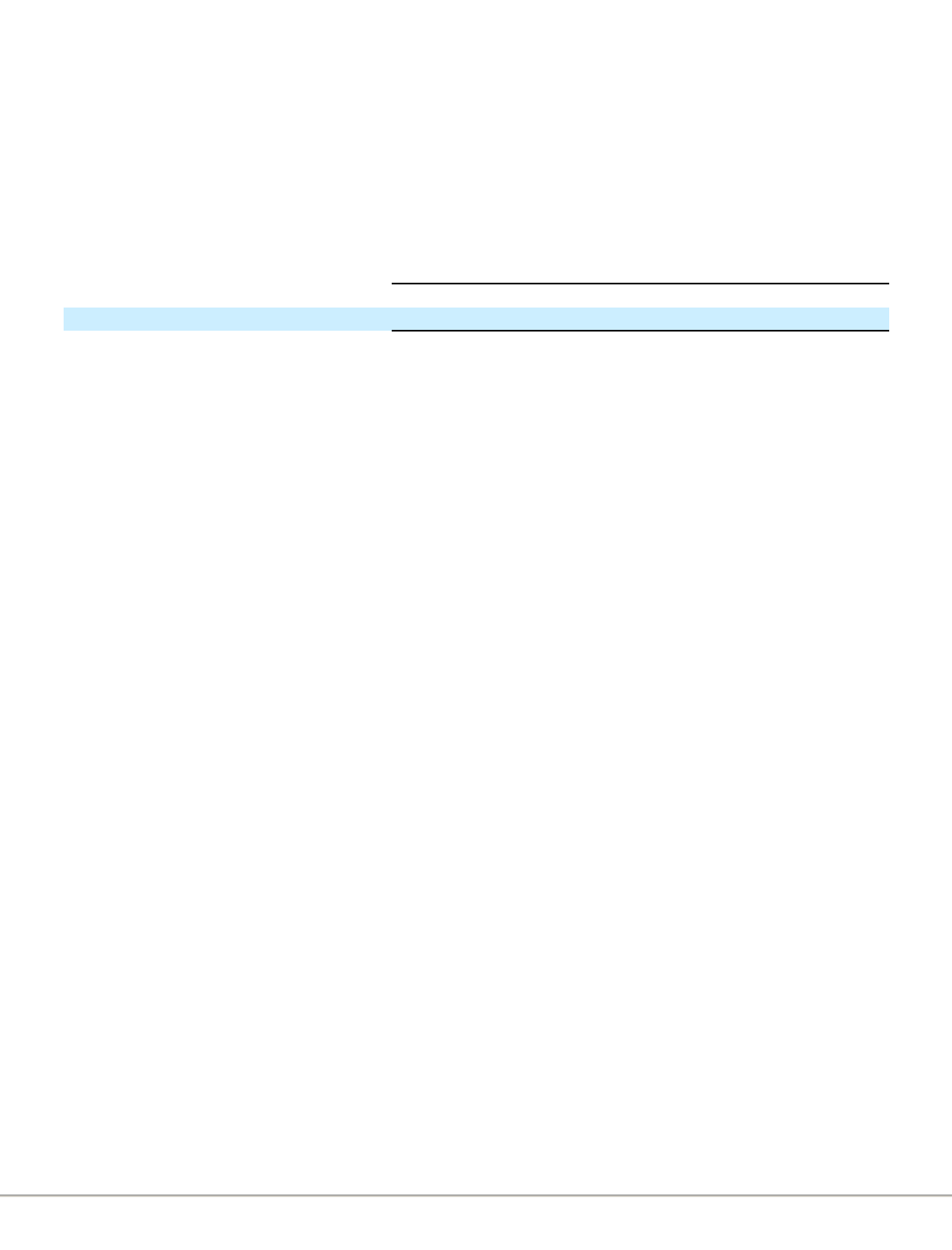

Commitments and Contractual Obligations

The following table discloses aggregate information about our contractual obligations as of December 31, 2011 and the periods in which

payments are due (in millions):

(1) Does not include contractual payments to the Pre-IPO Stockholders under the Tax Receivable Agreement (estimated to

be approximately $36.5 million as of December 31, 2011). Please see “—Our Income Taxes.”

Off-Balance Sheet Arrangements

We have significant obligations for aircraft as all 37 of our aircraft in service at December 31, 2011 were acquired under operating leases

and therefore are not reflected on our balance sheet. These leases expire between 2017 and 2023. Aircraft rent payments were $116.6 million and

$103.4 million, for 2011 and 2010, respectively. Our aircraft lease payments for 32 of our aircraft are fixed rate obligations. Five of our leases

provide for variable rent payments, which fluctuate based on changes in LIBOR (London Interbank Offered Rate).

Our contractual purchase commitments consist primarily of aircraft and engine acquisitions through manufacturers and aircraft leasing

companies. As of December 31, 2011, firm aircraft orders consisted of 106 A320 family aircraft (61 of the existing aircraft model A320s and 45

A320 NEOs) with Airbus and five spare V2500 IAE International Aero Engines AG engines. Aircraft are scheduled for delivery in the period of

2012 through 2021, and spare engines are scheduled for delivery from 2012 through 2018. Committed expenditures for these aircraft and related

flight equipment, including estimated amounts for contractual price escalations and pre-delivery payments, will be approximately $304 million

in 2012 , $325 million in 2013 , $348 million in 2014 , $520 million in 2015 , $510 million in 2016 and $3 billion in 2017 and beyond .

The Company has a line of credit for $8.6 million and $3.6 million related to corporate credit cards, of which the Company had drawn

$2.4

million and $2.5 million as of December 31, 2011 and December 31, 2010 , respectively. The undrawn portion represents an off-balance sheet

arrangement.

In addition, the Company has undrawn lines of credit with two counterparties to its jet fuel derivatives in the amount of $8.0 million and

$1.0 million as of December 31, 2011 and 2010 respectively. The Company is required to post collateral for any excess above the line of credit if

the derivatives are in a net liability position. The undrawn portion represents an off-balance sheet arrangement.

As of December 31, 2011 the Company had a $10 million unsecured standby letter of credit facility of which $7.1 million had been drawn

upon for issued letters of credit. This facility represents an off-balance sheet arrangement.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market Risk-Sensitive Instruments and Positions

We are subject to certain market risks, including commodity prices (specifically aircraft fuel). The adverse effects of changes in these

markets could pose a potential loss as discussed below. The sensitivity analysis provided below does not consider the effects that such adverse

changes may have on overall economic activity, nor does it consider additional actions we may take to mitigate our exposure to such changes.

Actual results may differ.

Aircraft Fuel . Our results of operations can vary materially due to changes in the price and availability of aircraft fuel. Aircraft fuel

expense for the years ended December 31, 2011 , 2010 and 2009 represented approximately 41.9% , 34.8% and 30.8% of our operating

expenses. Increases in aircraft fuel prices or a shortage of supply could have a material adverse effect on our operations and operating results.

We source a significant portion of our fuel from refining resources located in the

61

2012

2013 - 2014

2015 - 2016

2017 and

beyond

Total

Operating lease obligations

$

147

$

302

$

295

$

450

$

1,194

Flight equipment purchase obligations

304

672

1,031

2,955

4,962

Total future payments on contractual obligations

(1)

$

451

$

974

$

1,326

$

3,405

$

6,156